Extreme Networks (EXTR): Is It Truly Overvalued? An In-Depth Exploration

Extreme Networks Inc (NASDAQ:EXTR) recently experienced a daily gain of 4.63%, despite a 3-month loss of -0.62%. Its Earnings Per Share (EPS) stands at 0.58. However, the question remains: is the stock significantly overvalued? This article aims to answer this question through a comprehensive valuation analysis. We encourage you to read on for a more informed investment decision.

Introduction to Extreme Networks

Extreme Networks Inc provides software-driven networking services for enterprise customers. Its offerings range from wired and wireless network infrastructure equipment to software for network management, policy, analytics, and access controls. The company has a single segment that develops and markets network infrastructure equipment. With its revenue equally distributed between the Americas, Europe, the Middle East, Africa, and Asia-Pacific, the company has a global presence.

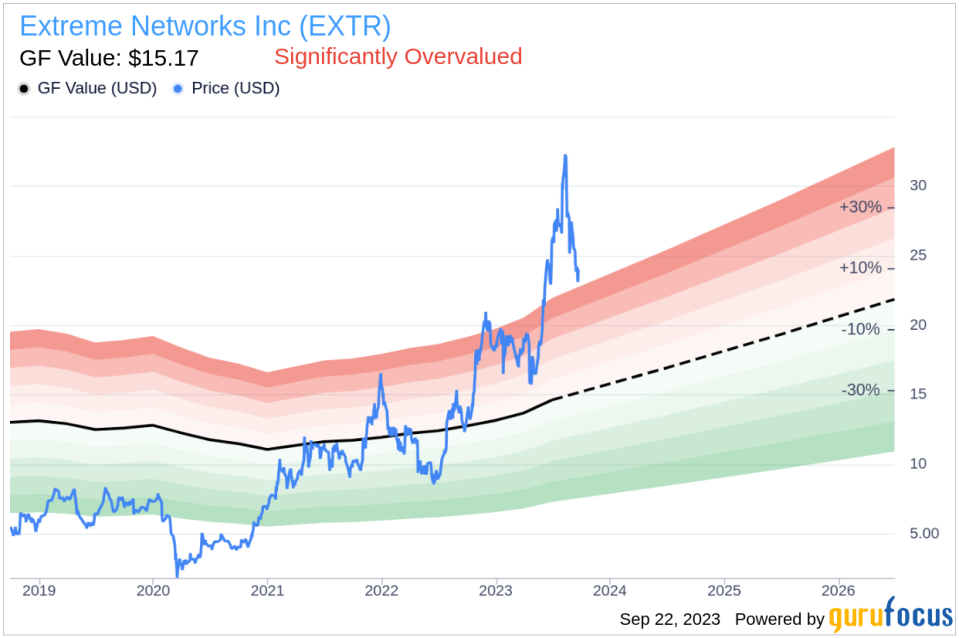

Currently, Extreme Networks (NASDAQ:EXTR) trades at $24.18 per share with a market cap of $3.10 billion. However, the GF Value, an estimation of fair value, is only $15.17. This discrepancy suggests that the stock may be significantly overvalued. To understand this better, let's delve into the company's financials and the GF Value concept.

Understanding the GF Value

The GF Value is a proprietary measure that estimates the intrinsic value of a stock. It considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line represents the stock's ideal trading value. If the stock price is significantly higher than the GF Value Line, it suggests overvaluation, and future returns might be poor. Conversely, if it's significantly lower, the stock could be undervalued, hinting at potentially higher future returns.

Based on this method, Extreme Networks (NASDAQ:EXTR) appears to be significantly overvalued. The stock's current price of $24.18 per share significantly exceeds the GF Value of $15.17, indicating a potential overvaluation. Consequently, the long-term return of its stock may be much lower than its future business growth.

For investors seeking higher future returns at reduced risk, consider these high-quality companies with low capital expenditures.

Financial Strength of Extreme Networks

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before investing. A good starting point is the cash-to-debt ratio. Extreme Networks has a cash-to-debt ratio of 0.89, which ranks lower than 58.55% of 2374 companies in the Hardware industry. GuruFocus ranks the overall financial strength of Extreme Networks at 6 out of 10, suggesting fair financial strength.

Profitability and Growth of Extreme Networks

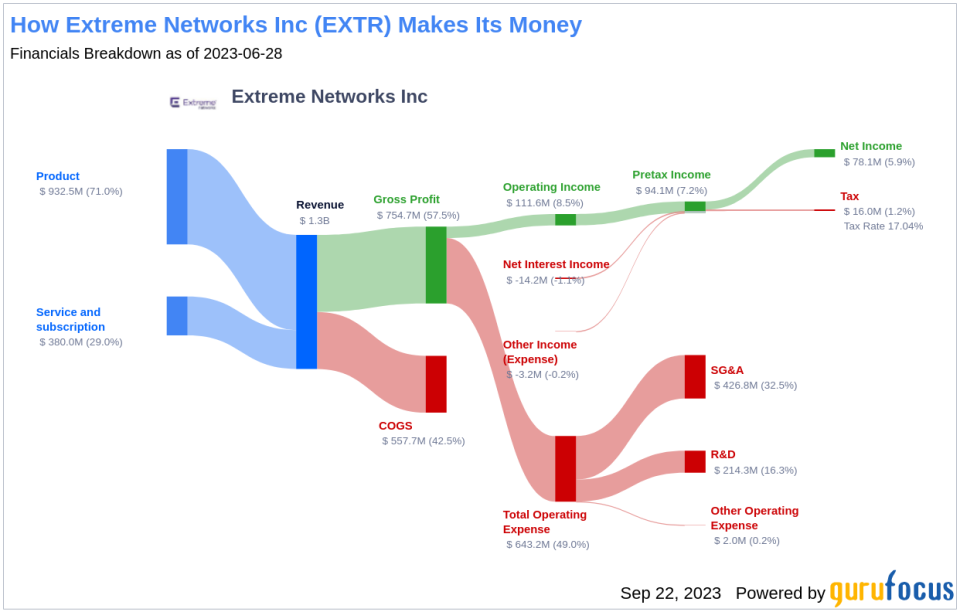

Consistent profitability over the long term reduces investment risk. Higher profit margins usually indicate a better investment compared to a company with lower profit margins. Extreme Networks has been profitable 3 times over the past 10 years. In the past twelve months, the company had a revenue of $1.30 billion and Earnings Per Share (EPS) of $0.58. Its operating margin is 8.5%, which ranks better than 70.69% of 2460 companies in the Hardware industry. However, the overall profitability of Extreme Networks is ranked 4 out of 10, indicating poor profitability.

Growth is a critical factor in a company's valuation. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth rate of Extreme Networks is 7.5%, which ranks better than 59.23% of 2335 companies in the Hardware industry. However, the 3-year average EBITDA growth rate is 0%, ranking worse than all 1962 companies in the Hardware industry.

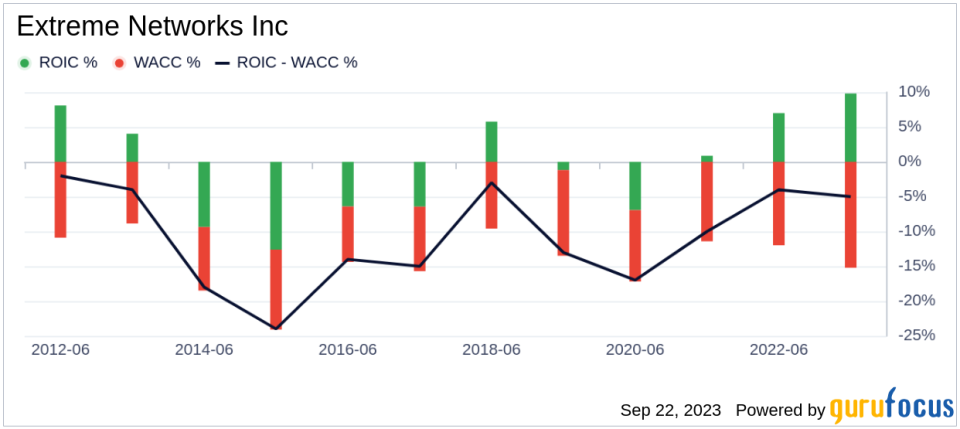

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can also help determine profitability. The ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. The WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Extreme Networks's ROIC is 9.9, and its cost of capital is 16.75.

Conclusion

In conclusion, Extreme Networks (NASDAQ:EXTR) appears to be significantly overvalued. Its financial condition is fair, but its profitability is poor. Its growth ranks worse than all 1962 companies in the Hardware industry. To learn more about Extreme Networks stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.