F.N.B. Corporation Reports Mixed Q4 Results Amid Balance Sheet Optimization

Net Income: Q4 net income available to common stockholders was $48.7 million, a significant decrease from Q4 2022's $137.5 million.

Earnings Per Share (EPS): Q4 diluted EPS fell to $0.13, compared to $0.38 in the same quarter last year.

Balance Sheet Optimization: FNB executed sales of investment securities and auto loans, aiming for improved future profitability and capital positioning.

Loan Growth: Period-end total loans and leases grew by 6.8% year-over-year, excluding held-for-sale auto loans.

Net Interest Income: Slight decrease to $324 million in Q4, impacted by higher deposit costs and migration to higher yielding deposit products.

Tangible Book Value: Increased by 14.5% year-over-year to $9.47 per common share.

Capital Ratios: Common Equity Tier 1 (CET1) regulatory capital ratio estimated at 10.1%.

On January 18, 2024, F.N.B. Corporation (NYSE:FNB) released its 8-K filing, detailing the financial outcomes for the fourth quarter of 2023. The report revealed a mixed performance with a notable decrease in net income available to common stockholders to $48.7 million from $137.5 million in the same quarter of the previous year. This decline was also reflected in the diluted EPS, which dropped to $0.13 from $0.38 year-over-year.

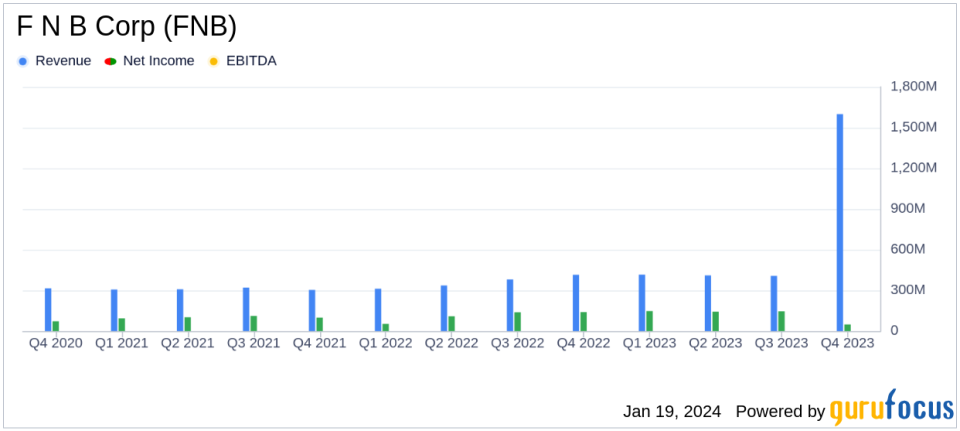

F.N.B. Corporation, with its primary operations in Community Banking, Wealth Management, and Insurance, saw a full-year record revenue and tangible book value per share growth of 14.5%. The company's proactive balance sheet management included the sale of approximately $650 million of available-for-sale investment securities and the transfer of $355 million of indirect auto loans to held-for-sale, aiming to enhance future profitability and capital positioning.

The company's loan portfolio showed resilience with a 6.8% increase in period-end total loans and leases year-over-year. However, net interest income slightly decreased to $324 million in Q4, primarily due to higher deposit costs and a shift in balance to higher yielding deposit products. Despite these challenges, FNB's tangible book value per common share grew significantly to $9.47, indicating a strong balance sheet and shareholder value.

Chairman, President, and CEO Vincent J. Delie, Jr. commented on the results:

"F.N.B. Corporation has again delivered exceptional performance with full year operating earnings totaling a record $1.57 per diluted common share (non-GAAP), record revenue of $1.6 billion and tangible book value per common share (non-GAAP) growth of $1.20, or 14.5%, year-over-year to an all-time high of $9.47."

The company's Common Equity Tier 1 (CET1) regulatory capital ratio was estimated at 10.1%, reflecting a solid capital structure. The efficiency ratio (non-GAAP) remained at a favorable level of 52.5%, indicating the company's operational effectiveness.

In conclusion, F.N.B. Corporation's Q4 earnings report presents a picture of a company navigating a challenging interest rate environment while executing strategic balance sheet optimization initiatives. The full-year growth in revenue and tangible book value per share underscores the company's underlying strength and commitment to enhancing shareholder value.

Explore the complete 8-K earnings release (here) from F N B Corp for further details.

This article first appeared on GuruFocus.