Fabrinet (FN) Posts Record Revenue and Earnings Per Share in Q2 Fiscal Year 2024

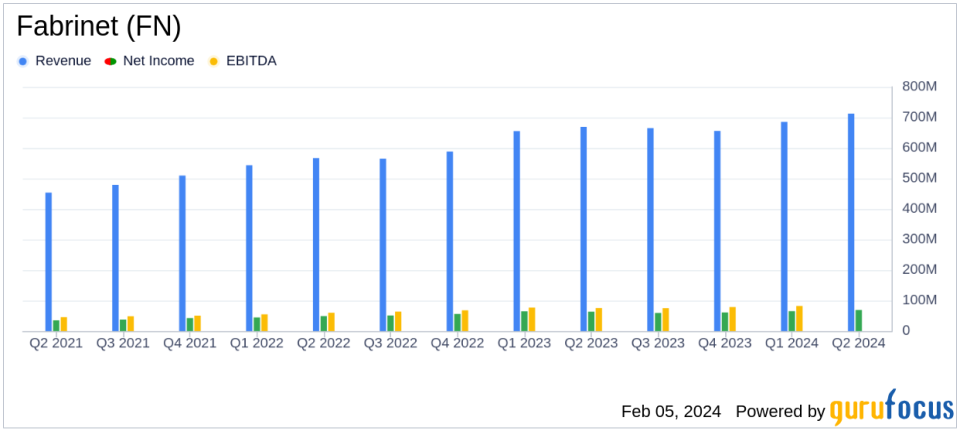

Revenue: Increased to $712.7 million in Q2 FY2024 from $668.7 million in Q2 FY2023.

Net Income: GAAP net income rose to $69.1 million, with non-GAAP net income at $76.1 million.

Earnings Per Share: GAAP EPS reached $1.89, and non-GAAP EPS climbed to $2.08.

Guidance: Q3 revenue projected between $705 million and $725 million, with EPS estimates of $1.89 to $1.96 on a GAAP basis and $2.08 to $2.15 on a non-GAAP basis.

Cash Flow: Free cash flow for the six months ended December 29, 2023, was $207.98 million.

On February 5, 2024, Fabrinet (NYSE:FN) released its 8-K filing, announcing financial results for the second quarter of the fiscal year 2024, which ended on December 29, 2023. The company, a leading provider of advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services, reported exceeding its guidance ranges with record revenue and net income per share.

Fabrinet (NYSE:FN) is known for its specialized manufacturing services catering to original equipment manufacturers (OEMs) in industries that demand high precision, such as optical communications, automotive components, medical devices, industrial lasers, and sensors. With a significant presence in North America and Asia-Pacific, the company's expertise spans the entire manufacturing process, from design and engineering to final assembly and testing.

Financial Performance and Outlook

The company's strong performance in the second quarter was highlighted by a significant increase in revenue to $712.7 million, up from $668.7 million in the same quarter of the previous fiscal year. This growth was primarily driven by robust datacom revenue, which continues to bolster the company's top-line performance. GAAP net income saw an increase to $69.1 million, or $1.89 per diluted share, compared to $63.2 million, or $1.71 per diluted share, in the second quarter of fiscal year 2023.

Non-GAAP net income, which excludes certain items like share-based compensation expenses, also showed a healthy increase, reaching $76.1 million, or $2.08 per diluted share, up from $70.0 million, or $1.90 per diluted share, in the prior-year period. The company's financial achievements are particularly noteworthy as they reflect Fabrinet's ability to navigate the complexities of the hardware industry and maintain profitability amidst a challenging economic landscape.

Key Financial Metrics

Key financial metrics from the income statement, balance sheet, and cash flow statement further demonstrate Fabrinet's solid financial position. The company's gross profit for the quarter stood at $88.3 million, with operating income reaching $69.0 million. The balance sheet shows a strong liquidity position, with cash and cash equivalents of $334.1 million and short-term investments totaling $406.5 million. The company's total assets amounted to $2.13 billion, with shareholders' equity at $1.61 billion.

Free cash flow, an important metric indicating the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets, was reported at $207.98 million for the six months ended December 29, 2023. This robust free cash flow underscores Fabrinet's ability to invest in growth opportunities, reduce debt, and return value to shareholders.

Seamus Grady, Chief Executive Officer of Fabrinet, commented on the results, "Our strong second quarter results exceeded our guidance ranges and also represented record levels for revenue and net income per share. We continued to see strong datacom revenue growth, which helped drive our overall top line performance."

Looking Ahead

Looking forward, Fabrinet provided guidance for the third fiscal quarter ending March 29, 2024. The company expects revenue to be in the range of $705 million to $725 million. GAAP net income per diluted share is projected to be between $1.89 and $1.96, while non-GAAP net income per diluted share is anticipated to be between $2.08 and $2.15, based on approximately 36.6 million fully diluted shares outstanding.

The company's optimism is partly due to the expectation that newer datacom programs will significantly contribute to future results and that the impact of ongoing inventory adjustments in the telecom market may continue to diminish. Fabrinet's ability to maintain strong execution into the next quarter is seen as a positive indicator for sustained growth and profitability.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing and listen to the earnings call, which provides additional insights into the company's performance and outlook.

Explore the complete 8-K earnings release (here) from Fabrinet for further details.

This article first appeared on GuruFocus.