Extra Space Storage Inc. (EXR) Reports Decline in Q4 Net Income Amid Life Storage Merger Costs

Net Income: Q4 net income per diluted share decreased by 32.9% year-over-year, primarily due to merger-related costs.

FFO and Core FFO: FFO per diluted share was $1.89, with Core FFO at $2.02 per diluted share, a 3.3% decrease from the prior year.

Same-Store Performance: Same-store revenue increased by 0.8%, while same-store NOI saw a marginal decrease of 0.1%.

Acquisitions and Management: Acquired 10 operating stores and added 225 stores to the third-party management platform.

Dividends: Paid a quarterly dividend of $1.62 per share.

Balance Sheet: Completed a public bond offering of $600.0 million of 5.9% senior unsecured notes due 2031.

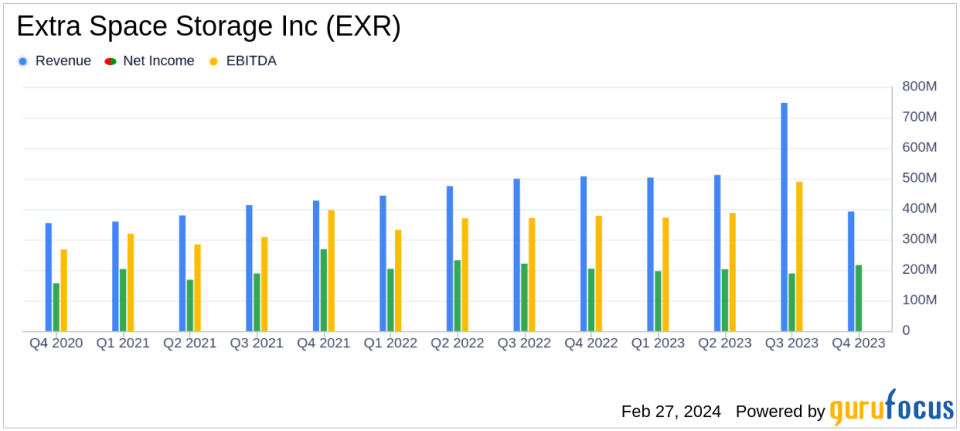

On February 27, 2024, Extra Space Storage Inc. (NYSE:EXR) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year ended December 31, 2023. The company, a leading owner and operator of self-storage facilities in the United States, reported a decrease in net income attributable to common stockholders to $1.02 per diluted share for the quarter, a 32.9% decrease compared to the same period in the prior year. This decline was primarily due to $30.6 million in transition costs and other non-cash expenses related to the Life Storage Merger.

Extra Space Storage is a fully integrated real estate investment trust (REIT) that owns, operates, and manages almost 3,600 self-storage properties in 42 states, with over 270 million net rentable square feet of storage space. The company's portfolio includes wholly owned facilities, joint ventures, and third-party managed stores.

The company's performance in the fourth quarter reflects the challenges associated with the integration of Life Storage assets. Despite these challenges, the company achieved funds from operations (FFO) of $1.89 per diluted share and Core FFO of $2.02 per diluted share, representing a 3.3% decrease compared to the same period in the prior year. The slight increase in same-store revenue by 0.8% and the stable same-store net operating income (NOI) underscore the resilience of the company's operating model.

Financial achievements such as the acquisition of new stores and the expansion of the third-party management platform are significant for a REIT like Extra Space Storage, as they contribute to the growth of the company's asset base and revenue streams. The addition of 225 stores to the management platform, in addition to those acquired through the Life Storage Merger, demonstrates the company's commitment to expanding its operational footprint.

Key financial details from the income statement include:

Financial Metric | Q4 2023 | Q4 2022 | Change |

|---|---|---|---|

Net Income Attributable to Common Stockholders | $216,134 | $204,260 | 32.9% Decrease |

FFO | $418,575 | $300,067 | Decrease |

Core FFO | $449,131 | $300,150 | Decrease |

Important metrics such as FFO and Core FFO are crucial for evaluating the performance of a REIT, as they provide a clearer picture of the company's operating results by excluding the effects of depreciation and other non-cash charges that are not indicative of the company's actual financial performance.

"We had a solid quarter, focusing on optimizing the performance of the recently added Life Storage assets, while maximizing the performance of the legacy Extra Space Storage locations," said Joe Margolis, CEO of Extra Space Storage Inc. He also expressed confidence in the durability of the self-storage sector and the company's ability to capture customer volume when demand accelerates.

The company's balance sheet remains strong, with a public bond offering and a healthy dividend payout. The outlook for 2024 includes stronger revenue growth from the Life Storage assets, despite expectations of lower new customer rates.

Extra Space Storage's performance in the context of the Life Storage Merger and the broader self-storage industry indicates a period of transition with a focus on integrating new assets and optimizing performance. While the decrease in net income reflects the costs associated with this transition, the company's overall solid performance and strategic acquisitions position it well for future growth.

For more detailed information on Extra Space Storage Inc.'s financial results, including the full earnings release, balance sheet, and outlook for 2024, investors are encouraged to review the complete 8-K filing.

Explore the complete 8-K earnings release (here) from Extra Space Storage Inc for further details.

This article first appeared on GuruFocus.