ExxonMobil (XOM) to Develop DAC Technology to Capture CO2

Exxon Mobil Corporation XOM plans to develop technology for direct air capture (“DAC”) of carbon dioxide, recognizing its significant role in a net-zero future, per a Reuters report.

The company has the potential to be a significant player in the expanding DAC industry, provided that cost constraints are reduced and the technology reaches an efficiency level suitable for large-scale deployment.

However, XOM does not intend to invest in developing electric vehicle charging stations as it is not an area wherein it can gain a substantial competitive edge.

The DAC technology is seen as a potential tool for achieving carbon neutrality and addressing the challenges of global warming. It involves extracting carbon directly from the atmosphere. However, one of the significant challenges associated with DAC is its high costs, which have been a limiting factor in the widespread adoption of the technology.

The development of the DAC technology could potentially leverage ExxonMobil’s expertise in carbon capture and storage (“CCS”). The CCS business also involves capturing emissions and storing them underground. By building upon its CCS experience, ExxonMobil may be well-positioned to contribute to the advancement of the DAC technology.

As part of its energy transition strategy, ExxonMobil primarily focuses on reducing carbon emissions from its operations and the expansion of CCS technologies. Instead of directing substantial investments toward renewable energy sources, such as solar and wind, the company is concentrating on areas like hydrogen and biofuels.

Notably, the majority of the $17 billion earmarked for ExxonMobil’s Low Carbon business between 2022 and 2027 is allocated toward initiatives aimed at reducing its emissions and expanding its CCS initiatives. Overall, investing in the DAC technology aligns ExxonMobil with the transition toward a low-carbon economy, and can offer environmental and economic benefits in the long run.

Price Performance

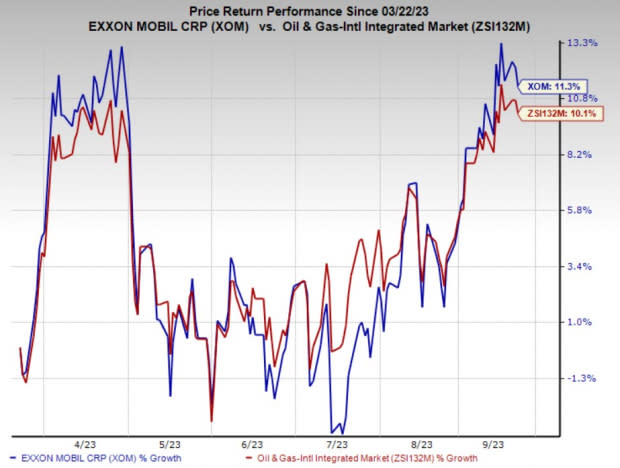

Shares of ExxonMobil have outperformed the industry in the past six months. The stock has gained 11.3% compared with the industry’s 10.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ExxonMobil currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners, LP USAC is one of the largest independent natural gas compression service providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 58 cents, respectively.

Enerplus Corporation ERF is an independent oil and gas production company with resources across Western Canada and the United States.

Enerplus has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for ERF’s 2023 and 2024 earnings per share is pegged at $2.27 and $2.73, respectively.

Helix Energy Solutions Group, Inc. HLX is an international offshore energy company that provides specialty services to the offshore energy industry, with a focus on their growing well intervention and robotics operations.

HLX has witnessed upward earnings estimate revisions for 2023 and 2024 over the past 60 days. The Zacks Consensus Estimate for Helix Energy’s 2023 and 2024 earnings per share is pegged at 48 cents and 87 cents, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Enerplus Corporation (ERF) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report