ExxonMobil (XOM) Commences Baytown Chemical Unit Production

Exxon Mobil Corporation XOM announced the commissioning of two chemical production units at its Baytown manufacturing facility in Texas.

The company’s $2-billion expansion is part of its long-term strategy to enhance the value of products produced at its facilities along the U.S. Gulf Coast.

The two units will enable ExxonMobil to meet the increasing demand for plastics and various other chemicals. The company plans to produce 400,000 metric tons of branded polymers per year, which are used to make automotive parts, construction materials, reusable containers, hygiene and personal care products.

Additionally, the project will create opportunities for ExxonMobil to venture into the linear alphaolefins market. XOM will have an annual production capacity of 350,000 tons of olefins, which find application in a wide range of uses, such as high-performance engine and industrial oils, waxes, building materials for surfactants, packaging polyethylene plastics, and various specialty chemicals.

ExxonMobil’s Baytown facility is one of the world’s largest and most technologically advanced integrated refining and petrochemical complexes. Situated 25 miles east of Houston, ExxonMobil's expansive complex spans 3,400 acres along the Houston Ship Channel. The facility includes a refinery, chemical plant, olefins plant, plastics plant and global technology center.

With the latest expansion of the Baytown chemical facility, ExxonMobil is well-positioned to capitalize on the heightened production from the Permian Basin, resulting in the delivery of higher-value products from its refining and chemical facilities on the Gulf Coast.

Amid increasing consumer demand for enhanced recycling solutions, Exxon's Baytown facility is actively researching new methods for plastic degradation. This expansion at the Baytown complex is expected to generate 200 jobs, further enhancing the 104-year-old refining and chemicals hub.

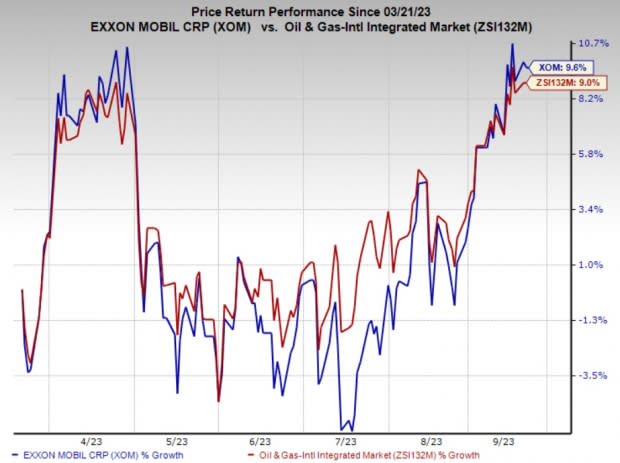

Price Performance

Shares of ExxonMobil have outperformed the industry in the past six months. The XOM stock has gained 9.6% compared with the industry’s 9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ExxonMobil currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners, LP USAC is one of the largest independent natural gas compression service providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 58 cents, respectively.

Enerplus Corporation ERF is an independent oil and gas production company with resources across Western Canada and the United States.

Enerplus has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for ERF’s 2023 and 2024 earnings per share is pegged at $2.26 and $2.66, respectively.

Helix Energy Solutions Group, Inc. HLX is an international offshore energy company that provides specialty services to the offshore energy industry, with a focus on their growing well intervention and robotics operations. HLX has witnessed upward earnings estimate revisions for 2023 and 2024 over the past 60 days.

The Zacks Consensus Estimate for Helix Energy’s 2023 and 2024 earnings per share is pegged at 48 cents and 87 cents, respectively. HLX currently has a Zacks Style Score of A for Momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Enerplus Corporation (ERF) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report