Factors to Determine Ford's (F) Fate This Earnings Season

Ford F is slated to release third-quarter 2022 results on Oct 26, after the closing bell. The Zacks Consensus Estimate for the quarter’s revenues and earnings is pegged at $37.7 billion and 37 cents a share, respectively.

The Zacks Consensus Estimate for Ford’s third-quarter earnings per share has moved down by 17 cents in the past 30 days. The bottom-line projection implies a year-over-year decline of 27.5%. The Zacks Consensus Estimate for quarterly revenues, however, suggests a year-over-year increase of 10.7%.

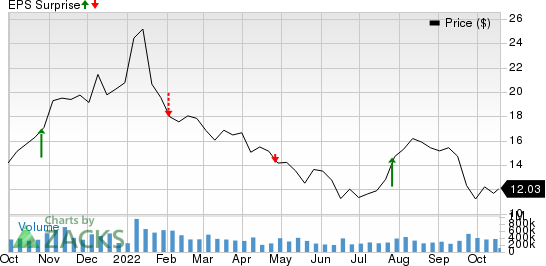

The U.S. auto biggie beat earnings estimates in the last reported quarter courtesy of higher-than-expected profits in its North America, South America and Europe segments. Over the trailing four quarters, Ford surpassed earnings estimates on two occasions for as many misses, with the average surprise being 24.5%. This is depicted in the graph below:

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Things to Note

Ford’s third-quarter revenues are likely to have been boosted by an increase in sales volume along with rising average prices of vehicles. The Zacks Consensus Estimate for total wholesale shipments worldwide is pegged at 1,101,000 units, indicating an increase from 1,012,000 units in the year-ago period. Our projection for the same is 1,128,000 units, implying growth of 11.4% on a yearly basis. The consensus mark for revenues from automotive sales is $37,289 million, implying an uptick from $33,211 million recorded in the corresponding quarter of 2021. We project automotive revenues to grow 9% year over year to $36,194.5 million in the to-be-reported quarter.

On the flip side, Ford issued a warning last month that its third-quarter 2022 profits are likely to take a hit in view of commodity cost headwinds stemming from exacerbated supply chain snarls and inflationary pressure. The Zacks Consensus Estimate for third-quarter adjusted automotive EBIT is pegged at $1,986 million, suggesting a fall from $2,459 million recorded in the year-ago period. Meanwhile, we project adjusted automotive EBIT to fall around 44% to $1,374 million.

The consensus mark for revenues from Ford Credit is pegged at $2,314 million, implying a decrease from $2,434 million. Our estimate for the same is $2,356.2 million. The consensus mark for adjusted EBIT from the segment is $770 million, suggesting a fall from $1,077 million in the third quarter of 2021. We expect adjusted EBIT from the segment to contract 16% year over year.

The consensus mark for revenues from Ford Mobility is pegged at $58 million, implying an increase from $38 million. Our estimate for the same is $65.9 million. The consensus mark for loss before interest and taxes from the segment is $270 million, widening from $258 million in the third quarter of 2021. We expect the bottom line from the segment to drop 13.1% year over year.

It should be noted that F envisions third-quarter total adjusted EBIT to be $1.4-$1.7 billion, implying a drop from $3.7 billion recorded in the last reported quarter and $3 million earned in third-quarter 2021. The weak forecast is primarily attributed to $1 billion in added supplier costs for the three months ending September due to inflation and component shortages. Our estimates for total adjusted EBIT for the quarter under discussion imply a decline of more than 43%

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Ford for the to-be-reported quarter, as it does not have the right combination of the two key ingredients. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Ford has an Earnings ESP of -33.52%. This is because the Most Accurate Estimate is pegged 13 cents lower than the Zacks Consensus Estimate.

Zacks Rank: It currently carries a Zacks Rank of 3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With the Favorable Combination

While an earnings beat appears uncertain for Ford, here are a few players from the auto space, which, according to our model, have the right combination of elements to post an earnings beat for the quarter to be reported:

Oshkosh OSK will release third-quarter 2022 results on Oct 27. The company has an Earnings ESP of +0.84% and a Zacks Rank #3.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at $1.16 per share and $2.14 billion, respectively. OSK surpassed earnings estimates in two of the trailing four quarters for as many misses, with the average surprise being a negative 13.62%.

Lear LEA will release third-quarter 2022 results on Nov 1. The company has an Earnings ESP of +11.72% and a Zacks Rank #3.

The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $2.15 per share and $5.18 billion, respectively. LEA surpassed earnings estimates in three of the trailing four quarters and missed once, with the average surprise being 14.41%.

Cummins CMI will release third-quarter 2022 results on Nov 3. The company has an Earnings ESP of +0.96% and a Zacks Rank #2.

The Zacks Consensus Estimate for Cummins’ to-be-reported quarter’s earnings and revenues is pegged at $4.87 per share and $6.88 billion, respectively. CMI surpassed earnings estimates in two of the trailing four quarters and missed twice, with the average surprise being 1.5%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research