Expert: Gold Euphoria Is “Justified”

This article was originally published on ETFTrends.com.

In 2018, rising interest rates that coincided with an extended bull run in U.S. equities for most of the year fueled a strong dollar, tamping down gains for gold. However, when investors got washed in a cycle of volatility that started in the fall and lasted through year’s end, investors were quick to reconsider the precious metal as a safe haven, which helped ETFs like the SPDR Gold Shares (GLD) –an industry leader with a $34 billion market cap.

Gold has long been used as a safe haven asset, particularly when the value of the dollar declines. Furthermore, it provides a hedge for inflation since its price typically rises in conjunction with consumer prices.

During the Great Depression of the 1930s, gold was also a hedge against deflation. While the prices of assets were dropping during this time, the purchasing power of gold rose to prominence.

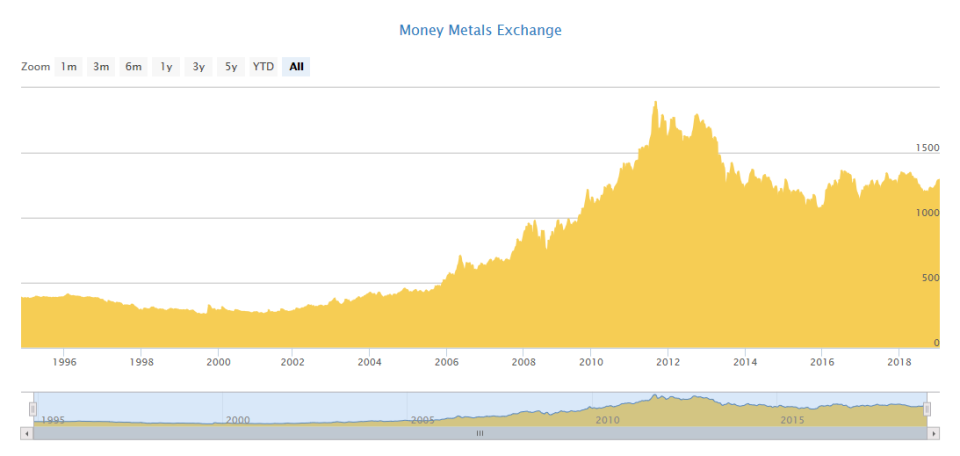

Fast forward to the financial crisis in 2008, the price of gold increased sharply while faith in U.S. equities was languishing. In essence, gold has proven to withstand times of geopolitical and economic uncertainty.

Furthermore, the value of gold has risen steadily over the years.

With the latest Fedspeak sounding more dovish as it now projects two interest rate hikes in 2019 as opposed to three or more, this could be the trigger for gold to return to come back into the forefront, particularly as a safe-haven option in the wake of more volatility. While bonds are typically the default play when U.S. equities go awry, gold is also a prime option for diversification as a safe alternative.

ETF traders can access gold plays through the Direxion Daily Jr Gold Miners Bull 3X ETF (JNUG) and Direxion Daily Gold Miners Bull 3X ETF (NUGT).

"Investors are looking for higher gold prices, and with good reason," said George Milling-Stanley, head of gold strategy at State Street Global Advisors. Listen to the full interview below:

For more market trends, visit ETF Trends.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

An Alternative ETF to Hedge Against Further Market Volatility

Indonesia ETFs Slip After Credit Suisse Downgrades the Developing Economy

A One-ETF-Fits-All Solution in Today’s Challenging Fixed Income Market

Fidelity Expands Its Commission-Free ETF Platform to Include Over 500 Options

Schwab ETF OneSource Doubles Lineup to 500+ Commission-Free ETFs