ExxonMobil (XOM) Expects Global Climate Targets to Fall Short

Exxon Mobil Corporation XOM believes that the world is failing to keep the planet’s temperature below 2°C.

Oil and gas are expected to meet more than 50% of the world’s energy requirements in 2050 as they are a reliable, low-carbon fuel source for generating power, producing hydrogen and heating purposes.

ExxonMobil cited that carbon emissions from burning fossil fuel and energy use will decline to 25 billion metric tons in 2050, which is more than double the 11 billion metric tons outlined by the Intergovernmental Panel on Climate Change.

This also represents a 25% decline from a peak of 34 billion metric tons expected in the current decade, primarily due to significant growth in renewables, a decline in coal use and improvements in energy efficiency.

Despite the notable decline in emissions, global carbon production is expected to increase higher than the levels expected to limit the impacts of climate change. Global efforts to reduce emissions are falling back even though countries continue to roll out bids to have net-zero emissions.

Fossil fuel will continue to be a significant energy source globally for many decades to come. It produces massive amounts of energy required to create and support the manufacturing, commercial transportation and industrial sectors. Notably, the global drive to reduce emissions shows the significant progress expected to be made even as the global economy more than doubles.

ExxonMobil is investing more in oil and gas production than most peers. Even though the oil giant supports the 2015 Paris Climate Accord, it maintains that the world will have to keep consuming oil and gas to fuel economic growth.

ExxonMobil will invest $17 billion over six years through 2027 in low-carbon emission technologies, including carbon capture and sequestration, and hydrogen. The technologies have significant potential for hard-to-decarbonize sectors such as the steel, chemical and cement industries. ExxonMobil allocated a majority of the funds to reduce emissions from its operations and from third parties.

Price Performance

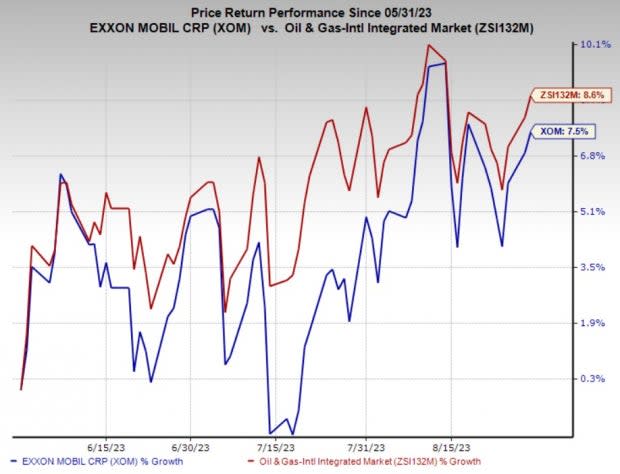

Shares of ExxonMobil have underperformed the industry in the past three months. The stock has gained 7.5% compared with the industry’s 8.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

ExxonMobil currently carries a Zack Rank #3 (Hold).

Some other top-ranked players in the energy sector are USA Compression Partners, LP USAC, currently sporting a Zacks Rank #1 (Strong Buy), and Core Laboratories N.V. CLB and Sunoco LP SUN, each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners is one of the largest independent natural gas compression services providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 55 cents, respectively.

Core Labs’ strong presence in the emerging shale plays and its global footprint will provide for steady growth rates going forward. CLB’s technology-heavy portfolio of proprietary products and services gives it the opportunity to optimize production from new and existing fields.

Core Labs has witnessed upward earnings estimate revision for 2023 and 2024 in the past 30 days. The consensus estimate for CLB’s 2023 and 2024 earnings per share is pegged at 88 cents and $1.17, respectively.

Sunoco is among the biggest motor fuel distributors in the United States wholesale market in terms of volumes. For 2023, the partnership expects adjusted EBITDA of $865-$915 million.

Over the past 30 days, Sunoco has witnessed upward earnings estimate revisions for 2023 and 2024, respectively. The Zacks Consensus Estimate for SUN’s 2023 and 2024 earnings per share is pegged at $4.37 and $3.81, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report