Exploring PCTEL And Two More Top Dividend Stocks For Your Portfolio

Amidst the buzz of technological partnerships shaping the market, as seen with Alphabet's potential AI collaboration with Apple, investors are closely watching for opportunities that balance growth prospects with steady returns. In this climate, dividend stocks like PCTEL stand out for their potential to offer investors a blend of income and relative stability in a dynamic market landscape.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

AGCO (NYSE:AGCO) | 5.34% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.58% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.76% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.99% | ★★★★★★ |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.54% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.93% | ★★★★★★ |

Burnham Holdings (OTCPK:BURC.A) | 6.90% | ★★★★★★ |

Agree Realty (NYSE:ADC) | 5.31% | ★★★★★★ |

ALLETE (NYSE:ALE) | 4.87% | ★★★★★★ |

ONEOK (NYSE:OKE) | 5.09% | ★★★★★★ |

Click here to see the full list of 173 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

PCTEL (NasdaqGS:PCTI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PCTEL, Inc. is a global provider of industrial Internet of Things (IoT) devices, antenna systems, and test and measurement solutions with a market capitalization of approximately $132.95 million.

Operations: PCTEL, Inc.'s revenue is primarily derived from its Antennas & Industrial IoT Devices segment, which generated $59.50 million, and its Test & Measurement Products segment, contributing $27.76 million.

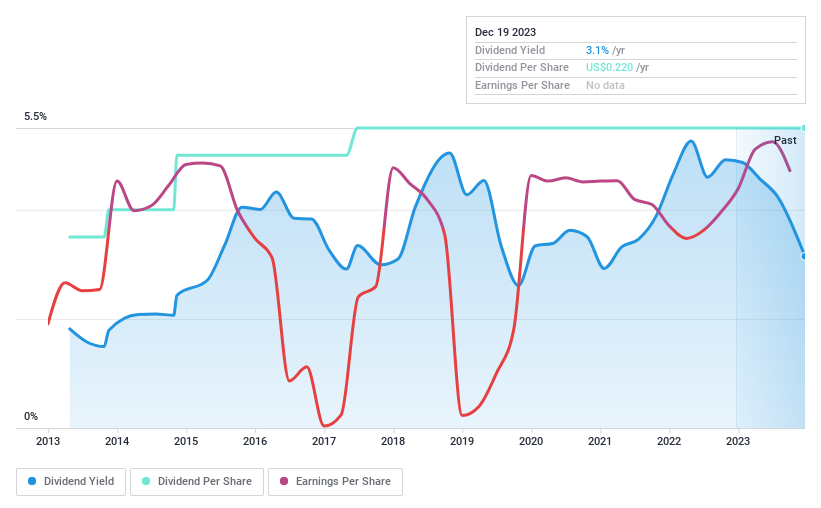

Dividend Yield: 3.1%

PCTEL, despite a robust earnings growth of 274.3% last year and a forecasted annual earnings increase of 17.15%, faces challenges with its dividend sustainability. The payout ratio at 95.8% suggests dividends aren't well covered by earnings, complemented by a dividend yield (3.15%) below the US market's top quartile (4.61%). However, cash flows are healthier with a cash payout ratio of 43.6%. Recent product advancements may bolster operational efficiency but delisting raises questions about accessibility for investors.

Standard Motor Products (NYSE:SMP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Standard Motor Products, Inc. is a company that specializes in manufacturing and distributing replacement automotive parts across the United States and internationally, with a market capitalization of approximately $684.30 million.

Operations: Standard Motor Products, Inc.'s revenue is derived from three primary segments: Vehicle Control ($737.93 million), Temperature Control ($337.75 million), and Engineered Solutions ($282.59 million).

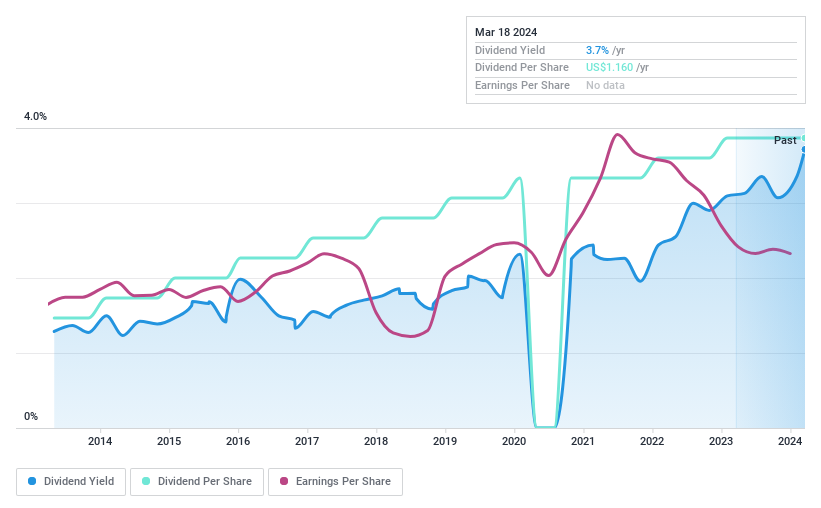

Dividend Yield: 3.7%

Standard Motor Products (SMP) maintains a decade-long record of increasing dividends, underpinned by a 22% cash payout ratio and 39.9% earnings payout ratio, indicating a sustainable dividend policy. The company's P/E ratio of 10.8x is below the US market average, suggesting value potential relative to peers. However, recent financials show a year-over-year decline in Q4 sales and net income with flat to low single-digit sales growth projected for 2024; this may pressure future dividend growth despite current stability. On February 5th, SMP affirmed its quarterly dividend commitment at US$0.29 per share, reflecting ongoing shareholder returns amidst modest performance metrics.

Qifu Technology (NasdaqGS:QFIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qifu Technology, Inc. is a company that operates its credit-tech platform under the 360 Jietiao brand within the People’s Republic of China, with a market capitalization of approximately $2.98 billion.

Operations: Qifu Technology, Inc. generates its revenue primarily from unclassified services, amounting to CN¥16.29 billion.

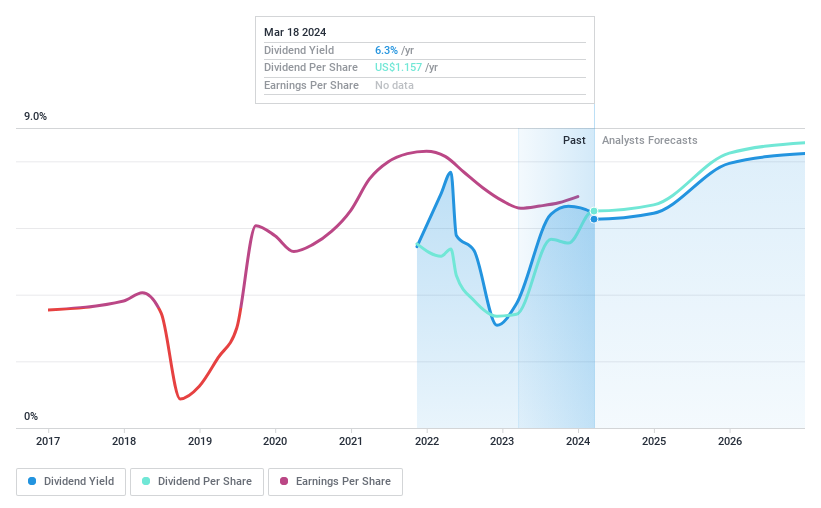

Dividend Yield: 6.3%

Qifu Technology's dividend history is marred by volatility, with significant annual fluctuations over the past two years. Despite this, its dividends appear sustainable with a 28.7% earnings payout ratio and an even more conservative 18.9% cash flow payout ratio. The company's recent actions, including a share buyback program and reaffirmation of its semi-annual dividend policy—pledging 20-30% of GAAP net income after tax—signal confidence in its financial health despite past inconsistencies in dividend payments.

Make It Happen

Investigate our full lineup of 173 Top Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com