Exploring February 2024's Top Dividend Stocks in Australia

As the Australian market holds steady over the past week, it reflects a resilient uptrend with a 6.2% increase over the past year, alongside an optimistic forecast of 12% annual earnings growth. In this context, a good stock often combines reliable dividend payouts with potential for capital appreciation, aligning well with current market conditions for income-focused investors.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Korvest (ASX:KOV) | 7.01% | ★★★★★☆ |

Computershare (ASX:CPU) | 3.09% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.44% | ★★★★★☆ |

Bendigo and Adelaide Bank (ASX:BEN) | 6.72% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.86% | ★★★★★☆ |

Centrepoint Alliance (ASX:CAF) | 7.58% | ★★★★★☆ |

Atlas Arteria (ASX:ALX) | 7.34% | ★★★★☆☆ |

Joyce (ASX:JYC) | 7.50% | ★★★★☆☆ |

Brambles (ASX:BXB) | 3.09% | ★★★★☆☆ |

Northern Star Resources (ASX:NST) | 2.05% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

APM Human Services International (ASX:APM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: APM Human Services International Limited is a provider of human and health services across Australia and globally, with a market capitalization of approximately A$1.27 billion.

Operations: APM Human Services International Limited generates its revenues primarily through operations in ANZ at A$814.85 million, North America at A$642.13 million, and the Rest of World at A$436.83 million.

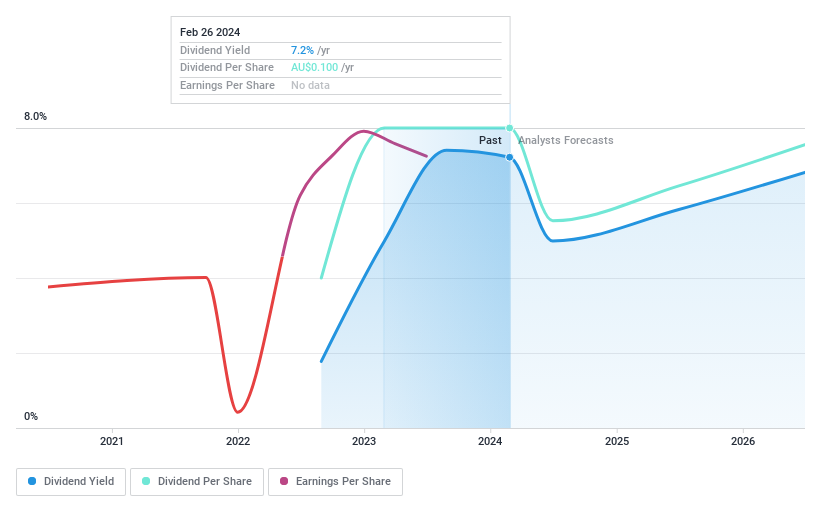

Dividend Yield: 7.2%

APM Human Services International, with a dividend yield of A$7.22%, stands above the Australian market average. While trading at 65% below estimated fair value suggests potential, its dividends are relatively new, making stability and growth assessments premature. Earnings have increased significantly by 161.1% over the past year and are projected to grow further; however, a high level of debt and a volatile share price temper the outlook. The recent withdrawal of CVC Capital Partners' A$1.4 billion acquisition offer adds an element of uncertainty to APM's future prospects.

Centrepoint Alliance (ASX:CAF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Centrepoint Alliance Limited is an Australian financial services provider that operates through its subsidiaries with a market capitalization of approximately A$65.30 million.

Operations: Centrepoint Alliance Limited generates its revenues through the provision of diverse financial services within Australia.

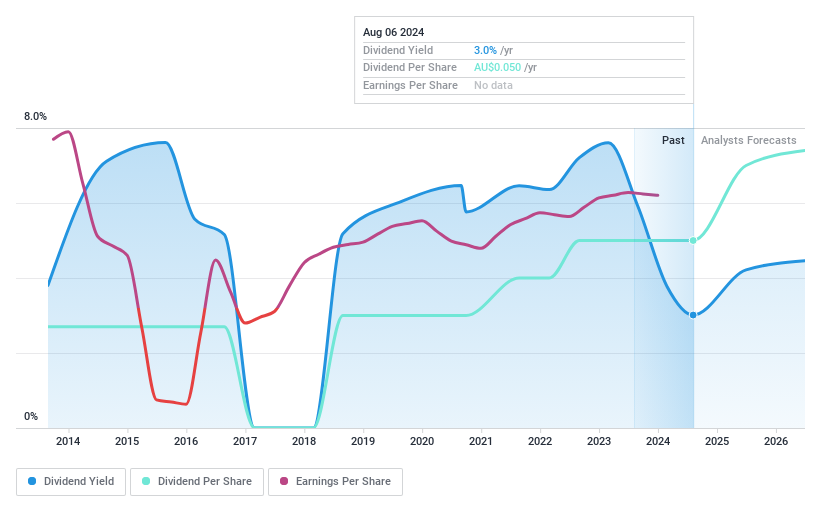

Dividend Yield: 7.6%

Centrepoint Alliance's dividend yield of A$7.58% ranks well in the Australian market, supported by a payout ratio of 60.4% and cash payout ratio at 89.7%, indicating dividends are backed by both earnings and cash flow. Despite trading 47.9% below fair value, investors should note the historical volatility in its dividend payments over the past decade, which may raise concerns about future reliability despite recent increases in payouts. The company's half-year report showed a rise in sales to A$140.2 million and net income to A$4.86 million, suggesting financial improvement that could support ongoing dividends if sustained.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited is an Australian company specializing in electrical, instrumentation, communication, and maintenance services with a market capitalization of approximately A$249.96 million.

Operations: Southern Cross Electrical Engineering Limited generates its revenue primarily through the provision of electrical services, which contributed A$464.71 million to the company's income.

Dividend Yield: 5.3%

Southern Cross Electrical Engineering's dividend sustainability is underscored by a low cash payout ratio of 29.3% and an earnings payout ratio of 65%, indicating dividends are comfortably funded. With earnings growth at 13.8% annually over five years and a P/E ratio below the Australian market average, the stock shows value potential despite its dividend yield being lower than the top quartile of Australian dividend payers. However, investors should be cautious due to SXE's history of volatile dividends over the past decade. Recent events include their participation in a conference on February 12, 2024, and an upcoming earnings report scheduled for today's date.

Turning Ideas Into Actions

Dive into all 27 of the Top Dividend Stocks we have identified here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com