Facebook's cryptocurrency project is called Calibra, will launch in 2020

Facebook (FB) on Tuesday announced the details of its widely-rumored cryptocurrency project: a financial services offering called Calibra.

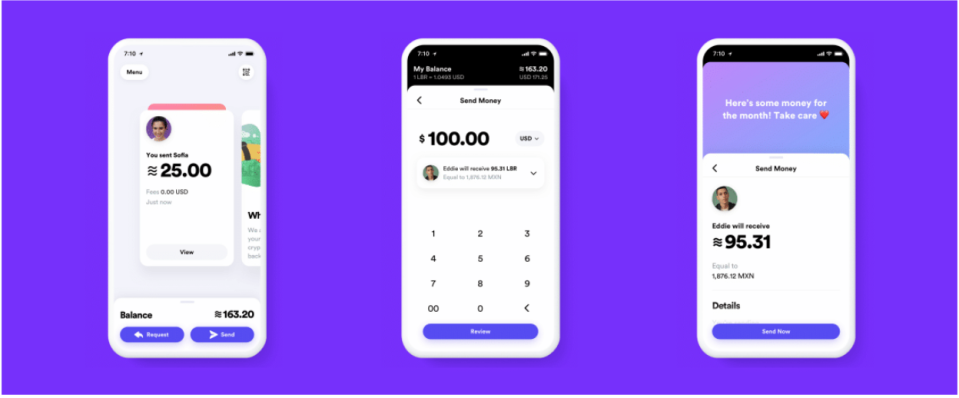

Calibra is a “newly formed Facebook subsidiary” and its first product, launching in 2020, will be a digital wallet to store and send Libra, a new cryptocurrency.

The digital wallet will initially be available inside WhatsApp and Facebook Messenger, and eventually as a standalone app for iOS and Android.

Calibra will enable users to send Libra to each other “as easily and instantly as you might send a text message, and at low to no cost.” Eventually, Facebook says, “we hope to offer additional services for people and businesses, such as paying bills with the push of a button, buying a cup of coffee with the scan of a code, or riding your local public transit without needing to carry cash or a metro pass.”

The differences between Calibra and Libra

Libra, the cryptocurrency, will run on its own Libra blockchain, which today launches an open-source testnet. The blockchain and cryptocurrency will all be overseen by the Libra Association, a not-for-profit that is separate from Facebook and headquartered in Geneva.

The Libra Association posted its announcement at the same time as Facebook’s Calibra announcement, and says it is targeting the first half of 2020 to launch the cryptocurrency.

The cryptocurrency will be backed by the Libra Reserve, a “collection of low-volatility assets like bank deposits and government securities, in currencies from stable and reputable central banks,” a Libra Association spokesperson tells Yahoo Finance.

Libra Association says Libra is not a stablecoin, because it is not pegged to a single currency and does not have a fixed value in any fiat currency. Rather, a spokesperson says, it will be “a blend of multiple currencies,” so its value “will fluctuate in any given local currency, and exchanges will charge a spread above or below the value of the reserve.”

Libra Association’s 28 “founding members” include: Facebook; Coinbase; Visa; MasterCard; PayPal; Stripe; Uber; Lyft; eBay; and Spotify. Every founding member has committed to a minimum investment of $10 million, and Libra Association says it aims to have 100 founding members by the time Libra launches.

These companies will “work together on finalizing the association’s charter” but the Libra Association is not yet saying whether being a founding member means that all of these organizations will accept Libra as payment.

The announcement stresses that the Libra Association is “independent.” But considering the co-orchestrated launch and simultaneous announcements, critics may scoff at the idea that Libra is truly separate from Facebook.

There will also surely be widespread debate over whether Libra is truly a decentralized cryptocurrency, and whether its blockchain is truly permissionless.

Promises about security

In a companion document to its announcement, Calibra stresses repeatedly that it will prioritize security. Calibra will be a regulated entity, and will keep customers’ financial data separate from Facebook social data. (Facebook has long had ambitions of offering financial services.)

[MORE: Facebook hasn't told us: why launch a cryptocurrency?]

The security guidelines continue, in boldface type: “Calibra will not share account information or financial data with Facebook, Inc or any third party without customer consent. For example, Calibra customers’ account information and financial data will not be used to improve ad targeting on the Facebook, Inc family of products.”

The language is an obvious attempt to address and assuage the rising concerns around Facebook’s use of customer data, at a time when Facebook is under investigation by the FTC and the New York Attorney General.

But the noise around Facebook’s privacy problems is now so loud, and has become such a major issue for lawmakers and 2020 presidential candidates, that a press release full of corporate security promises is unlikely to fully reassure any users who have been turned off by the entire scandal.

Will a Facebook-endorsed cryptocurrency really be the thing to lure them back?

Calibra looks different from JPM Coin and other crypto plays from mainstream giants

The reports that Facebook would be getting into cryptocurrency have helped buoy the price of bitcoin (BTC-USD) in June, though the price was already on the rise recently. Bitcoin is up 30% in the past month and 140% in 2019 so far.

But this has happened before: a big-name company appears to be dipping a toe into cryptocurrency; bitcoin believers cheer the news as a sign of mainstream acceptance; disappointment follows once the full details of the project come out.

[MORE: Binance says Libra could spark ‘mass adoption’ of crypto]

For example, when JPMorgan announced “JPM Coin” back in February it looked like a major bank was embracing cryptocurrency. But once details emerged, it became clear that JPM Coin is more of an internal token, only for use by JPM clients—not a true, decentralized cryptocurrency. (There was similar short-lived excitement about erroneous reports of Goldman Sachs launching a bitcoin trading desk.)

Facebook’s dip into crypto looks different, because the goal appears to be for Libra to be used outside of Facebook’s walls, with those big-name, consumer-facing partners like Spotify, eBay, Uber, and Lyft.

In other words, Facebook’s crypto project could be the one that truly does bring mainstream legitimacy and usage to cryptocurrency—but what will that mean for “the alpha and the omega” cryptocurrency, bitcoin?

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Cryptocurrency CEO who paid $4.6M for lunch with Buffett: 'It might be unrealistic'

SEC lawsuit against Kik has major implications for crypto industry

Exclusive: SEC quietly widens its crackdown on ICOs

There are now two 2020 candidates accepting crypto donations

JPMorgan blockchain chief: Why we launched our own cryptocurrency

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.