ExxonMobil (XOM) Speeds Up Plan to Double Its LNG Portfolio

Exxon Mobil Corporation XOM is progressing ahead of its schedule in expanding its liquefied natural gas (LNG) portfolio, per a Reuters report.

The company is aiming to double its capacity to 40 million tons per annum (Mtpa) by 2030, up from the current production of nearly 30 Mtpa. This growth trajectory marks a significant step from the company's 2020 announcement, reflecting its strategic shift toward self-reliance in LNG trading.

Unlike its competitors, such as TotalEnergies TTE and Shell plc SHEL, which have substantial gains in LNG trading, Shell reported a $2.4 billion income from this in the fourth quarter of 2023.

ExxonMobil is focusing on trading its gas rather than depending on third-party supplies. This approach is informed by the higher profit margins ExxonMobil perceives in handling its production and sales, as opposed to the narrower margins in third-party gas trading.

The cornerstone of ExxonMobil's LNG strategy is its stake in the Golden Pass LNG project, in partnership with QatarEnergies, which boasts an export capacity of about 18 Mtpa and is set to commence production in 2025.

Additionally, ExxonMobil is moving forward with the final investment decision for its PNG Papua LNG project in Papua New Guinea. It plans to start engineering and design for a project in Mozambique by the end of 2024.

These developments are pivotal in ExxonMobil’s strategy to target the Asia market, which is anticipated to represent 75% of the global energy demand by 2050. Through these strategic investments and a focus on leveraging its LNG assets, ExxonMobil aims to establish a leading and financially robust LNG portfolio that will cater to the growing energy needs of the Asia Pacific region.

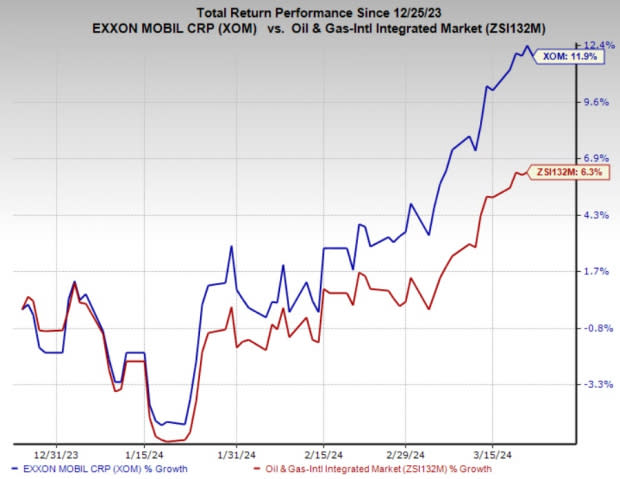

Price Performance

ExxonMobil shares have outperformed the industry in the past three months. The stock has gained 11.9% compared with the industry’s 6.3% growth.

Image Source: Zacks Investment Research

Zacks Ranks & Stock to Consider

ExxonMobil currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at a better-ranked company mentioned below. This company presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Global Partners GLP is a leading operator of gasoline stations and convenience stores. Over the past 30 days, GLP has witnessed upward earnings estimate revisions for 2024 and 2025, respectively.

The Zacks Consensus Estimate for Global Partners’ 2024 and 2025 earnings per share is pegged at $3.90 and $4.47, respectively. GLP currently has a Zacks Style Score of A for Value.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Global Partners LP (GLP) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report