Expeditors (EXPD) Stock Down on Q2 Earnings & Revenue Miss

Expeditors International of Washington’s EXPD second-quarter 2023 earnings of $1.30 per share fell short of the Zacks Consensus Estimate of $1.34. Moreover, the bottom line plunged 42.7% year over year. Total revenues of $2,239.8 million lagged the Zacks Consensus Estimate of 2,878.8 million and decreased 51.3% year over year. Results were hurt by the lackluster demand scenario.

The below-par second-quarter performance naturally disappointed investors. As a result, EXPD stock declined in early trading following the earnings release.

A dip in volumes also played spoilsport. Airfreight tonnage and ocean container volumes tumbled 15% and 13% year over year, respectively. Operating income declined 51% to $278 million. Total operating expenses fell 51% to $1.99 billion.

Airfreight services revenues decreased 53% year over year to $525 million in the second quarter of 2023. Ocean freight and ocean services revenues fell 66.2% to $593.8 million. Customs brokerage and other services revenues declined 27.9% year over year to $894.8 million.

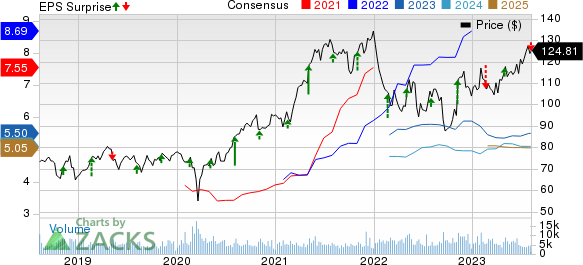

Expeditors International of Washington, Inc. Price, Consensus and EPS Surprise

Expeditors International of Washington, Inc. price-consensus-eps-surprise-chart | Expeditors International of Washington, Inc. Quote

Per Jeffrey S. Musser, EXPD’s president and chief executive officer, “Despite increased air capacity, shippers face uncertain demand for their products, as consumers remain cautious amidst declines in their purchasing power. In that regard, second-quarter operating conditions were very much a continuation of what we experienced in the immediately prior two quarters”.

In the reported quarter, EXPD repurchased 6 million shares at an average price of $114.61 per share. Expeditors also pays dividends of 69 cents per share on a semi-annual basis. It exited the June-end quarter with cash and cash equivalents of $1.69 billion compared with $2.03 billion at 2022 end.

Currently, Expeditors carries a Zacks Rank #3 (Hold).

Q2 Performance of Some Other Transportation Companies

American Airlines’ AAL second-quarter 2023 earnings (excluding 4 cents from non-recurring items) of $1.92 per share easily beat the Zacks Consensus Estimate of $1.58. AAL’s results were aided by lower costs and higher revenues.

Operating revenues of $14,055 million rose 4.7% year over year. The top line beat the Zacks Consensus Estimate of $13,736.3 million. Passenger revenues, accounting for 92.3% of the top line, increased to $12,978 million from $12,223 million a year ago. This was driven by strong air-travel demand, mainly on the domestic front.

Demand was particularly strong in June on the back of growth in close-in bookings. AAL currently carries a Zacks Rank #2 (Buy).

United Airlines UAL, currently sporting a Zacks Rank #1, reported second-quarter 2023 earnings per share of $5.03, which outpaced the Zacks Consensus Estimate of $3.99 and improved more than 100% year over year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Operating revenues of $14,178 million outshined the Zacks Consensus Estimate of $13,927.1 million. UAL’s revenues climbed 17.1% year over year due to upbeat air-travel demand. The uptick was driven by a 20.1% rise in passenger revenues (accounting for 91.7% of the top line) to $13,002 million. Nearly 42 million passengers traveled on UAL flights in the second quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report