Exploring Last Week’s Economic Indicators: Household Debt, Services PMI, and Trade

This article was originally published on ETFTrends.com.

Economic indicators are released every week to provide insight into the overall health and performance of an economy. They serve as essential tools for policymakers, advisors, investors, and businesses because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending February 8, the SPDR S&P 500 ETF Trust (SPY) rose 1.86%. The Invesco S&P 500 Equal Weight ETF (RSP) was up 0.29%.

While the economic calendar for last week featured a lighter load, three noteworthy economic reports warrant attention: the quarterly household debt and credit report, the services sector PMI, and the trade balance. These data points can collectively provide insights into various aspects of the economy, including consumer behavior and service sector health. In this article, we will summarize the latest data on each of these indicators.

Household Debt and Credit

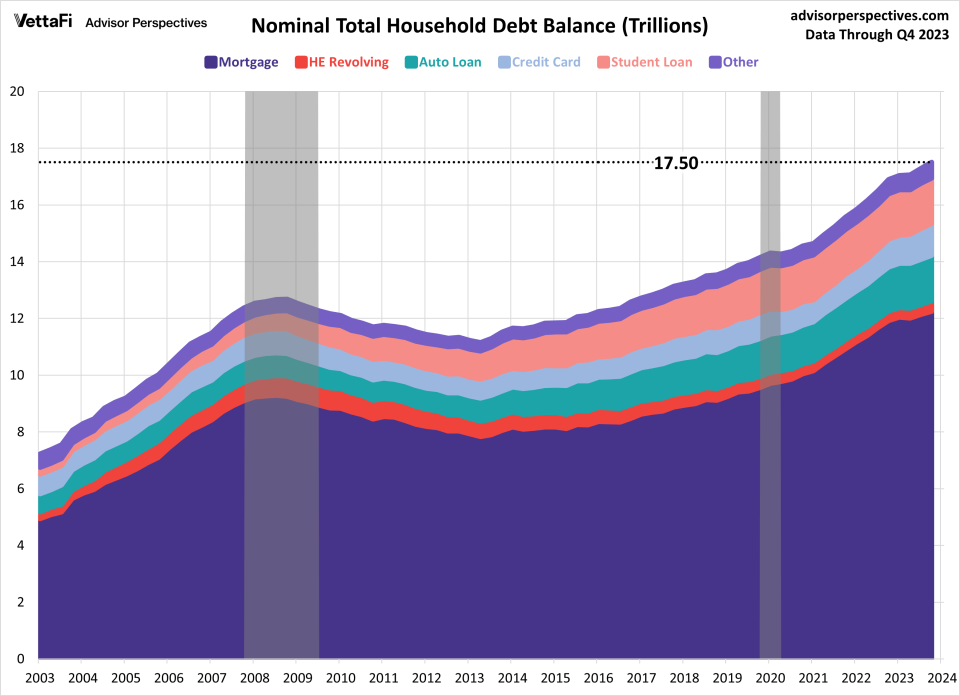

In the latest quarterly household debt and credit report released by the NY Fed, we saw a notable $212 billion uptick in household debt, reaching a record $17.50 trillion in Q4. The latest data represents a 1.23% increase from Q3’s debt level of $17.29 trillion. For a second straight quarter, all debt categories grew; however, the latest surge was primarily fueled by increased mortgage, credit card, and auto loan balances. Specifically, mortgage balances hit an all-time high of $12.25 trillion (a 0.9% increase), credit card balances reached a record high of $1.13 trillion (a 4.6% increase), and auto loan balances climbed to a record high of $1.61 trillion (a 0.8% increase). This comprehensive report serves as a gauge for the financial conditions of U.S. households, offering insights into their economic well-being.

Services PMI

Economic activity expanded in the services sector for a 13th-straight month. The ISM Services PMI reached its highest level in the past four months, coming in at 53.4 in January. The latest reading was better than the expected 52.0 forecast. Nearly all subcomponents of the index improved in January, with inventories being the sole component that contracted. Additionally, 10 service industries reported growth, while seven industries reported a decline. Overall, the business conditions in the services sector are currently stable, as the sector has now grown in 43 of the past 44 months; the lone contraction was in December 2022. Notably, many respondents reported optimism about the economy due to potential interest rate cuts, but they also remain cautious about inflation, cost pressures, and ongoing geopolitical conflicts.

Trade Balance

The U.S. international trade deficit expanded more than expected in December due to a larger increase in imports than exports. The trade deficit increased by 0.5% in December to $62.20 billion, larger than the $62.00 billion forecast. Exports rose by $3.9 billion (1.5%) to $258.25 billion while imports rose $4.2 billion (1.3%) to $320.45 billion. The trade balance, which reports on the country's imports and exports of goods and services, provides insights into foreign trade dynamics, serving as a gauge for the overall growth or contraction of the economy. The deficit has now grown in three of the past four months. However, despite the recent growth, the deficit has shrunk 11.4% compared to the start of the year, and is 12.9% smaller compared to a year ago.

Economic Indicators and the Week Ahead

The upcoming week will feature the latest inflation, consumer spending, and consumer sentiment data. On Tuesday, the Bureau of Labor Statistics will release January’s Consumer Price Index (CPI). Then on Thursday, the Census Bureau will release retail sales data for January. Finally, on Friday, the University of Michigan will release its preliminary report for its Consumer Sentiment Survey for February.

Current forecasts show that headline and core CPI increased 0.2% and 0.3% from December, respectively. Retail sales, which will impact interests in the SPDR S&P Retail ETF (XRT), are expected to increase for a third-straight month, rising 0.1% from December. Lastly, the preliminary report for the Michigan Consumer Sentiment Index, which could impact interest in the Consumer Discretionary Select Sector SPDR ETF (XLY), is predicted to increase from January’s final reading of 79.0 to 80.0.

For more news, information, and strategy, visit the Innovative ETFs Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM