F&G Annuities & Life Inc (FG) Faces Net Loss in Q4 and Full Year 2023 Despite Record ...

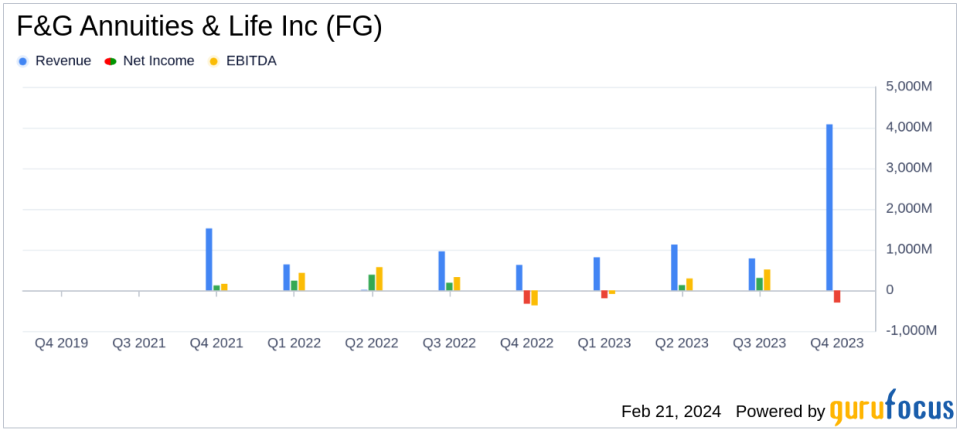

Net Loss: Reported a net loss of $299 million in Q4 and $58 million for the full year 2023.

Adjusted Net Earnings: Q4 adjusted net earnings were $75 million, full year adjusted net earnings stood at $335 million.

Gross Sales: Achieved record gross sales of $4.1 billion in Q4, a 52% increase year-over-year, and $13.2 billion for the full year.

Assets Under Management (AUM): AUM reached a record $49.5 billion, a 14% increase from the previous year.

Dividends and Share Repurchases: Paid $0.21 per share in Q4 dividends and returned $119 million to shareholders in the full year.

Solvency and Ratings: Estimated RBC ratio for the primary operating subsidiary was approximately 440%, with a ratings upgrade from A.M. Best.

On February 21, 2024, F&G Annuities & Life Inc (NYSE:FG) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. Despite achieving record gross sales and assets under management, the company reported a net loss for both the quarter and the full year, primarily due to unfavorable mark-to-market effects and other items.

Company Overview

F&G Annuities & Life Inc is a leading provider of insurance solutions serving retail annuity and life customers as well as institutional clients. Through its insurance subsidiaries, including FGL Insurance and Fidelity & Guaranty Life Insurance Company of New York, it markets a broad portfolio of products such as fixed indexed annuities, multi-year guarantee annuities, immediate annuities, indexed universal life insurance, funding agreements, and pension risk transfer solutions.

Financial Performance and Challenges

The net loss for Q4 2023 stood at $299 million, or $2.41 per diluted share, compared to a net loss of $176 million, or $1.41 per share, for the same period in 2022. The full year net loss was $58 million, or $0.47 per share, a significant downturn from the net earnings of $635 million, or $5.52 per share, in the previous year. These losses included substantial net unfavorable mark-to-market effects, which were excluded from adjusted net earnings.

Adjusted net earnings for Q4 were $75 million, or $0.60 per share, a decrease from $130 million, or $1.04 per share in Q4 2022. For the full year, adjusted net earnings were $335 million, or $2.68 per share, compared to $353 million, or $3.07 per share in the previous year. These figures reflect the company's resilience in the face of market volatility, particularly in the annuities industry.

Financial Achievements and Importance

F&G Annuities & Life Inc's record gross sales of $4.1 billion for Q4 and $13.2 billion for the full year underscore the company's strong market position and product demand. The growth in AUM to $49.5 billion represents a 14% increase from the previous year, indicating successful new business flows and stable inforce retention. These achievements are particularly important in the insurance industry, where asset growth and sales performance are key indicators of financial health and future profitability.

Key Financial Metrics

Important metrics from the earnings report include:

"Record profitable gross sales for F&G continues: Record gross sales of $4.1 billion for the fourth quarter, an increase of 52% over the fourth quarter 2022. For the full year 2023, record gross sales of $13.2 billion, an increase of 17% over the full year 2022 driven by record retail channel sales and robust institutional market sales."

This growth in sales and AUM is vital for F&G as it demonstrates the company's ability to attract and retain customers, even in a challenging economic environment.

Analysis of Company's Performance

While the net losses are a concern, the adjusted net earnings and record sales highlight the underlying strength of F&G's core business. The company's strategic focus on diversifying its product offerings and expanding its market presence has contributed to its robust sales figures. Moreover, the return of capital to shareholders through dividends and share repurchases reflects confidence in the company's financial stability and commitment to delivering shareholder value.

The company's strong solvency position, with an RBC ratio well above the target, and the recent ratings upgrade by A.M. Best, signal financial strength and stability. These factors, combined with the strategic investments from its parent company, Fidelity National Financial, Inc. (FNF), position F&G for continued growth and market opportunity capture in the future.

In conclusion, F&G Annuities & Life Inc's 2023 financial results present a mixed picture, with significant challenges offset by strategic achievements and a strong focus on growth and customer satisfaction. Investors and stakeholders will be watching closely to see how the company navigates the volatile market conditions and leverages its strengths in the coming year.

Explore the complete 8-K earnings release (here) from F&G Annuities & Life Inc for further details.

This article first appeared on GuruFocus.