Exploring Top Dividend Stocks In Hong Kong For March 2024

As Asian equities experience a surge, with Hong Kong's Hang Seng Index notably up led by the tech sector, investors are keeping a keen eye on global economic indicators and central bank policies. Amidst these market conditions, dividend stocks in Hong Kong emerge as potential candidates for those seeking income-generating investments that may offer stability in a landscape of fluctuating monetary policies and inflation expectations.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Fu Shou Yuan International Group (SEHK:1448) | 3.27% | ★★★★★☆ |

China Medical System Holdings (SEHK:867) | 4.80% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.03% | ★★★★★☆ |

CITIC Telecom International Holdings (SEHK:1883) | 7.98% | ★★★★★☆ |

Industrial and Commercial Bank of China (SEHK:1398) | 7.94% | ★★★★★☆ |

Agricultural Bank of China (SEHK:1288) | 7.26% | ★★★★★☆ |

Far East Horizon (SEHK:3360) | 7.67% | ★★★★★☆ |

Zhejiang Expressway (SEHK:576) | 6.87% | ★★★★★☆ |

Anhui Expressway (SEHK:995) | 6.85% | ★★★★★☆ |

Tian An China Investments (SEHK:28) | 6.83% | ★★★★★☆ |

Click here to see the full list of 42 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

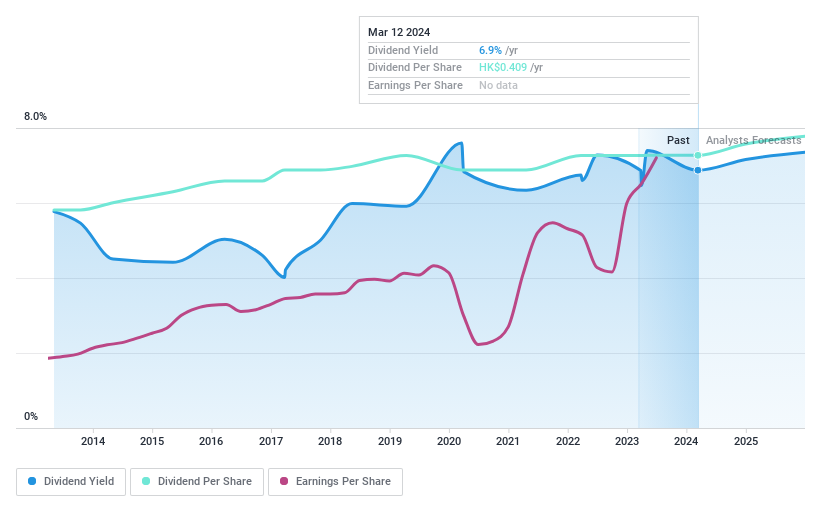

Agricultural Bank of China (1288.HK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited is a major bank that offers a comprehensive range of banking products and services, with a market capitalization of approximately HK$1.54 trillion.

Operations: The Agricultural Bank of China Limited generates its revenue from a variety of banking products and services.

Dividend Yield: 7.3%

Agricultural Bank of China's dividend yield stands at 7.26%, which is modest relative to Hong Kong's top dividend payers. The bank has a history of reliable dividends over the past decade, and with a payout ratio of 31.2%, its dividends are currently well-covered by earnings—a trend expected to continue with a projected coverage at 32.3% in three years. Despite earnings forecasted to grow at 4.48% per year, the stock trades at a significant discount—71% below estimated fair value—potentially offering value to investors. Recent capital raising through Tier 2 notes worth RMB 70 billion aims to bolster its capital adequacy, reflecting prudent financial management but also suggesting potential future dilution or debt servicing costs that could affect dividend sustainability.

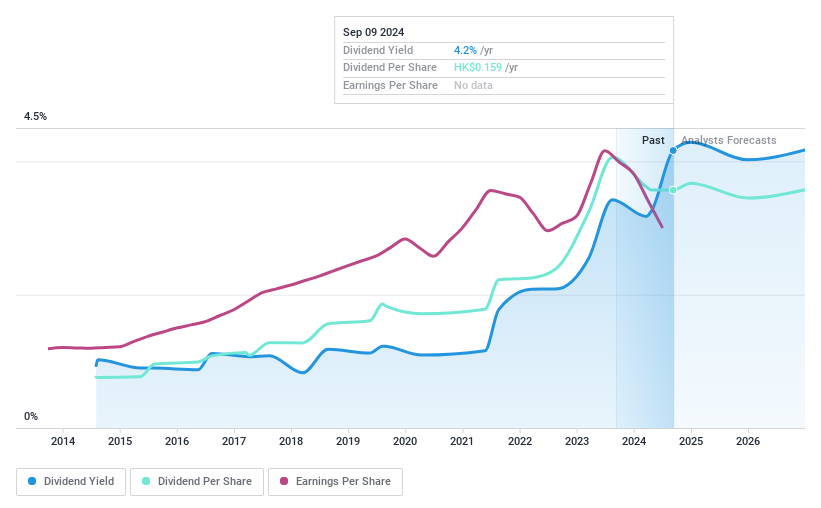

Fu Shou Yuan International Group (1448.HK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fu Shou Yuan International Group Limited operates as a provider of burial and funeral services in the People's Republic of China, with a market capitalization of approximately HK$12.47 billion.

Operations: Fu Shou Yuan International Group Limited generates revenue primarily through burial services, which brought in CN¥2.31 billion, and funeral services, contributing CN¥0.42 billion.

Dividend Yield: 3.3%

Fu Shou Yuan International Group offers a modest dividend yield of 3.27%, below the Hong Kong market's top quartile, but its stability is underpinned by a decade of consistent growth and a sustainable payout ratio of 40.2%. Earnings have expanded by 40.5% over the past year, and with dividends well-covered by both earnings and cash flows (cash payout ratio at 30.7%), the foundation for ongoing dividend payments appears robust. Despite analysts projecting a significant upside in stock price (46.6% increase), the current yield may not attract those seeking high immediate returns, yet it could appeal to investors prioritizing steady income and long-term value appreciation.

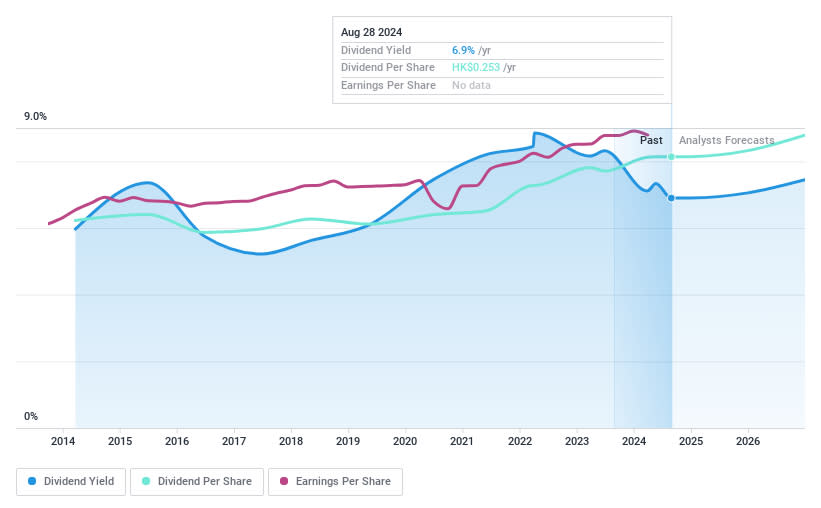

Zhejiang Expressway (0576.HK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Expressway Co., Ltd. is an investment holding company specializing in the operation, maintenance, and management of roads within the People's Republic of China, with a market capitalization of approximately HK$35.66 billion.

Operations: Zhejiang Expressway Co., Ltd. generates revenue primarily through toll operations and securities operations, with CN¥9.37 billion from tolls and CN¥6.33 billion from securities activities.

Dividend Yield: 6.9%

Zhejiang Expressway sustains a reliable dividend with a 10-year history of steady payments, supported by a low payout ratio of 25.2% and cash flows (cash payout ratio at 25.9%). Despite trading below fair value estimates and analysts forecasting a price increase, its yield at 6.87% trails the Hong Kong market's top dividend payers. Earnings growth is notable at 68.3% last year; however, future earnings are expected to slightly decline, with large one-off items impacting financial results.

Make It Happen

Unlock more gems! Our Top Dividend Stocks screener has unearthed 39 more companies for you to explore.Click here to unveil our expertly curated list of 42 Top Dividend Stocks .

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion .

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com