F.N.B. Corporation Enhances eStore® with New Common Application

FNB Continues to Upgrade Client Experience with a Single Application for Multiple Products, Document Upload Portal and Automated Authentication and Data Prefill Technology

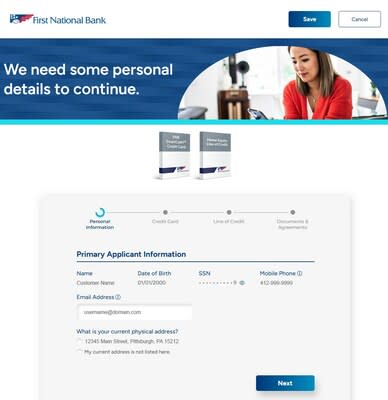

PITTSBURGH, June 8, 2023 /PRNewswire/ -- F.N.B. Corporation (NYSE: FNB) has announced the launch of the FNB eStore® Common application (eStore Common app) as the latest enhancement to its innovative and award-winning digital banking experience. With the eStore Common app, FNB aims to be the first bank to offer a single, universal application for almost all its products and services, including the ability to apply for multiple products simultaneously.

Utilizing advanced technology, including artificial intelligence and machine learning, the eStore Common app delivers a more efficient and secure application process. In the new experience, FNB requests simple customer information up front, such as a mobile phone number and date of birth. The eStore Common app then uses sophisticated data sources to prefill numerous fields, minimize customer keystrokes and significantly reduce the amount of time needed to complete an application. In addition, FNB has significantly enhanced security utilizing out-of-band and biometric technology as well as artificial intelligence.

To streamline the eStore Common app application process even further, FNB also has introduced the FNB Document Center. The secure online portal enables customers to upload necessary financial information and documentation in one place, largely eliminating the need to provide paperwork in person.

With these new features in place, FNB continues to advance its omnichannel Clicks-to-Bricks strategy, remaining at the forefront of banking innovation and consistently strengthening customer relationships with solutions based on their needs and preferences.

"Our ongoing investments in eStore will continue, with a priority on financial education and on streamlining product recommendations and client interactions," said Vincent J. Delie, Jr., Chairman, President and Chief Executive Officer of F.N.B. Corporation and First National Bank. "With the FNB eStore® Common app, we are significantly enhancing our clients' ability to source loan and deposit products by substantially increasing the speed with which information can be exchanged and applications for multiple products can be submitted."

Early eStore Common app data highlights an up to 23 percent reduction in time spent completing consumer loan applications — with a maximum input time of seven minutes.1 The time savings increase when customers apply for multiple products. For example, a customer applying for an auto loan and credit card can complete the process in just over four minutes, which is 55 percent less time than is needed to complete the applications individually.

Central to FNB's digital banking leadership is eStore, the Company's unique, retail-oriented banking experience where customers can shop for products and services, open accounts, apply for loans, schedule an appointment and access financial education resources via their mobile device through FNB Direct, on a computer or in a branch. Recently, FNB earned international recognition for eStore and its Clicks-to-Bricks strategy when it was named a Model Bank for Omnichannel Retail Delivery by Celent, a leading global research and advisory firm for the financial services industry. In addition, American Banker named Delie one of its 2023 Innovators of the Year, highlighting his vision and leadership in the development of eStore.

The first phase of the eStore Common app project, which is now live, includes consumer loan products. FNB plans to add consumer deposit products prior to the end of 2023, with business products on the roadmap for 2024.

Customers can access the FNB eStore Common app by selecting a consumer loan product using eStore, adding the product to their shopping cart and then completing the checkout process. To learn more about FNB's omnichannel banking strategy, visit the Clicks-to-Bricks page at fnb-online.com.

1 For a consumer loan product, excluding mortgages. Does not include document upload time.

About F.N.B. Corporation

F.N.B. Corporation (NYSE: FNB), headquartered in Pittsburgh, Pennsylvania, is a diversified financial services company operating in seven states and the District of Columbia. FNB's market coverage spans several major metropolitan areas, including: Pittsburgh, Pennsylvania; Baltimore, Maryland; Cleveland, Ohio; Washington, D.C.; Charlotte, Raleigh, Durham and the Piedmont Triad (Winston-Salem, Greensboro and High Point) in North Carolina; and Charleston, South Carolina. The Company has total assets of more than $44 billion and approximately 350 banking offices throughout Pennsylvania, Ohio, Maryland, West Virginia, North Carolina, South Carolina, Washington, D.C. and Virginia.

FNB provides a full range of commercial banking, consumer banking and wealth management solutions through its subsidiary network, which is led by its largest affiliate, First National Bank of Pennsylvania, founded in 1864. Commercial banking solutions include corporate banking, small business banking, investment real estate financing, government banking, business credit, capital markets and lease financing. The consumer banking segment provides a full line of consumer banking products and services, including deposit products, mortgage lending, consumer lending and a complete suite of mobile and online banking services. FNB's wealth management services include asset management, private banking and insurance.

The common stock of F.N.B. Corporation trades on the New York Stock Exchange under the symbol "FNB" and is included in Standard & Poor's MidCap 400 Index with the Global Industry Classification Standard (GICS) Regional Banks Sub-Industry Index. Customers, shareholders and investors can learn more about this regional financial institution by visiting the F.N.B. Corporation website at www.fnbcorporation.com.

View original content to download multimedia:https://www.prnewswire.com/news-releases/fnb-corporation-enhances-estore-with-new-common-application-301846168.html

SOURCE F.N.B. Corporation