Expedia's (NASDAQ:EXPE) Posts Q4 Sales In Line With Estimates But Stock Drops

Online travel agency Expedia (NASDAQ:EXPE) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 10.3% year on year to $2.89 billion. It made a non-GAAP profit of $1.72 per share, improving from its profit of $1.26 per share in the same quarter last year.

Is now the time to buy Expedia? Find out by accessing our full research report, it's free.

Expedia (EXPE) Q4 FY2023 Highlights:

Revenue: $2.89 billion vs analyst estimates of $2.88 billion (small beat)

EPS (non-GAAP): $1.72 vs analyst estimates of $1.70 (1.4% beat)

Free Cash Flow was -$415 million compared to -$1.59 billion in the previous quarter

Gross Margin (GAAP): 88.2%, up from 84.3% in the same quarter last year

Booked Room Nights: 77.4 million, up 6.6 million year on year

Market Capitalization: $21.44 billion

"We delivered on our full year guidance and drove record results, all while completing a massive transformation and navigating the inherent volatility that comes with that. Our work is finally starting to deliver results, and we are in the best place we've ever been technologically," said Peter Kern, Vice Chairman and CEO, Expedia Group.

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

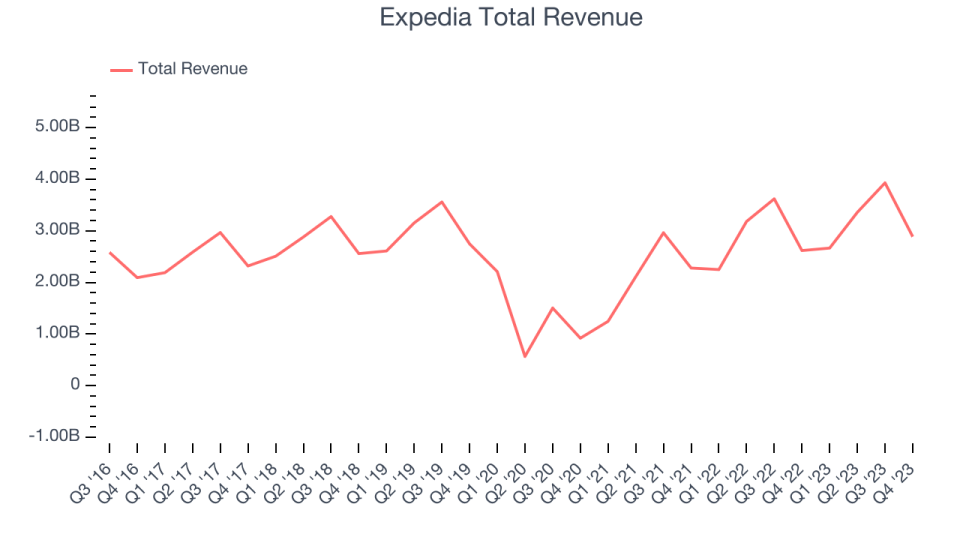

Sales Growth

Expedia's revenue growth over the last three years has been exceptional, averaging 57.1% annually. This quarter, Expedia reported mediocre 10.3% year-on-year revenue growth, in line with what analysts were expecting.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Usage Growth

As an online travel company, Expedia generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Expedia's nights booked, a key performance metric for the company, grew 19.6% annually to 77.4 million. This is strong growth for a consumer internet company.

In Q4, Expedia added 6.6 million nights booked, translating into 9.3% year-on-year growth.

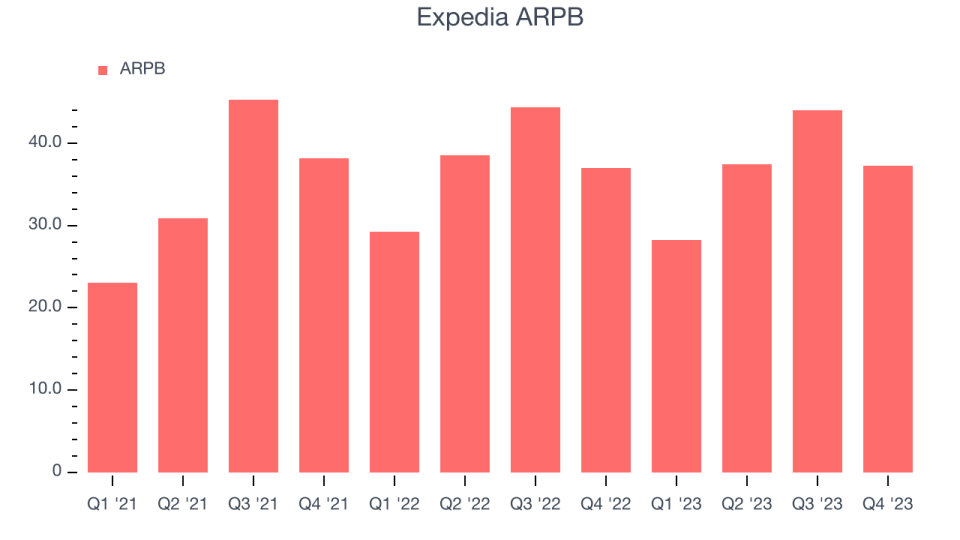

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track for consumer internet businesses like Expedia because it not only measures how much users book on its platform but also the commission that Expedia can charge.

Expedia's ARPB growth has been decent over the last two years, averaging 5%. The company's ability to increase prices while constantly growing its nights booked demonstrates the value of its platform. This quarter, ARPB grew 0.9% year on year to $37.30 per booking.

Key Takeaways from Expedia's Q4 Results

It was good to see Expedia beat analysts' adjusted EBITDA expectations this quarter. On the other hand, its revenue growth stalled as its gross bookings came in lower than expected. Overall, this was a mediocre quarter for Expedia, and the market was likely looking for more bookings. The company is down 7.8% on the results and currently trades at $147.27 per share.

So should you invest in Expedia right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.