Expensify Inc (EXFY) Faces Revenue Decline Amid Cost-Cutting Efforts and Platform Expansion

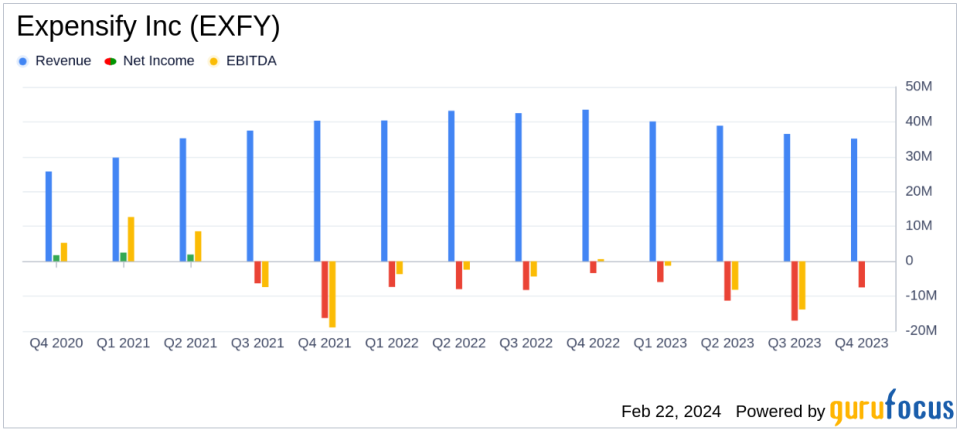

Revenue: Full-year revenue decreased by 11% to $150.7 million.

Net Loss: Net loss widened to $41.7 million from $27.0 million year-over-year.

Adjusted EBITDA: Achieved $13.2 million for the full year, showcasing cost management.

Expensify Card Growth: Interchange revenue grew 63% to $11.1 million annually.

Cost-Cutting Measures: Q4 saw significant improvements in cash flow and reduced net loss due to cost-cutting.

Free Cash Flow Guidance: Provided guidance of $10.0 million - $12.0 million for fiscal 2024.

On February 22, 2024, Expensify Inc (NASDAQ:EXFY) released its 8-K filing, detailing its financial results for the fourth quarter and full fiscal year of 2023. The company, known for its cloud-based expense management software platform, faced a challenging economic environment, which reflected in an 11% year-over-year revenue decrease to $150.7 million. Despite this, Expensify's interchange revenue from its Expensify Card grew significantly, indicating a strong adoption of this product.

Financial Performance and Strategic Cost-Cutting

Expensify's net loss for the year expanded to $41.7 million, compared to a net loss of $27.0 million in the previous year. However, the company's aggressive cost-cutting measures in the fourth quarter of 2023 led to improvements across several financial metrics. Notably, the company utilized $0.5 million cash in operating activities, marking an 89% quarter-over-quarter improvement. Free cash flow also saw a 49% quarter-over-quarter improvement, despite being negative at $(3.6) million.

The company's adjusted EBITDA for the year stood at $13.2 million, a testament to its ability to manage costs effectively. The non-GAAP net loss was significantly reduced to $0.5 million, indicating a near break-even on an adjusted basis. These measures, implemented midway through Q4, are expected to show their full impact in the coming quarters.

Business Highlights and Forward-Looking Initiatives

Expensify's 2023 business highlights include platform expansion efforts, such as sponsoring over 25 conferences and launching new consumer payment functionalities. The company also reduced its debt by $44.6 million and saw employees purchase $4.3 million worth of Class A common stock.

Looking ahead, Expensify is preparing for a global launch of its New Expensify platform in 2024. The platform aims to capture the SMB market with scalable, low-cost lead generation strategies. Additionally, the company has established a new card program expected to yield more interchange per transaction, with full migration anticipated by the end of 2024.

"If 2023 was a year of planting, we believe 2024 will be a year of harvesting," said David Barrett, Founder and CEO of Expensify. He remains optimistic about the company's fundamental health and the opportunities ahead, despite the broader economic challenges.

Financial Outlook and Investor Relations

Expensify has initiated free cash flow guidance for fiscal 2024, estimating it to be between $10.0 million and $12.0 million. This forward-looking statement is based on current estimates and assumptions and is not a guarantee of future performance.

Investors and other stakeholders are encouraged to follow Expensify's Investor Relations website for material information, including SEC filings, press releases, and conference calls.

In conclusion, while Expensify Inc (NASDAQ:EXFY) navigated a tough fiscal year with declining revenues and a widened net loss, the company's strategic cost-cutting measures and growth in interchange revenue from the Expensify Card signal potential for recovery. With a focus on platform expansion and new product offerings, Expensify is positioning itself for what it hopes to be a fruitful 2024.

Explore the complete 8-K earnings release (here) from Expensify Inc for further details.

This article first appeared on GuruFocus.