Expro Group Holdings NV (XPRO) Reports Mixed Results Amidst Growth and Challenges

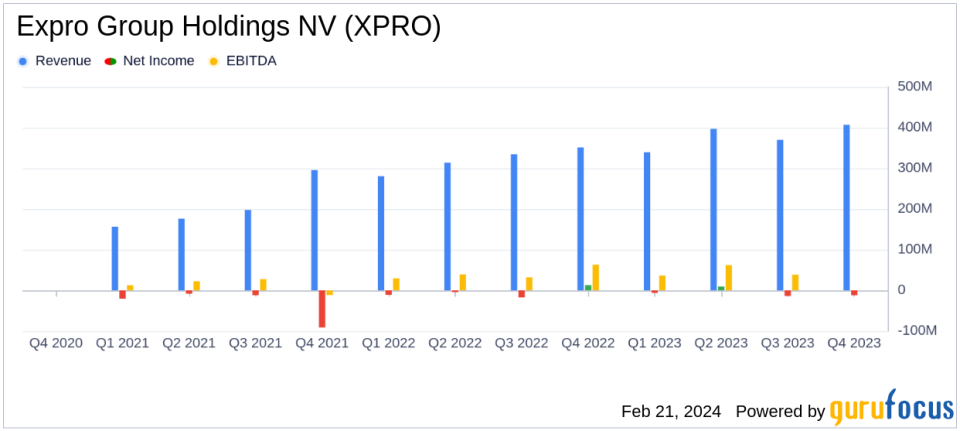

Revenue: $407 million in Q4, a 10% sequential increase; $1,513 million for the full year, an 18% year-over-year increase.

Net Loss: $12 million in Q4, improved from a $14 million loss in Q3; $23 million net loss for the full year.

Adjusted EBITDA: $85 million in Q4, a 70% sequential increase; $249 million for the full year, up from $206 million in 2022.

Adjusted EBITDA Margin: 21% in Q4, up from 14% in Q3; approximately 16% for both 2023 and 2022.

Capital Expenditures: $37 million in Q4; approximately $122 million for the full year.

Cash Flow: Net cash provided by operating activities was $33 million in Q4; $138 million for the full year.

2024 Outlook: Anticipated revenues between $1,600 million to $1,700 million; Adjusted EBITDA between $325 million and $375 million.

On February 21, 2024, Expro Group Holdings NV (NYSE:XPRO) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its comprehensive suite of services across the well life cycle, has reported a year of growth tempered by operational challenges.

Company Profile

Expro Group offers a range of services including well construction, well flow management, well intervention and integrity, and subsea well access. With a global footprint, the company is a key player in offshore production solutions, benefiting from its 2021 merger with Frank's International. Expro's focus on production optimization caters to both onshore and offshore markets, with a significant portion of its business derived from international (80%) and offshore (70%) operations.

Performance and Challenges

Expro's revenue growth reflects a resilient demand for its services, particularly in the North and Latin America (NLA) segment, which saw a 38% increase in revenue due to the acquisition of PRT Offshore and heightened activity in Mexico and the U.S. However, the company faced a net loss of $12 million in Q4, albeit an improvement from the previous quarter's $14 million loss. The full year's net loss of $23 million, compared to $20 million in 2022, underscores the challenges Expro has encountered, including the suspension of vessel-deployed light well intervention (LWI) operations due to an incident.

Financial Achievements and Importance

The company's Adjusted EBITDA of $85 million in Q4, a significant 70% increase from the previous quarter, and a steady Adjusted EBITDA margin of approximately 16% for both 2023 and 2022, demonstrate Expro's ability to manage costs and optimize operations effectively. These achievements are crucial in the oil and gas industry, where efficient capital management and operational excellence are key drivers of profitability.

Key Financial Metrics

Expro's capital expenditures totaled $37 million in Q4 and approximately $122 million for the full year, indicating ongoing investments in its operational capabilities. The company's liquidity position remains strong, with a total liquidity of $299 million as of December 31, 2023. Moreover, the company's net cash provided by operating activities stood at $33 million for Q4 and $138 million for the full year, highlighting its operational cash flow strength.

Management Commentary

Michael Jardon, CEO of Expro, commented on the company's robust Q4 financial results and the positive outlook for 2024, emphasizing the early stages of a multi-year growth cycle for the energy services sector and Expro's business. He also highlighted the strategic acquisition of Coretrax, which is expected to enhance Expro's technology-enabled services and solutions.

Analysis of Company's Performance

Despite the operational setbacks, Expro's strategic acquisitions and contract wins have positioned the company to capitalize on the anticipated upswing in industry activity. The company's focus on technology and innovation, as evidenced by notable awards and achievements, is expected to drive future growth and enhance its market position.

For a detailed analysis of Expro Group Holdings NV (NYSE:XPRO)'s financial performance, including income statements, balance sheets, and cash flow statements, please refer to the full 8-K filing.

Value investors and potential GuruFocus.com members interested in the oil and gas sector may find Expro Group Holdings NV's ability to navigate industry challenges and focus on growth opportunities to be a compelling narrative for further exploration.

Explore the complete 8-K earnings release (here) from Expro Group Holdings NV for further details.

This article first appeared on GuruFocus.