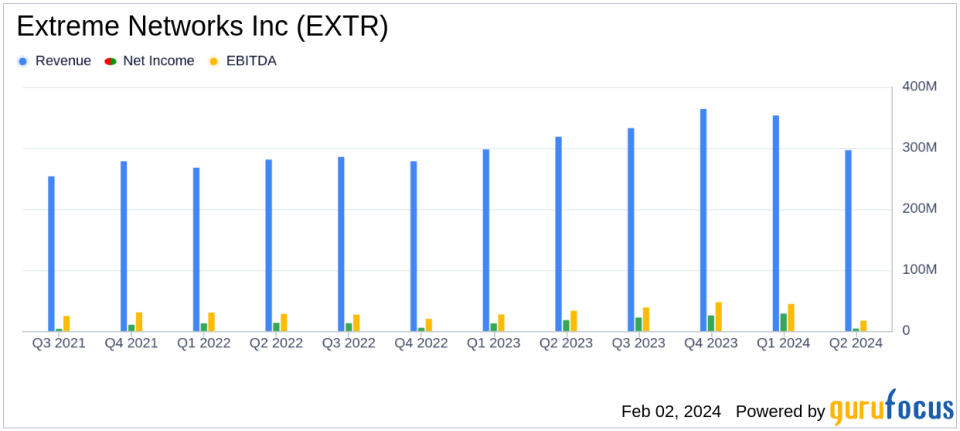

Extreme Networks Inc (EXTR) Reports Mixed Fiscal Q2 2024 Results Amid Industry Challenges

Revenue: $296.4 million, a decrease of 6.9% year-over-year.

SaaS ARR: $158.0 million, an increase of 37.4% year-over-year.

GAAP EPS: $0.03, down from $0.13 in the prior year quarter.

Non-GAAP EPS: $0.24, slightly down from $0.27 in the prior year quarter.

Gross Margin: GAAP gross margin improved to 61.9% from 57.1% year-over-year.

Operating Margin: Non-GAAP operating margin remained stable at 14.8%, compared to 14.9% in the prior year quarter.

Free Cash Flow: Generated $28.6 million, indicating strong cash generation capabilities.

On January 31, 2024, Extreme Networks Inc (NASDAQ:EXTR) released its 8-K filing, detailing the financial results for its second quarter ended December 31, 2023. The company, known for its software-driven networking services, faced a challenging quarter with a revenue decline of 6.9% year-over-year, yet showcased a robust 37.4% growth in SaaS annual recurring revenue (ARR). Despite the revenue dip, Extreme Networks achieved a notable improvement in gross margins and maintained a healthy operating margin profile.

Extreme Networks operates in a single segment, developing and marketing network infrastructure equipment, with roughly half of its revenue generated in the Americas and the rest from Europe, the Middle East, Africa, and Asia-Pacific. The company's products include high-density Wi-Fi, centralized management, and cloud-based network management, which are essential for enterprise customers seeking to enhance network security, visibility, and performance.

Financial Performance and Challenges

President and CEO Ed Meyercord highlighted the integration of AI, security, and analytics as a key differentiator for the company, driving significant subscription ARR growth. However, the networking industry is still navigating the tail end of COVID-induced supply chain constraints, impacting inventory purchases by distributors and partners. Meyercord remains optimistic about the company's positioning for a return to growth in FY25, supported by new product introductions such as Wi-Fi 7 access points and 4000 Series Universal Switches.

"The networking industry, like much of IT, is exiting the final stage of the COVID-induced era of supply chain constraints, which are still impacting our business. As a result, our distributors and partners have lowered inventory purchases, which we expect to accelerate in the third quarter. We expect to emerge in the fourth quarter at a more normalized level of revenue and earnings," said Ed Meyercord, President and CEO of Extreme Networks.

Financial Achievements and Importance

Kevin Rhodes, Executive Vice President and CFO, noted that despite lower revenue, the company improved gross margins and optimized operating expenses. The focus on cost actions is expected to drive recovery in EPS and cash flow. The company's liquidity remains strong, with $34.3 million in net cash flow from operations and $28.6 million in free cash flow generated during the quarter.

"Despite lower revenue in the second quarter, we improved our gross margins and optimized our operating expenses to maintain a healthy operating margin profile during the quarter," stated Kevin Rhodes, Executive Vice President and CFO.

Key Financial Metrics

Extreme Networks' financial achievements are particularly important in the hardware industry, where margins can be tight and cash flow management is critical. The company's ability to generate free cash flow and maintain healthy margins in a challenging environment demonstrates operational efficiency and resilience, key attributes for value investors.

Key details from the financial statements include:

GAAP net income was $4.0 million, down from $17.9 million in the prior year quarter.

Non-GAAP net income stood at $31.5 million, a decrease from $36.5 million year-over-year.

The company repurchased 1.5 million shares at a total cost of $25.0 million, reflecting confidence in its stock value.

Ending cash balance was $221.4 million, showcasing a solid liquidity position.

Analysis and Outlook

Extreme Networks' performance in Q2 FY24 reflects the ongoing industry-wide challenges but also underscores the company's strategic focus on subscription-based growth and margin expansion. The company's outlook for Q3 FY24 includes a targeted total net revenue between $200.0 million and $210.0 million, with a cautious view on operating margins due to higher sell-through than sell-in. For Q4 FY24, the company targets revenue between $265.0 million and $275.0 million, with an improvement in gross and operating margins.

Extreme Networks' strategic initiatives, including the introduction of new hardware solutions and a focus on Zero Trust Network Access, position the company to capitalize on the evolving needs of enterprise networking. The company's commitment to innovation and market expansion, coupled with prudent financial management, suggests a potential for value creation in the coming fiscal year.

For a more detailed analysis and insights into Extreme Networks Inc (NASDAQ:EXTR)'s financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Extreme Networks Inc for further details.

This article first appeared on GuruFocus.