F.N.B. Corp (FNB) Q4 Earnings Beat Estimates as Provisions Dip

F.N.B. Corporation’s FNB fourth-quarter 2023 adjusted earnings per share of 38 cents outpaced the Zacks Consensus Estimate of 35 cents. However, the bottom line reflects a decline of 13.6% from the prior-year quarter.

The results were primarily aided by a decline in provisions. However, lower net interest income (NII) and non-interest income, along with higher expenses, were the undermining factors. Probably due to these negatives, shares of the company lost 1.1% in the after-market trading following the earnings release.

After considering significant items, the net income available to common stockholders was $48.7 million, down significantly from $137.5 million in the year-ago quarter.

For 2023, adjusted earnings were $1.57 per share, surpassing the Zacks Consensus Estimate of $1.54. The bottom line increased 12.1% from 2022. The net income available to common stockholders (GAAP) was $476.8 million, up from $431.1 million in the previous year.

Revenues Decline, Expenses Rise

Quarterly net revenues (GAAP basis) were $337.1 million, down 18.9% from the year-earlier quarter. The top line also missed the Zacks Consensus Estimate of $399.7 million.

NII was $324 million, down 3.2% from the year-earlier quarter. Our estimate for NII was pegged at $315.8 million.

The net interest margin (FTE basis) (non-GAAP) contracted 32 basis points (bps) year over year to 3.21%.

Non-interest income was $13.1 million, down significantly year over year. The fall was primarily due to lower capital markets income. Our estimate for the metric was $79.1 million. After adjusting for the $67.4-million realized pre-tax loss on the investment securities restructuring, non-interest income (non-GAAP) was $80.4 million in the fourth quarter of 2023.

Non-interest expenses were $265.6 million, up 25.8% year over year. Our estimate for the same was $220 million.

As of Dec 31, 2023, the common equity Tier 1 (CET1) ratio was 10.1% compared with 9.8% in the prior-year quarter.

At the end of the fourth quarter, average loans and leases were $32.3 billion, up 6.6% sequentially. Average deposits totaled $34.4 billion, up 3.3% from the previous quarter.

Credit Quality Improves

F.N.B. Corp’s provision for credit losses was $13.2 million, down 53.8% from the prior-year quarter. Our estimate for provisions was $21.3 million.

The ratio of non-performing loans and other real estate owned (OREO) to total loans and OREO decreased 5 bps to 0.34%. Total delinquency decreased 1 bp to 0.70%.

In the reported quarter, net charge-offs to total average loans were 0.10%, down 6 bps year over year.

Balance Sheet Optimization Strategy

In December, the company completed the sale of $650 million of available-for-sale investment securities as part of its proactive balance sheet management strategy. Also, it transferred $355 million of indirect auto loans to held-for-sale.

Notably, the sale of $650-million available-for-sale investment securities resulted in a pre-tax realized loss of $67.4 million.

The company intends to sell $355 million of indirect auto loans with a negative valuation allowance of $16.7 million, recognized in other non-interest expenses. The sale of these loans is expected to close in the first quarter of 2024, with the proceeds being used to repay borrowings that have a similar yield to the sold loans.

Our Take

F.N.B. Corp’s solid liquidity position bodes well for the future. The company’s top line is expected to benefit from its efforts to increase fee income and opportunistic acquisitions. However, persistently rising expenses, owing to digitization and strategic buyouts, will likely hurt profits in the near term.

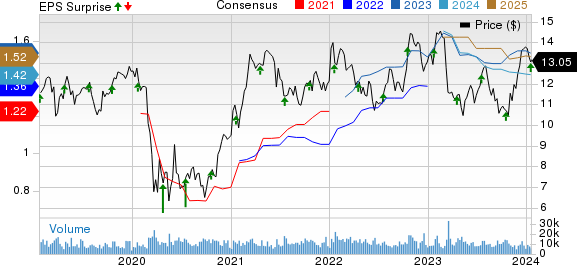

F.N.B. Corporation Price, Consensus and EPS Surprise

F.N.B. Corporation price-consensus-eps-surprise-chart | F.N.B. Corporation Quote

Currently, F.N.B. Corp carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Citigroup Inc.’s C fourth-quarter 2023 earnings per share (excluding the impacts of notable items) of 84 cents surpassed the Zacks Consensus Estimate of 73 cents. The company registered earnings of $1.16 a year ago.

Including the impacts of notable items in the quarter, C recorded a loss per share of $1.16.

Citigroup witnessed growth in total loans and deposits in the quarter. However, a decline in revenues and deteriorating credit quality were the major headwinds.

KeyCorp’s KEY fourth-quarter 2023 adjusted earnings from continuing operations of 25 cents per share surpassed the Zacks Consensus Estimate of 22 cents. This excludes an FDIC special assessment charge, efficiency-related expenses and a pension settlement charge.

KEY’s results benefited from a decline in provisions. However, lower NII and non-interest income, along with higher expenses, were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

F.N.B. Corporation (FNB) : Free Stock Analysis Report