F5 Inc (FFIV) Reports Notable Earnings Growth in Q1 FY24 Despite Revenue Dip

Revenue: Slight decline to $693 million, a 1% decrease from Q1 FY23.

GAAP Operating Margin: Improved significantly to 23.8%, up from 13.0% in Q1 FY23.

Non-GAAP Operating Margin: Increased to 35.5%, up from 26.5% in Q1 FY23.

GAAP Earnings Per Share (EPS): Grew 93% to $2.32, compared to $1.20 in Q1 FY23.

Non-GAAP EPS: Rose 39% to $3.43, up from $2.47 in Q1 FY23.

Product Revenue: Declined by 10%, with a notable 22% drop in systems revenue.

Services Revenue: Increased by 7%, indicating a shift towards service offerings.

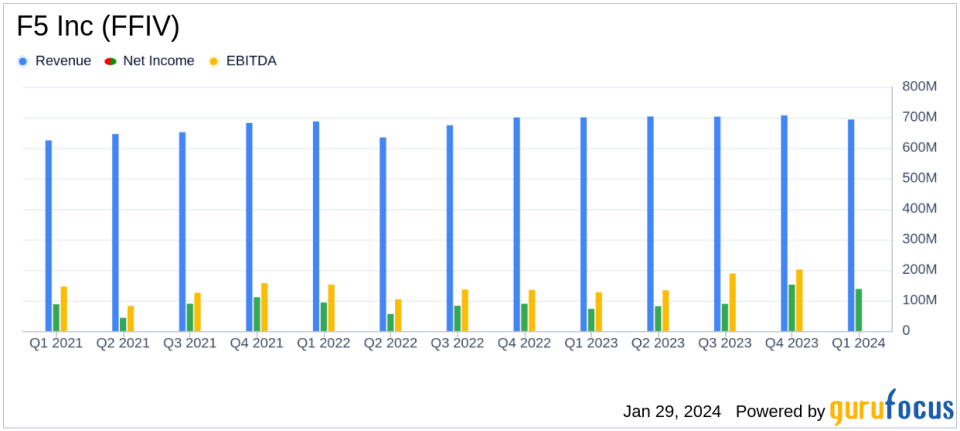

On January 29, 2024, F5 Inc (NASDAQ:FFIV) released its 8-K filing, detailing the financial outcomes for the first quarter of fiscal year 2024, which ended on December 31, 2023. Despite a slight revenue decline, the company reported substantial growth in both GAAP and non-GAAP earnings per share, alongside impressive improvements in operating margins.

F5 Inc, a leader in the application delivery controller market, is known for its products and services in security, application performance, and automation. The company, headquartered in Seattle and established in 1996, employs approximately 6,500 people. It generates around 55% of its revenue in the Americas, 25% in EMEA, and 20% in APAC/Japan. F5's revenue is evenly split between its services and products businesses, with a recent trend towards products due to increased software adoption.

Financial Highlights and Challenges

F5 Inc's first-quarter performance showed a 1% revenue decrease to $693 million, compared to $700 million in the same quarter of the previous fiscal year. The company experienced a 10% decline in product revenue, which was partially offset by a 7% increase in global services revenue. The software revenue grew by 2%, but this was overshadowed by a 22% decrease in systems revenue.

Despite the revenue dip, F5 Inc achieved a significant improvement in profitability. The GAAP gross margin increased to 80.3% from 77.9%, and the non-GAAP gross margin rose to 83.1% from 80.4%. This gross margin expansion reflects the company's operational efficiency and a favorable shift in the revenue mix.

Operating margins also saw a remarkable year-over-year increase. The GAAP operating margin improved by over 1,000 basis points to 23.8%, and the non-GAAP operating margin increased by more than 900 basis points to 35.5%. These improvements are indicative of F5 Inc's disciplined operational management and its ability to scale profitability even in the face of revenue headwinds.

Earnings Growth and Outlook

The company's GAAP net income for the quarter was $138 million, or $2.32 per diluted share, a significant increase from $72 million, or $1.20 per diluted share, in the first quarter of the previous fiscal year. Non-GAAP net income also saw a robust rise to $205 million, or $3.43 per diluted share, up from $149 million, or $2.47 per diluted share, in the prior year's quarter.

"Our team delivered solid first quarter results, including revenue near the high end and earnings per share above the high end of our guidance ranges," said Francois Locoh-Donou, F5s President and CEO. "As a result of our continued operating discipline, we delivered more than 1,000 basis points improvement in GAAP operating margin and more than 900 basis points improvement in non-GAAP operating margin year over year. We also delivered strong earnings growth, with 93% GAAP earnings per share growth and 39% non-GAAP earnings per share growth compared to last year."

Looking ahead, F5 Inc has provided a cautious yet optimistic outlook for the second quarter of fiscal year 2024, with expected revenue ranging from $675 million to $695 million and non-GAAP earnings per share between $2.79 and $2.91. The company has also raised its fiscal year 2024 non-GAAP earnings per share outlook to a growth of 6% to 8%, up from the previously expected 5% to 7% growth, due to a lower anticipated tax rate.

The company's performance demonstrates resilience in a challenging market environment, with a focus on operational efficiency and profitability. F5 Inc's ability to navigate through the complexities of the current economic landscape while delivering strong earnings growth is a testament to its strategic focus and execution capabilities.

For more detailed financial information and to access the full earnings release, please visit the 8-K filing.

Stay tuned to GuruFocus.com for further analysis and up-to-date financial news on F5 Inc (NASDAQ:FFIV) and other market-moving companies.

Explore the complete 8-K earnings release (here) from F5 Inc for further details.

This article first appeared on GuruFocus.