Factors to Impact Innovative Industrial's (IIPR) Q4 Earnings

Innovative Industrial Properties, Inc. IIPR, a leading real estate investment trust (REIT) specializing in the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated cannabis facilities, is set to announce its fourth-quarter and full-year 2023 results on Feb 26 after market close.

In the last reported quarter, Innovative Industrial delivered a surprise of 4.57% in terms of adjusted funds from operations (FFO) per share. Results reflected better-than-expected revenues.

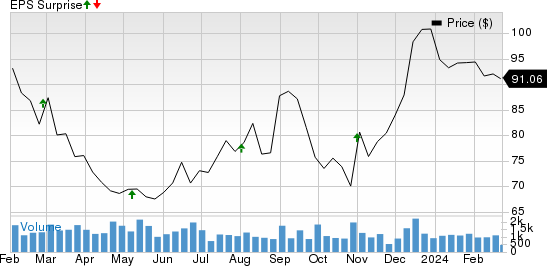

Over the last four quarters, IIPR’s adjusted FFO per share surpassed the consensus mark on all occasions, with the average beat being 7.67%. The graph below depicts the surprise history of the company:

Innovative Industrial has grabbed much attention in the past as it combines the high growth potential of the cannabis industry with the stability of the real estate market. In this article, we'll delve into IIPR's performance in recent quarters and analyze the factors that may have contributed to its fourth-quarter and full-year 2023 results.

Innovative Industrial Properties, Inc. Price and EPS Surprise

Innovative Industrial Properties, Inc. price-eps-surprise | Innovative Industrial Properties, Inc. Quote

Factors at Play

IIPR's performance in the fourth quarter of 2023 is expected to have benefited from the regulatory shifts in the cannabis sector and the growing acceptance of cannabis for medical and recreational purposes.

IIPR’s performance is likely to benefit from an increase in tenant reimbursements, acquisition and leasing of new properties and additional building infrastructure allowances provided to tenants at certain properties that resulted in increases to base rent and contractual rental escalations at certain properties.

However, continued inflation in input and labor costs is likely to have affected expenses in the quarter under consideration. This, along with pressure on pricing, is likely to have hampered profitability to some extent.

Projections

The Zacks Consensus Estimate for quarterly revenues is currently pegged at $77.25 million. The figure suggests a rise of 9.64% year over year.

Innovative Industrial Properties’ activities during the quarter in discussion were inadequate to gain analysts’ confidence. The Zacks Consensus Estimate for the fourth-quarter FFO per share has remained unrevised at $2.27 in the past month. It suggests a 7.08% increase year over year.

For the full year, the Zacks Consensus Estimate for adjusted FFO per share has been unrevised at $9.08 over the past month. The figure also indicates a 7.46% increase from the year-ago reported figure. The Zacks Consensus Estimate for 2023 revenues is pegged at $307.6 million, calling for growth of 11.3% from the year-ago reported number.

Here Is What Our Quantitative Model Predicts:

Our proven model does not conclusively predict a surprise in terms of FFO per share for Innovative Industrial Properties this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an FFO beat. However, that’s not the case here.

Innovative Industrial Properties currently carries a Zacks Rank of 3 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stock That Warrants a Look

Our model shows that Extra Space Storage Inc. EXR has the right combination of elements to report a surprise this quarter.

Extra Space Storage, scheduled to report quarterly numbers on Feb 27, has an Earnings ESP of +0.70% and carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

Innovative Industrial Properties, Inc. (IIPR) : Free Stock Analysis Report