Exploring February 2024's Choice UK Dividend Stocks

Amidst a period of fluctuating fortunes for the UK market, investors continue to navigate through waves of economic uncertainties and shifting trends. In this environment, discerning investors often turn to dividend stocks as a potential source of steady income and long-term value.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.67% | ★★★★★★ |

BAE Systems (LSE:BA.) | 2.32% | ★★★★★☆ |

AstraZeneca (LSE:AZN) | 2.40% | ★★★★★☆ |

M.T.I Wireless Edge (AIM:MWE) | 6.36% | ★★★★★☆ |

DCC (LSE:DCC) | 3.42% | ★★★★★☆ |

Intertek Group (LSE:ITRK) | 2.53% | ★★★★★☆ |

Imperial Brands (LSE:IMB) | 7.80% | ★★★★★☆ |

Nationwide Building Society (LSE:NBS) | 7.88% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.56% | ★★★★★☆ |

Cohort (AIM:CHRT) | 2.44% | ★★★★★☆ |

Click here to see the full list results from our Top Dividend Stocks screener.

Underneath we present 3 selections from the 50 stocks filtered out by our screen.

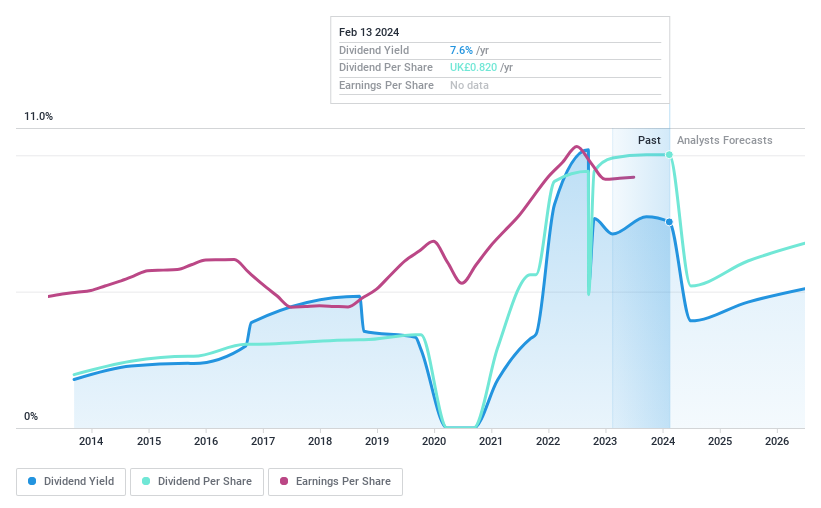

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a UK-based retailer specializing in homewares, with a market capitalization of approximately £2.19 billion.

Operations: Dunelm Group plc generates its revenue primarily through the sale of homewares, totaling £1.64 billion.

Dividend Yield: 7.6%

Dunelm Group presents a mixed picture for dividend investors. The company's debt profile has improved, with the debt to equity ratio more than halving over five years, indicating a stronger balance sheet. Earnings have grown consistently in that period, although there was a recent dip in profit margins and negative earnings growth over the past year. On the dividend front, payments are well-supported by both earnings and cash flows, with payout ratios suggesting sustainability. However, dividends have been volatile historically which may concern those seeking stable income streams. Despite this volatility, Dunelm's current yield stands above many UK peers and interest payments are comfortably covered by profits—positive signs for dividend seekers amid some cautionary notes. Take a closer look at Dunelm Group's potential here in our dividend report.

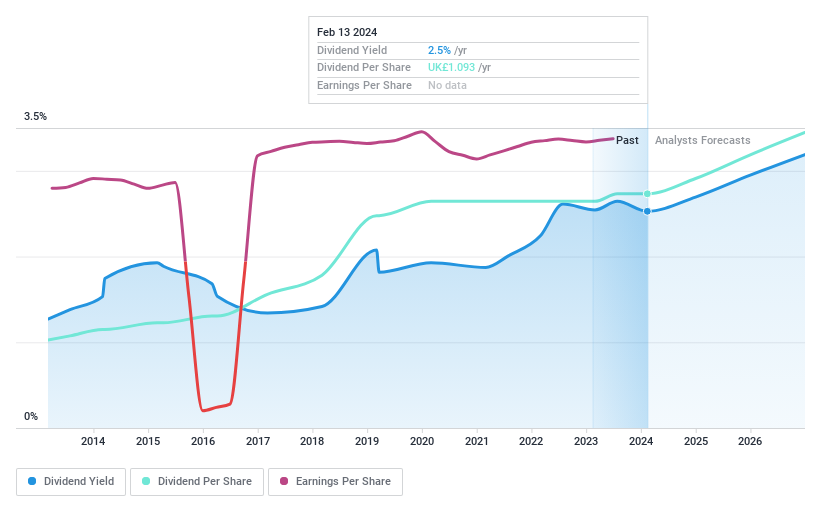

Intertek Group (LSE:ITRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intertek Group plc is a global company offering quality assurance solutions across multiple industries, with operations in the United Kingdom, the United States, China, Australia, and other countries, currently holding a market capitalization of approximately £6.97 billion.

Operations: Intertek Group plc generates its revenue by providing a diverse range of quality assurance services to industries worldwide.

Dividend Yield: 2.5%

Intertek Group exhibits a prudent financial posture for dividend enthusiasts, with a decreasing debt to equity ratio over the past five years, suggesting a fortifying balance sheet. The company's modest earnings growth has recently accelerated, outpacing its five-year trend. Dividends have shown consistency and reliability over the past decade and are well underpinned by both earnings and free cash flow, indicating sustainability despite a yield that isn't among the market's highest. However, investors might note that profit margins have contracted slightly from the previous year, and future revenue and profit growth are not projected to be robust. Click to explore a detailed breakdown of our findings in Intertek Group's dividend report.

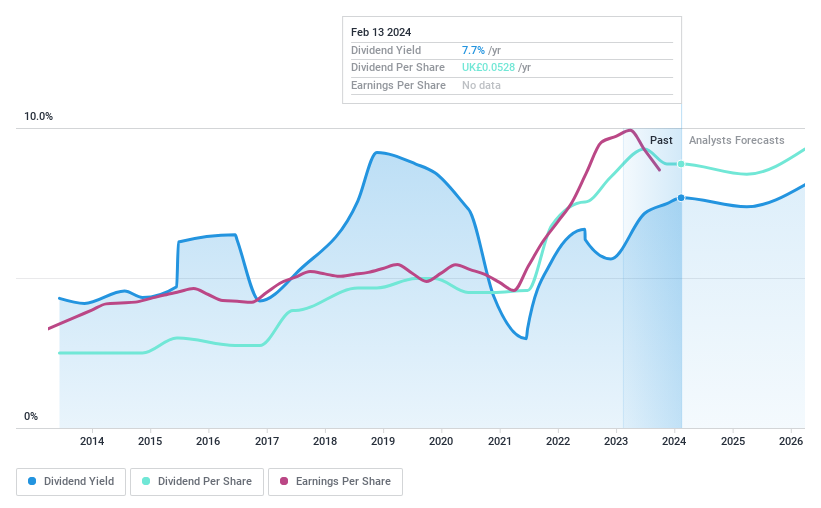

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Record plc is a financial services firm specializing in currency and derivative management, operating across the UK, North America, Continental Europe, and Australia, with a market capitalization of approximately £132 million.

Operations: Record plc generates its revenue primarily from the provision of currency and derivatives management services, amounting to £44.1 million.

Dividend Yield: 7.7%

Record plc stands as a compelling option for dividend-focused investors, boasting a debt-free balance sheet for the past five years, which underscores financial stability. Earnings have expanded at a respectable pace over the same period, supporting an upward trajectory in dividend payments. While recent profit margins have dipped and earnings growth has decelerated, dividends remain well-supported by robust coverage from both earnings and free cash flow. The firm's track record of reliable and stable dividends over the past decade adds to its appeal, even as future growth projections are modest rather than meteoric. Get an in-depth perspective on Record's performance by reading our dividend report here.

Next Steps

The Simply Wall St screener serves as a valuable compass in navigating the landscape of robust dividend-paying stocks in the United Kingdom. Gain an insight into the universe of 50 Top Dividend Stocks by clicking here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com