Extra Space Storage Inc (EXR): A High-Performing REIT with a GF Score of 91

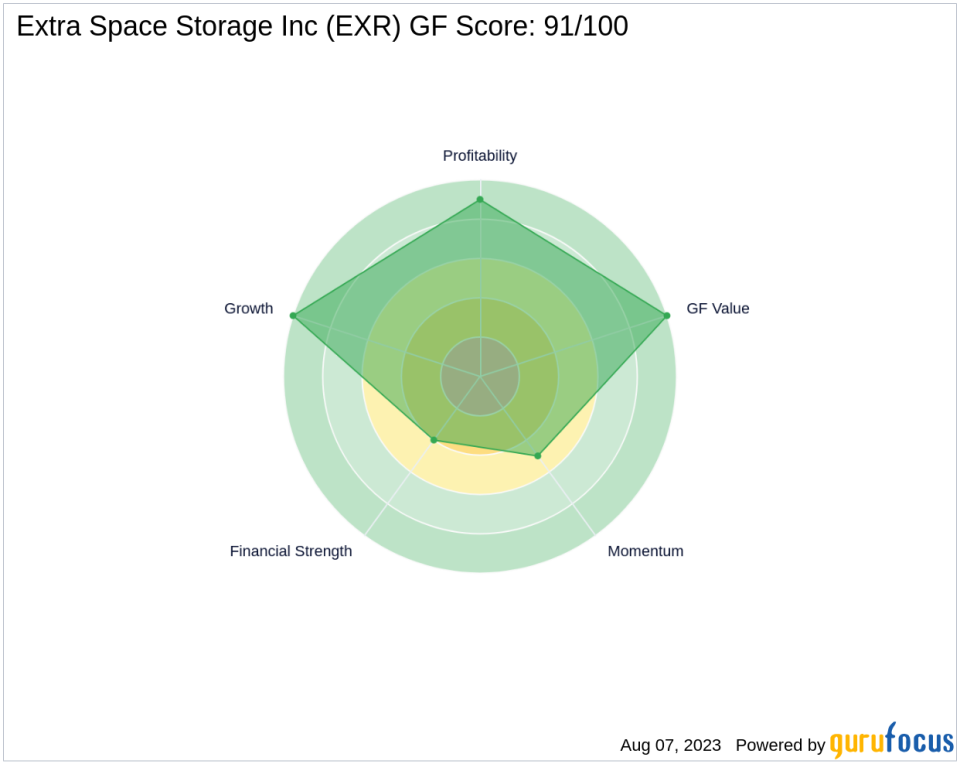

Extra Space Storage Inc (NYSE:EXR), a prominent player in the REITs industry, is currently trading at $130.62 with a market cap of $27.63 billion. The stock has seen a gain of 3.91% today, despite a loss of 11.15% over the past four weeks. The company's GF Score stands at an impressive 91 out of 100, indicating the highest outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which considers five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis

EXR's Financial Strength rank is 4/10. This metric evaluates the company's financial situation based on its debt burden, debt to revenue ratio, and Altman Z-Score. EXR's interest coverage stands at 3.64, indicating its ability to cover interest expenses with operating profits. The company's debt to revenue ratio is 3.82, suggesting a moderate level of debt relative to its revenue. The Altman Z-Score of 2.49 indicates that the company is not in any immediate danger of bankruptcy.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its strong profitability. The operating margin of 53.29% is significantly higher than the industry average, indicating efficient operations. The Piotroski F-Score of 6 suggests a stable financial situation. The company has also demonstrated consistent profitability over the past 10 years.

Growth Rank Analysis

EXR's Growth Rank is 10/10, reflecting robust growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 9.80%, and the 3-year revenue growth rate is 12.30%. The 5-year EBITDA growth rate of 10.60% further underscores the company's strong growth profile.

GF Value Rank Analysis

The GF Value Rank of EXR is 10/10, indicating that the stock is fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

The company's Momentum Rank is 5/10, reflecting a moderate momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors, EXR stands out with its high GF Score. Life Storage Inc (LSI) has a GF Score of 68, Rexford Industrial Realty Inc (NYSE:REXR) has a GF Score of 88, and Public Storage (NYSE:PSA) has a GF Score of 95. More details about the competitors can be found here.

Conclusion

In conclusion, Extra Space Storage Inc (NYSE:EXR) presents a compelling investment opportunity with its high GF Score of 91, indicating the highest outperformance potential. The company's strong financial strength, profitability, growth, and fair valuation, coupled with moderate momentum, make it a promising pick for potential investors.

This article first appeared on GuruFocus.