Exploring Top Canadian Dividend Stocks For February 2024

As the frosty Canadian February unfurls, it's time to cozy up with some of the warmest dividend stocks on the market. Let's break the ice with three sturdy financial beacons that promise to light up your portfolio with steady dividends and a glow of potential growth.

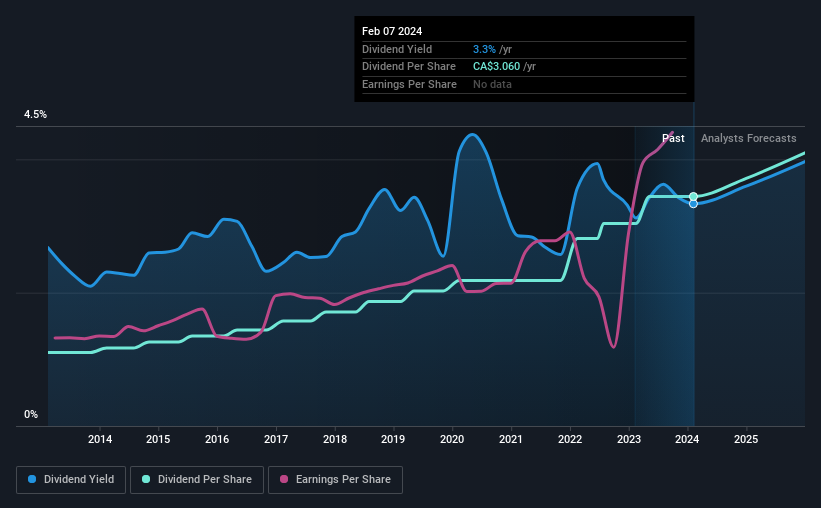

iA Financial (TSX:IAG)

iA Financial, a key player in life and health insurance within Canada and the U.S., operates with a market cap of CA$9.12 billion, drawing significant revenue from its Wealth Management segment. Analyzing iA Financial's dividend prospects reveals a mixed picture; while its debt to equity ratio has seen a slight uptick over five years, the company's earnings have consistently grown at an annual rate of 10.8%. Despite lower net profit margins compared to last year, iA Financial impresses with robust earnings growth over the past year and maintains a satisfactory net debt to equity ratio. The dividends appear well-supported by both earnings and cash flows, reflected in low payout ratios. However, it's worth noting that iA Financial's dividend yield isn't among the highest in Canada and future profit forecasts suggest potential declines—factors for investors to consider when assessing this stock for their dividend portfolios. Take a closer look at iA Financial's potential here.

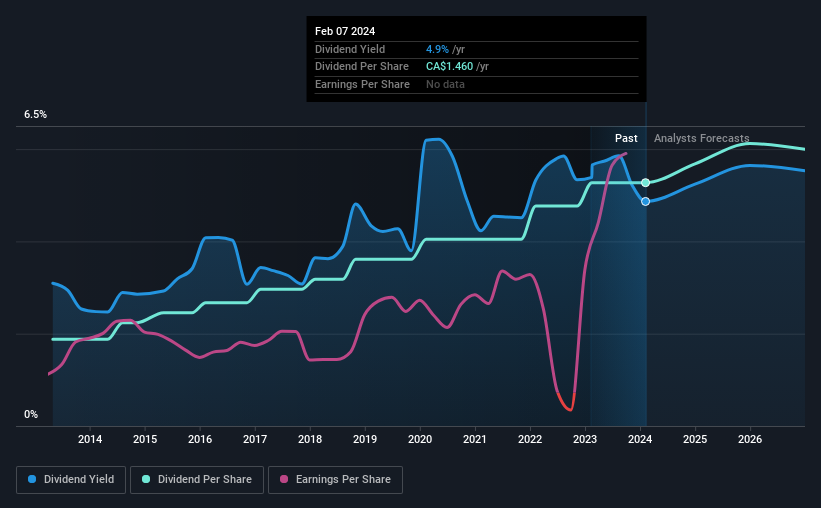

Imperial Oil (TSX:IMO)

Imperial Oil, a major player in Canada's energy sector, operates across three key segments: Chemicals, Upstream, and Downstream—generating the bulk of its CA$55.86 billion revenue from Downstream operations. Analysis of Imperial Oil's dividend potential shows a company with a solid financial footing; debt levels have been trimmed slightly over five years and operating cash flow stands robust at 85.5% of debt, indicating good coverage. Earnings have seen substantial growth historically but face forecasts for contraction in the coming years. The dividends themselves are well covered by earnings and cash flows with low payout ratios, suggesting sustainability. However, investors might note that the dividend yield is modest when stacked against Canada's top dividend payers and that recent profit margins have dipped slightly from previous highs—points to ponder for those eyeing long-term income streams in their portfolios. Click here and access our complete analysis report to understand the dynamics of Imperial Oil.

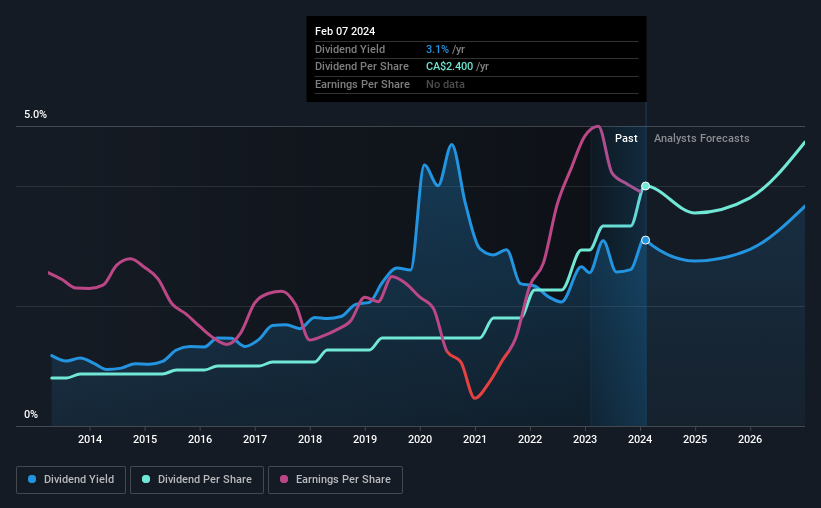

Manulife Financial (TSX:MFC)

Manulife Financial, with a market cap of CA$54.2 billion, serves a diverse clientele through financial products and services in Asia, Canada, the U.S., and globally. Its largest revenue streams emerge from Asia at 15662 and Global WAM at 6561. While Manulife's debt has risen over five years, its operating cash flow remains strong at 72.8% of debt, suggesting sound debt management. Earnings have increased annually by 16%, yet future forecasts anticipate a decline. Dividend-wise, Manulife shines with consistent growth over the past decade and robust coverage by both earnings (payout ratio: 19.9%) and cash flows (cash payout ratio: 13%), hinting at sustainability despite a dividend yield that doesn't top the Canadian market charts. Investors should weigh these aspects alongside the expectation of slower revenue growth when considering Manulife within their dividend portfolios. Click here to discover the nuances of Manulife Financial with our detailed analytical report.

Final Thoughts

Discover a world of robust dividend payers with ease using the intuitive Simply Wall St screener. Access the full spectrum of Top Dividend Stocks by clicking on this link.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com