Expedia Group Inc (EXPE) Posts Record Revenue and Profitability in Q4 and Full Year 2023

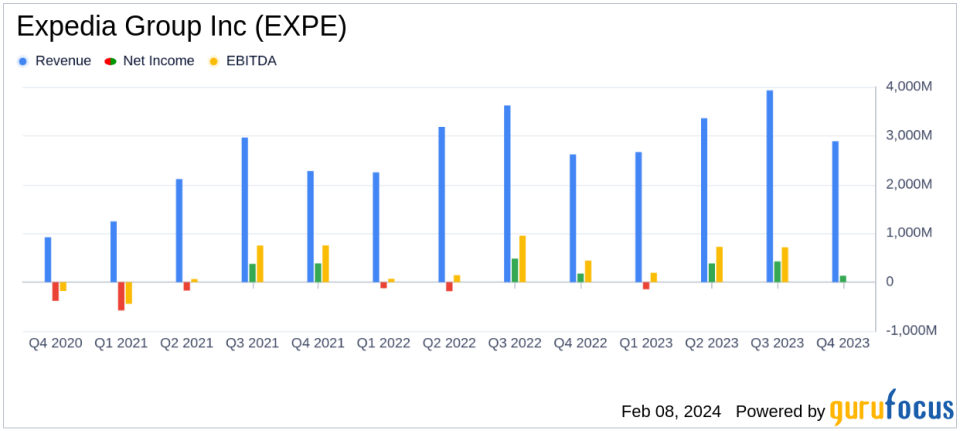

Revenue Growth: Full year and Q4 revenue increased by 10% year-over-year.

Net Income Surge: Full year GAAP net income grew by 127% compared to 2022.

Adjusted EBITDA: Full year adjusted EBITDA rose by 14%, with margin expansion.

Share Repurchase: Expedia repurchased over 19 million shares for a record $2 billion in 2023.

Lodging Bookings: Record full year lodging gross bookings grew by 11%, with hotel gross bookings up by 18%.

B2B Revenue: Record quarterly and full year B2B revenue, increasing by 28% and 33% respectively.

On February 8, 2024, Expedia Group Inc (NASDAQ:EXPE) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading online travel agency, reported record revenue and profitability, marking a significant year of growth and operational success.

Expedia Group Inc (NASDAQ:EXPE), the world's second-largest online travel agency by bookings, operates an extensive brand portfolio including Expedia.com, Hotels.com, Travelocity, Orbitz, Wotif, AirAsia, Vrbo, and Trivago. The company's services span lodging, air tickets, rental cars, cruises, and other travel-related offerings. With a focus on technology solutions and partner growth, Expedia has successfully expanded its market presence, driving double-digit top-line growth and margin expansion in 2023.

Financial Performance and Strategic Achievements

Expedia's CEO, Peter Kern, highlighted the company's delivery on full-year guidance, technological advancements, and strategic positioning for future growth. The company's focus on customer acquisition, share growth in B2C and B2B businesses, and product and partner experience has positioned it to lead the industry.

The company's financial achievements are significant, with the highest ever full year and fourth quarter revenue, both growing by 10% compared to 2022. The full year GAAP net income saw a remarkable increase of 127%, and the adjusted EBITDA grew by 14%. These results underscore Expedia's ability to drive profitability in the competitive travel and leisure industry.

Financial Metrics and Operational Highlights

Expedia's lodging segment, which accounts for the majority of its sales, saw record gross bookings, with hotel bookings increasing by 18%. The B2B segment also experienced record revenue growth, reflecting the company's strong position in the market. The share repurchase program, with over $2 billion in buybacks, demonstrates confidence in the company's value and future prospects.

Despite a decrease in operating income and net income attributable to Expedia Group common stockholders in Q4, the company's overall performance for the year was robust. Adjusted net income and adjusted EPS for the full year increased by 32% and 43%, respectively, indicating healthy underlying financial strength.

Analysis and Outlook

Expedia's performance in 2023 reflects a successful year of navigating volatility and transforming operations. The company's record revenue and profitability, along with its strategic repurchases, signal a strong foundation for continued growth. With a clear focus on technology and customer experience, Expedia is well-positioned to capitalize on the recovering travel industry and expand its market leadership.

Investors and potential GuruFocus.com members interested in the travel and leisure sector may find Expedia's strong financial results and strategic initiatives indicative of the company's resilience and potential for long-term value creation.

For a more detailed analysis of Expedia Group Inc's financial results, including the full financial statements and reconciliations of non-GAAP measures, please refer to the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Expedia Group Inc for further details.

This article first appeared on GuruFocus.