Factors to Know Ahead of Sprouts Farmers' (SFM) Q3 Earnings

Sprouts Farmers Market, Inc. SFM is likely to register an increase in the top line when it reports third-quarter 2023 earnings on Oct 31 before market open. The Zacks Consensus Estimate for revenues stands at $1,682 million, indicating an increase of 5.7% from the prior-year reported figure.

The bottom line of this grocery retailer is also expected to have increased year over year. Over the past 30 days, the Zacks Consensus Estimate for third-quarter earnings per share has been stable at 62 cents, suggesting an increase of 1.6% from the year-ago quarter. The company had guided adjusted earnings in the band of 59-63 cents a share for the quarter.

Sprouts Farmers has a trailing four-quarter earnings surprise of 14.3%, on average. In the last reported quarter, this Phoenix, AZ-based company surpassed the Zacks Consensus Estimate by a margin of 10.9%.

Factors to Consider

Sprouts Farmers' focus on product innovation, technology and targeted marketing with everyday great pricing bodes well. It has been steadily expanding its presence in the natural organic space, given the huge demand in the segment. Management has been lowering operational complexity, optimizing production, improving the in-stock position and updating to smaller-format stores. Apart from these, the company has been trying to expand private-label offerings.

Cumulatively, the aforementioned factors are likely to have favorably impacted the top line. On its last earnings call, Sprouts Farmers guided a low-single-digit increase in comparable store sales for the third quarter. We expect comparable store sales growth of 2% for the quarter under review.

Sprouts Farmers has worked diligently to provide customers with a seamless shopping experience through its website, mobile app and a supply chain that prioritizes freshness. The introduction of grocery pickup services and home delivery options at all its stores represents a significant step toward meeting the growing demand for online shopping. Such initiatives have been helping Sprouts Farmers expand its customer base and revenues.

However, the company faces challenges in the SG&A domain, particularly in the third quarter. We anticipate SG&A expenses to increase 7.2% year over year in the quarter. As a percentage of net sales, we expect the metric to increase 50 basis points to 29.5%. Consequently, we foresee a 50-basis point contraction in the operating margin.

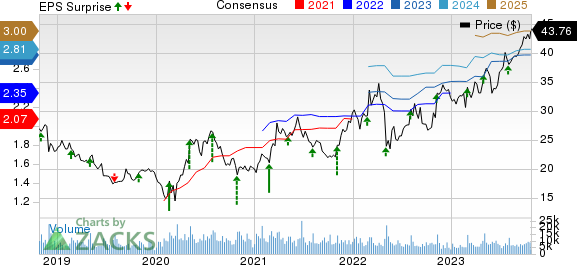

Sprouts Farmers Market, Inc. Price, Consensus and EPS Surprise

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Sprouts Farmers this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Although Sprouts Farmers currently has a Zacks Rank #3, its Earnings ESP of 0.00% makes the surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this season:

Build-A-Bear Workshop BBW currently has an Earnings ESP of +0.66% and carries a Zacks Rank #2. The Zacks Consensus Estimate for third-quarter fiscal 2023 earnings per share is pegged at 51 cents, flat year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Build-A-Bear Workshop’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $107.6 million, which indicates an increase of 3% from the figure reported in the prior-year quarter. BBW has a trailing four-quarter earnings surprise of 21.6%, on average.

Ulta Beauty ULTA currently has an Earnings ESP of +3.75% and a Zacks Rank of 3. The company is likely to register a decrease in the bottom line when it reports third-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $4.98 suggests a decline of 6.7% from the year-ago reported number.

Ulta Beauty’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.48 billion, which suggests an increase of 6.1% from the prior-year quarter. ULTA has a trailing four-quarter earnings surprise of 12.9%, on average.

The Home Depot HD currently has an Earnings ESP of +0.63% and a Zacks Rank #3. The company is expected to register a bottom-line decline when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $3.80 suggests a drop of 10.4% from the year-ago quarter.

Home Depot’s top line is anticipated to decline year over year. The consensus mark for revenues is pegged at $37.71 billion, indicating a decline of 3% from the figure reported in the year-ago quarter. HD has a trailing four-quarter earnings surprise of 2.2%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report