Exploring German Dividend Stocks For Steady February 2024 Income

In the past week and year, the German market has shown remarkable stability, with no significant changes in its overall performance. Looking ahead, expectations of a steady 13% annual earnings growth over the next few years present an optimistic backdrop for investors seeking reliable income streams. Against this stable market landscape, dividend stocks stand out as potentially attractive options for those aiming to secure consistent returns amidst economic predictability.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 5.88% | ★★★★★★ |

FORTEC Elektronik (XTRA:FEV) | 3.50% | ★★★★★☆ |

CEWE Stiftung KGaA (XTRA:CWC) | 2.34% | ★★★★★☆ |

Mensch und Maschine Software (XTRA:MUM) | 2.80% | ★★★★★☆ |

Talanx (XTRA:TLX) | 2.99% | ★★★★★☆ |

Siemens (XTRA:SIE) | 2.73% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.30% | ★★★★★☆ |

FRoSTA (DB:NLM) | 2.53% | ★★★★★☆ |

Deutsche Börse (XTRA:DB1) | 2.02% | ★★★★★☆ |

Hannover Rück (XTRA:HNR1) | 2.56% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft is a European company specializing in the development, production, and marketing of frozen food products across Germany, Italy, Poland, Austria, and Eastern Europe with a market capitalization of approximately €432 million.

Operations: FRoSTA Aktiengesellschaft generates its revenues primarily from the sale of frozen food products in key markets across Germany, Italy, Poland, Austria, and other Eastern European countries.

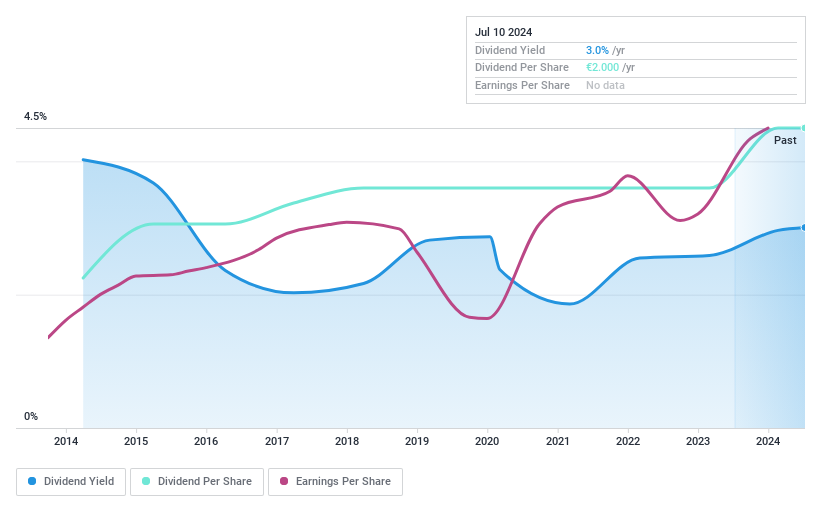

Dividend Yield: 2.5%

FRoSTA AG (DB:NLM) presents a compelling case for dividend investors seeking stability and prudent financial management. Over the past five years, the company has demonstrated a commitment to fiscal health, substantially reducing its debt-to-equity ratio while maintaining robust profit growth. The past year's earnings surge notably outpaced its five-year average, indicating an acceleration in profitability. Importantly for dividend seekers, FRoSTA's dividends appear sustainable; the payout ratio suggests that earnings comfortably cover distributions to shareholders, and this is reinforced by a low cash payout ratio which underscores the dividends' coverage by free cash flow. Additionally, FRoSTA has built a track record of reliable and stable dividends over the past decade. However, it's worth noting that its yield is modest compared to Germany's top dividend payers.

Delve into the full analysis dividend report here for a deeper understanding of FRoSTA.

Upon reviewing our latest valuation report, FRoSTA's share price might be too optimistic.

Consider placing the stock on a Simply Wall St watchlist and revisit its valuation at a later date when it might be more favorable.

Edel SE KGaA (XTRA:EDL)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA is a European independent music company with a diverse range of subsidiary operations, and it has a market capitalization of approximately €108.5 million.

Operations: Edel SE & Co. KGaA generates its revenues primarily through two segments: Marketing and Sales, which contributes €135.6 million, and Manufacturing and Logistics with €144.7 million in earnings.

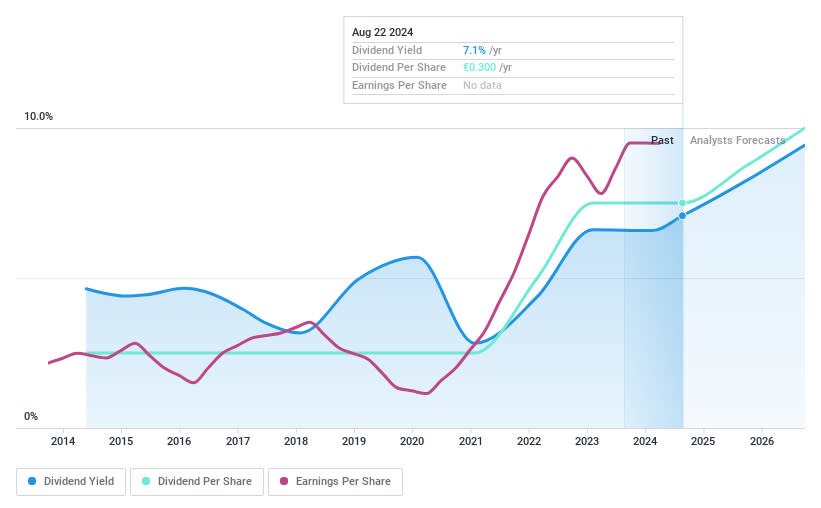

Dividend Yield: 5.9%

Edel SE KGaA emerges as a noteworthy player among German dividend stocks, showing financial resilience through a significant reduction in its debt-to-equity ratio over five years, signaling improved fiscal health. Earnings have seen substantial growth during the same period, although the past year's performance has not kept pace with this longer-term trend. The company's dividends boast a decade of reliability and growth, underpinned by earnings and cash flows that comfortably cover payouts—factors crucial for dividend sustainability. However, despite these strengths, Edel SE KGaA's high net debt to equity ratio warrants caution for risk-averse investors.

Click to explore a detailed breakdown of our findings in Edel SE KGaA's dividend report.

Our valuation report here indicates Edel SE KGaA may be undervalued.

To ensure that you don't miss out on any news or updates around this stock or any of your other holdings, keep them under close view with the insightful analysis available through Simply Wall St's portfolio tool.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mensch und Maschine Software SE is a provider of computer-aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management solutions with a presence in Germany and abroad, boasting a market capitalization of approximately €833 million.

Operations: Mensch und Maschine Software SE generates its revenues primarily through two segments: M+M Software, which contributed €103.7 million, and its Systemhaus/VAR Business with €230.8 million in sales.

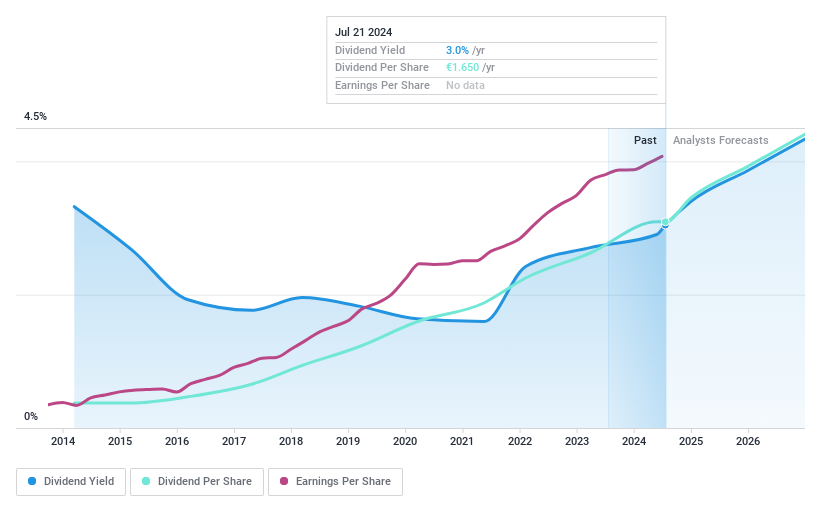

Dividend Yield: 2.8%

Mensch und Maschine Software, a player in the German dividend stock arena, presents a mixed bag for investors seeking income. The firm has demonstrated fiscal prudence by significantly reducing its debt-to-equity ratio over five years and maintaining dividends supported by both earnings and cash flows—key indicators of sustainability. Earnings have consistently grown, albeit with recent growth trailing the five-year average. While MUM's dividend yield isn't top-tier compared to some German market leaders, its decade-long track record of reliable and growing dividends may appeal to investors prioritizing stability over high yield.

Dive into the specifics of Mensch und Maschine Software here with our thorough dividend report.

With the insight that this stock may be undervalued, it's crucial to stay informed on its valuation changes. Simply Wall St's portfolio tool offers a dynamic way to keep tabs on your investments.

Key Takeaways

Harness the power of data-driven insights to navigate the world of German dividend stocks with ease using the Simply Wall St screener. Delve into our full catalog of 22 Top Dividend Stocks here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com