Exploring Top Dividend Stocks For Portfolio Growth In February 202

As February 2024 unfolds, the United States market has shown resilience amidst global economic headwinds, with steady growth and a robust outlook catching the eye of investors. In this climate, dividend stocks stand out as beacons for those seeking to bolster their portfolios with assets that not only offer potential for appreciation but also provide a stream of income through regular payouts.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.56% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.38% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.64% | ★★★★★★ |

AGCO (NYSE:AGCO) | 5.46% | ★★★★★★ |

Helmerich & Payne (NYSE:HP) | 4.96% | ★★★★★★ |

Ennis (NYSE:EBF) | 5.06% | ★★★★★★ |

Bristol-Myers Squibb (NYSE:BMY) | 4.93% | ★★★★★★ |

Best Buy (NYSE:BBY) | 5.05% | ★★★★★★ |

Dillard's (NYSE:DDS) | 5.19% | ★★★★★★ |

ALLETE (NYSE:ALE) | 4.94% | ★★★★★★ |

Click here to see the full list results from our Top Dividend Stocks screener.

Here we highlight 3 of our preferred stocks from the screener, which has 100 names in total.

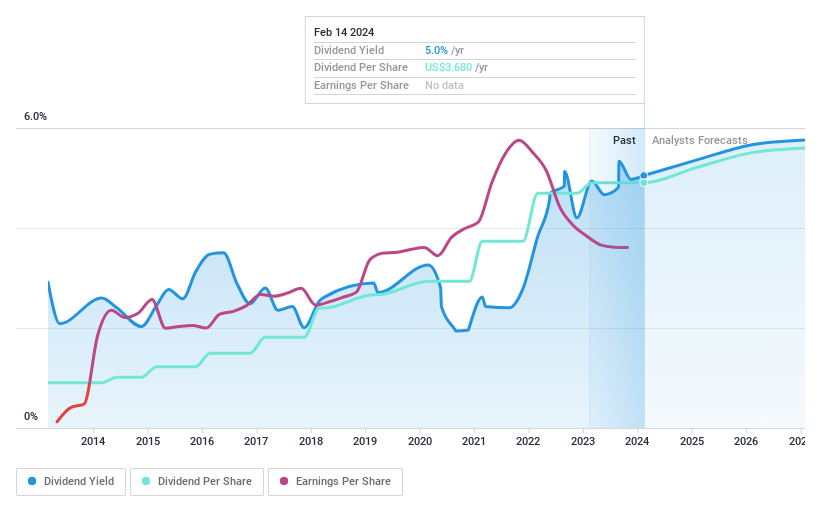

Best Buy (NYSE:BBY)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Best Buy Co., Inc. is a retailer specializing in technology products with operations across the United States and Canada, boasting a market capitalization of approximately $15.7 billion.

Operations: Best Buy Co., Inc. generates its revenues primarily through its domestic segment, which brought in $40.2 billion, complemented by an additional $3.3 billion from its international operations.

Dividend Yield: 5%

Best Buy (NYSE:BBY), while not a standout in the dividend stock arena, presents a balanced profile for income-focused investors. Over five years, its earnings have modestly increased by 2.2% annually, and although recent profit margins have dipped slightly to 2.9%, the company's dividends appear sustainable with both earnings and cash flows providing adequate coverage—payout ratios stand at 62.5% and cash payout at 57.6%, respectively. Debt levels are manageable with a net debt to equity ratio of 7.8%, well within satisfactory bounds, and operating cash flow robustly covers existing debt obligations by over 200%. Dividend reliability is underscored by a decade of stable payments; however, forecasts suggest only modest growth in profits and revenues ahead, tempering expectations for significant dividend expansion or dramatic financial performance leaps. Take a closer look at Best Buy's potential here in our dividend report.

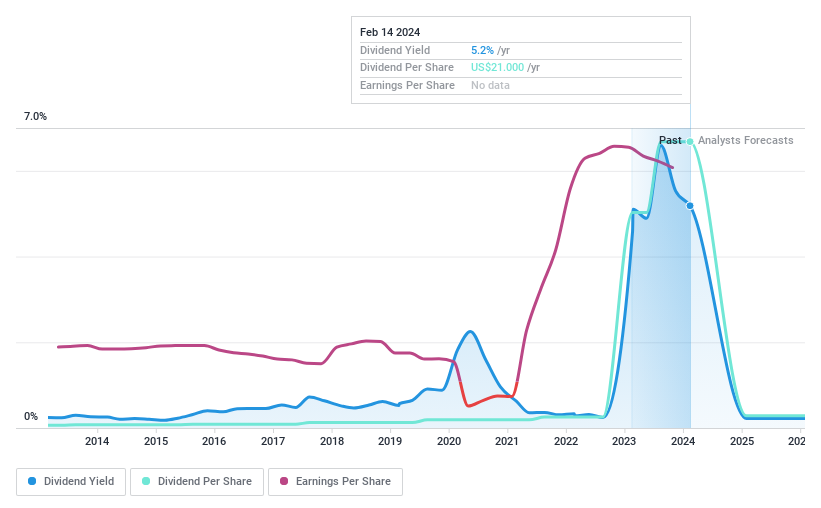

Dillard's (NYSE:DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. is a retail company that manages department stores across the southeastern, southwestern, and midwestern United States with a market capitalization of approximately $6.57 billion.

Operations: Dillard's, Inc. primarily generates revenue through its retail operations segment, which amounted to approximately $6.49 billion.

Dividend Yield: 5.2%

Dillard's (NYSE:DDS) offers a conservative dividend profile, with a history of reliable and increasing payouts over the past decade. The company's debt has been reduced significantly, with cash holdings surpassing total debt, indicating financial stability. Despite a dip in profit margins from the previous year and an anticipated decline in earnings and revenue over the next three years, DDS maintains robust dividend coverage through both earnings—with an exceptionally low payout ratio—and free cash flow. This suggests that while growth prospects may be limited, DDS's commitment to returning value to shareholders through dividends remains steadfast. Delve into the full analysis dividend report here for a deeper understanding of Dillard's.

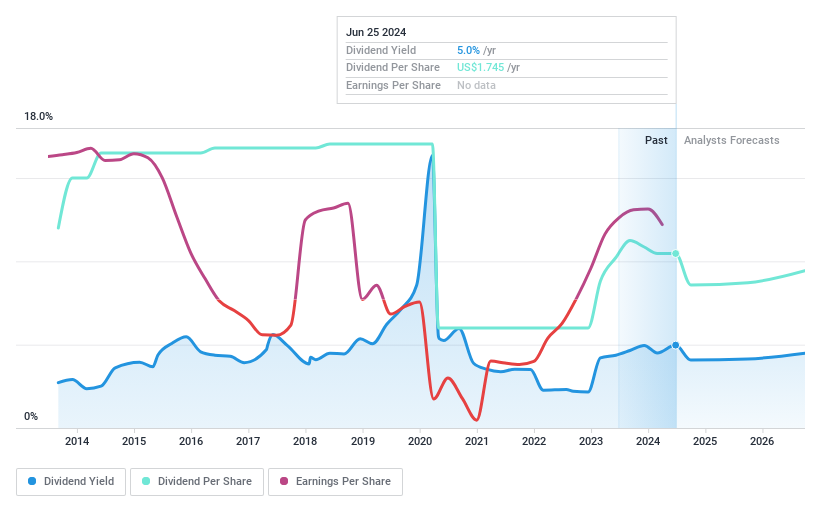

Helmerich & Payne (NYSE:HP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Helmerich & Payne, Inc. is a drilling services provider specializing in solutions for oil and gas exploration and production companies, with a market capitalization of approximately $3.6 billion.

Operations: Helmerich & Payne, Inc. generates its revenues primarily through its North America Solutions segment with $2.49 billion, supplemented by International Solutions at $212.52 million and Offshore Gulf of Mexico operations contributing $120.61 million.

Dividend Yield: 5%

Helmerich & Payne (NYSE:HP) presents an intriguing dividend stock profile, with a decade-long track record of stable and growing dividends. The company's financial health is underscored by a satisfactory net debt to equity ratio and debt that is comfortably covered by operating cash flow. Earnings have seen substantial growth over the past year, surpassing its five-year average, while profit margins have also improved. HP's dividends are well-supported by both earnings and cash flows, reflected in low payout ratios. Although its revenue growth isn't projected to be robust, HP maintains a high dividend yield within the top quartile of US payers. Unlock comprehensive insights into our analysis of Helmerich & Payne stock in this dividend report.

Final Remarks

Discover the diversity of dividend-paying stocks tailored to your investment strategy with the Simply Wall St screener. Click through to start exploring the rest of the 100 Top Dividend Stocks now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com