'Extremely bearish' chart formation signals the top 7 Big Tech stocks including Apple, Nvidia, and Tesla face elevated risk of a selloff

An "extremely bearish" pattern has formed on the Magnificent 7 stocks' combined price chart, fueling fears of a selloff.

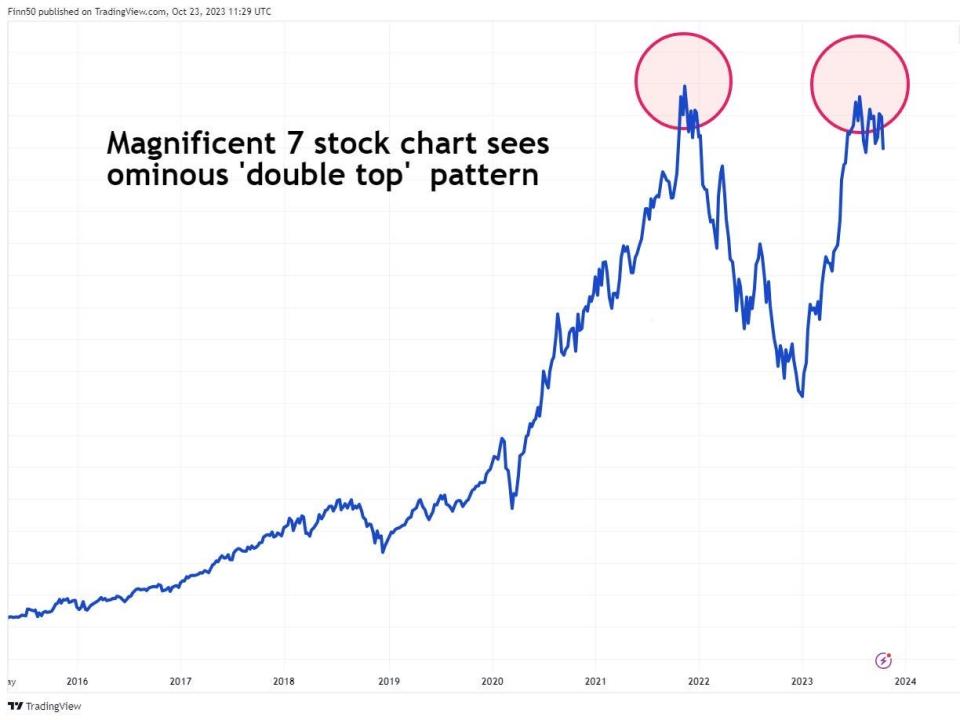

"For what's worth, the top 7 largest tech stocks are currently staring down from a scary double-top technical formation," Crescat Capital's Octavio Costa wrote in a LinkedIn post.

That's amplifying concerns that Wall Street's reliance on a handful of Big Tech stocks may have reached unsustainable levels.

The US stock-market rally of 2023, which defied high interest rates and recession calls, has been led by a surprisingly small clutch of Big Tech names that have come to be known as the Magnificent 7.

The group — made up of Apple, Microsoft, Alphabet, Meta, Amazon, Nvidia, and Tesla — recently accounted for as much as 30% of the S&P 500 index's entire market capitalization, fueling concerns that investment flows are getting over-concentrated in a narrow segment of the equity universe.

"Such an unprecedented concentration in a small cluster of stocks presents challenges as well as opportunities. The key challenge is that, due to the size of the Magnificent Seven, investors in the S&P 500 Index are now disproportionately exposed to the future prospects of these stocks," Christopher Peel, portfolio manager and research analyst at Franklin Templeton, wrote in a recent note.

Such concerns are being amplified by an ominous chart pattern that's now taking shape on a chart that tracks the combined price of the Magnificent 7 stocks. The signal, known as a "double top" in technical analysis, is widely considered as an omen for an imminent bearish trend reversal.

"A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. A double top signals a medium or long-term trend change in an asset class," the online finance dictionary Investopedia defines the pattern.

"For what's worth, the top 7 largest tech stocks are currently staring down from a scary double-top technical formation. Either interest rates must decline drastically from current levels or the valuations among these stocks are primed for a meaningful reappraisal," Octavio Costa, macro strategist at Denver-based asset management firm Crescat Capital, wrote in a LinkedIn post.

The combined share prices of the seven most valued US stocks has surged 82% so far this year, compared with a 10% advance in the benchmark S&P 500 index. The sizzling Big Tech rally was powered mainly by investor excitement over the rise of artificial intelligence technologies, following the smashing debut of OpenAI's language bot ChatGPT.

At the peak of this year's equity rally, the combined market capitalization of the seven stocks exceeded $11 trillion, or nearly triple the GDP of Germany.

The US stock market's reliance on the Magnificent 7 shares has reached a "historically unhealthy level," Motley Fool's Sean Williams wrote in a recent post.

Not everyone is bearish on US tech stocks. The shares will break out of their mid-2023 funk with a double-digit end-of-year rally, according to Wedbush Securities.

Managing director Dan Ives said this month that he's expecting the sector's listed companies to post strong third-quarter earnings that will highlight how the rapid rise of artificial intelligence has juiced up their profits.

Read the original article on Business Insider