What Can We Expect for First Community Bancshares Inc (NASDAQ:FCBC) Moving Forward?

First Community Bancshares Inc (NASDAQ:FCBC), a USD$501.30M small-cap, is a bank operating in an industry, which has been simplifying their business and operating models over the last few years, both for economic reasons and to reduce organizational complexity. Financial services analysts are forecasting for the entire industry, a positive double-digit growth of 15.82% in the upcoming year . Below, I will examine the sector growth prospects, as well as evaluate whether First Community Bancshares is lagging or leading in the industry. View our latest analysis for First Community Bancshares

What’s the catalyst for First Community Bancshares’s sector growth?

There is a growing awareness that banks cannot excel at every activity, and that it may be easier and cheaper to outsource noncore activities. However, the threat of disintermediation in the payments industry is both real and imminent, taking profits away from traditional incumbent financial institutions. Over the past year, the industry saw growth of 9.28%, though still underperforming the wider US stock market. First Community Bancshares is neither a lagger nor a leader, and has been growing in-line with its industry peers at around 11.20% in the prior year. Holding other factors constant, this may mean First Community Bancshares will also trade in-line with its peers in terms of relative valuation.

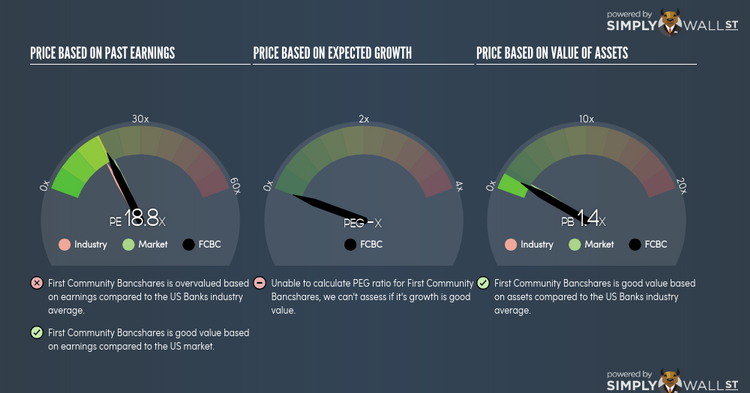

Is First Community Bancshares and the sector relatively cheap?

The banking industry is trading at a PE ratio of 17x, relatively similar to the rest of the US stock market PE of 20x. This means the industry, on average, is fairly valued compared to the wider market – minimal expected gains and losses from mispricing here. Furthermore, the industry returned a similar 8.91% on equities compared to the market’s 10.47%. On the stock-level, First Community Bancshares is trading at a PE ratio of 19x, which is relatively in-line with the average banking stock. In terms of returns, First Community Bancshares generated 7.73% in the past year, which is 1% below the banking sector.

What this means for you:

Are you a shareholder? First Community Bancshares’s ability to deliver earnings growth in the past aligns with that of the broader market and it is trading in-line with its peers. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto First Community Bancshares as part of your portfolio. However, if you’re relatively concentrated in financials, you may want to value First Community Bancshares based on its cash flows to determine if it is overpriced based on its current growth outlook.

Are you a potential investor? If First Community Bancshares has been on your watchlist for a while, now may be the time to enter into the stock. If you like track record in growth, you’ll be paying a fair value for the company, given that it is trading relatively in-line with its peers. However, if you’re hoping to gain from an undervalued mispricing, this is probably not the best time.

For a deeper dive into First Community Bancshares’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other financial stocks instead? Use our free playform to see my list of over 600 other financial companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.