Expedia Looks Set to Be the Contrarian Trade of 2024

Expedia Group Inc. (NASDAQ:EXPE) announced its full-year 2023 results earlier this month, and markets did not take kindly to developments in its earnings, with the stock dropping by 18% the day after earnings were announced. Management warned that the tailwinds in travel demand seen by the company so far in 2023 could be moderating globally in 2024, especially within air travel. But what really seems to have blindsided investors was news about Expedia's CEO, Peter Kern, stepping down from the company to be replaced by long-time veteran Ariane Gorin.

While the news of executive succession could cast doubts over the strategic vision of Expedia, I think the stock now offers an attractive entry point given the recent developments after reviewing management commentary and the earnings report.

Recap of Expedia's business pivot in the post-pandemic world

Expedia is a travel technology company that operates some of the most-visited online travel properties in the world, such as the eponymous Expedia.com, Hotels.com, Vrbo and Trivago, to name a few. The company has made a few changes to the way it operates, diversifying its revenue collection models in a post-pandemic world driven by higher interest rates and uncertain macroeconomic outlooks.

Most of the company's prior focus would be on an agency-based model where Expedia acted as an agent in the transaction between the traveler and the travel merchant without collecting any upfront fees. The company also operated a merchant-based model, where it facilitated end-end transactions, including collecting payments upfront, while also offering travel merchants value-added services under the Expedia Traveler Preference program. Over time, the merchant model and business-to-business segments have been the fastest-growing revenue contributors. In addition to growing quickly, Expedia's business-to-business segment also has higher Ebitda margins.

2023 results show how company is quietly pivoting toward customers with larger wallets

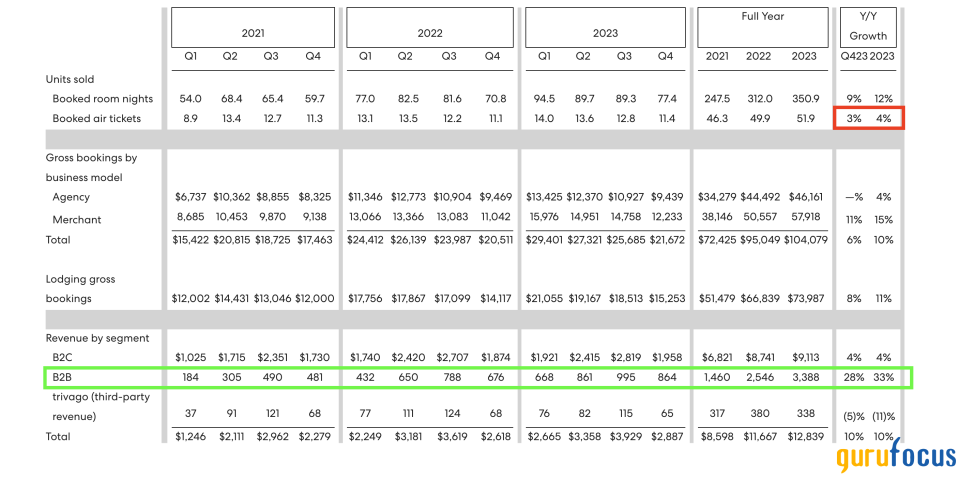

In 2023, the travel company's gross bookings continued to decelerate to 10% growth on a year-over-year basis. Expedia had seen some strong tailwinds from "revenge travel" trends as travelers globally resumed their travel plans with Covid-lockdowns fully easing. However, those post-pandemic tailwinds that Expedia witnessed in the first quarter of 2023 started to fade last year, with bookings slowing from 20% year over year in the first quarter to 6% in the fourth quarter. The softness in travel demand was most notable in air ticket bookings, which grew only 3% year over year in the last quarter of 2023, as can be seen in the table below.

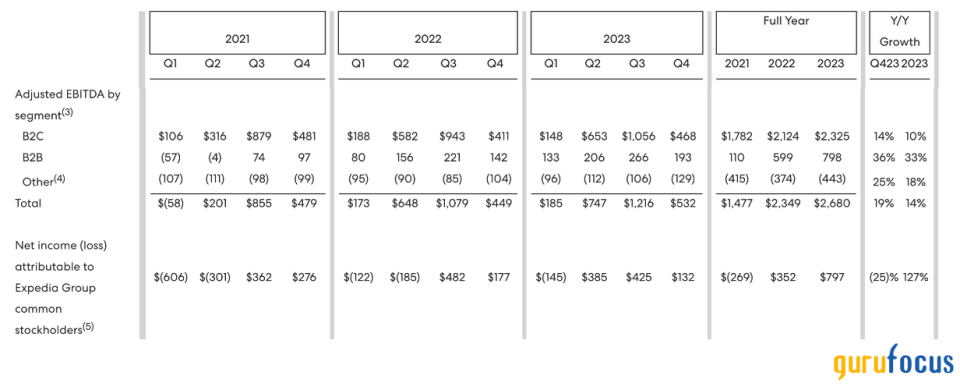

However, the strength of its business-to-business segment continues to be underappreciated by most investors, which grew by a stellar 33% in 2023 versus 2022. Since the pandemic lockdowns, Expedia has doubled down on its focus to make the B2B business more meaningfully representative of its overall travel business, and the results appear to be paying off handsomely. As can be seen below, Expedia's B2B segment is not only outpacing the overall revenue growth of the company, it also offers higher Ebitda margins.

Earlier in the year, management explained that the B2B business benefits from economies of scale due to the technical foundations that were already laid out by Expedia, courtesy of its business-to-consumer segment. Here is some of management's commentary from Expedia's first-quarter earnings call:

"I think the B2B business has been growing terrifically, as I mentioned in my prepared remarks. We haven't had to do any big technical migrations. In fact, we've added to the capabilities over the last couple of years. And we've seen the benefits of that in many of our business lines."

As the year progressed, management continued to reap the high-margin and high-growth benefits from the B2B business, and I believe they will continue to do so. In my opinion, this is one of the reasons why Expedia's board announced the CEO succession plan since the new incoming chief executive, Ariane Gorin, has led the B2B business through its most pivotal time in history during the pandemic. This development, in my opinion, is actually good news that positions Expedia for a new chapter of growth.

On the earnings front, Expedia's adjusted Ebitda of $532 million grew 19% year over year, outpacing the 10% revenue growth that we saw in an earlier table. This was a new record for the company in terms of adjusted Ebitda, which grew 19%, while Ebitda margins expanded by 130 basis points to 18.50%. Fourth-quarter non-GAAP earnings per share came in at $1.72, 1.40% better than what analysts expected. The strong display of earnings allowed the company to record $1.80 billion in free cash at a free cash margin of 14%, higher than their pre-pandemic five-year FCF margins of around 11%. Management also mentioned that they have used their free cash to repurchase around $2 billion in their own stock throughout the year.

In terms of Expedia's debt standing and liquidity levels, the company's gross leverage ratio has reduced to 2.30, which is still off from its long-term target of 2. The company is carrying a significant amount of debt at the moment of $6.30 billion. Although the company has a net cash position of $4.30 billion, I believe management is actively working to reduce debt toward long-term targets. The company holds all its debt in the form of senior notes, and 44% of its debt should mature over the next two years, allowing the company to get closer to its long-term leverage ratio.

2024 outlook

As mentioned earlier, travel demand has been softening from a robust first-quarter 2023. Management expects that a softening in travel demand will persist in the first quarter of this year, given that pandemic-induced travel tailwinds will fade. In addition, severe quality issues in Boeing's Max 9 airplanes that Alaska Airlines witnessed midair at the start of the year have further dampened travel demand in this quarter, according to Expedia. United Airlines echoed similar sentiments in its earnings call last month as well. Given these updates, management still expects revenue to grow in line with the growth rates seen in 2023, which should be around 10%. This is almost three times higher than the projected revenue growth in the S&P 500, as per FactSet.

While projecting earnings, management said it expects a one-time hit of $100 million as they move into the last stages of initiatives to streamline operations and several backend technology platforms. Hence, the company is also projecting Ebitda margin expansion similar to the margin expansion that was seen in 2023. Given that margins expanded by 0.8% to 20.9% , I can expect Ebitda margins of about 21.50% in 2024. This means Expedia's Ebitda is expected to grow by 13.30%, which is better than the 10.9% expected in the S&P 500. At these growth rates, I think a forward price-earnings ratio of 18 to 21 is justified. With Expedia currently trading at a forward price-earnings ratio of just 11.70, there is significant room for upside this year.

Risks and other factors to consider

The risks of investing in Expedia currently involve a larger industry-wide travel weakness that may persist throughout the year. The company has already mentioned it expects the weakening trends seen in the latter half of last year to persist in the first quarter. Sustained geopolitical tension and uncertain macroeconomic environments are the most likely culprits here. I think Expedia's first-quarter outlook, along with the CEO transition announcement, caused pessimism, sparking a sell-off in the company's stock.

However, I am still optimistic about travel trends improving as we progress through Memorial Day in the U.S. Multiple industry reports from Skift andDeloitte expect tourism to moderate but still stay strong throughout the year. In fact, Deloitte also mentioned that corporate travel spending in the U.S. is still likely to finally pass the pre-pandemic line. This plays well into the B2B segment strength that I mentioned earlier.

Takeaways

After carefully evaluating Expedia's earnings and perusing management commentary, I am convinced of the attractive entry points Expedia offers today. The severe pessimism in the stock is currently unwarranted, and with significant room for expansion, I think Expedia could be the contrarian trade of the year.

This article first appeared on GuruFocus.