Factors Likely to Drive Purple Innovation's (PRPL) Q2 Earnings

Purple Innovation, Inc. PRPL is expected to report second-quarter 2023 results on Aug 9, after the closing bell. The leading premium mattress company is anticipated to have witnessed a decline in the top line in the to-be-reported quarter.

The Zacks Consensus Estimate for second-quarter revenues is pegged at $132.4 million, indicating a decline of 8.2% from that reported in the year-ago quarter. The consensus estimate for a loss of 11 cents per share suggests no change from the year-ago quarter’s actual. The consensus mark has been unchanged in the past 30 days.

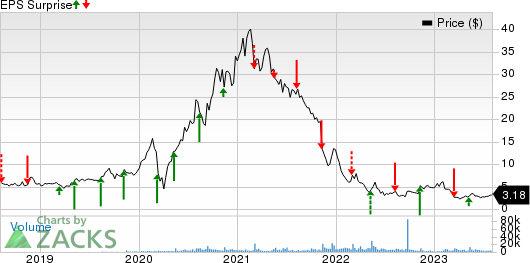

In the last reported quarter, the company posted an earnings surprise of 7.7%. However, it has delivered a negative earnings surprise of 7.3%, on average, in the trailing four quarters.

PURPLE INNOVATION, INC. Price and EPS Surprise

PURPLE INNOVATION, INC. price-eps-surprise | PURPLE INNOVATION, INC. Quote

Key Factors to Note

Purple Innovation’s second-quarter performance is expected to have benefited from the innovative product line and the right strategy in place for expansion. The company is poised to have benefited from the introduction of its most innovative product line in Las Vegas in March 2023. Gains from this launch are likely to get reflected in its second-quarter top-line results.

Additionally, the company’s strategic plan of redevelopment and expansion of product lineup; new inspirational brand positioning; investment in wholesale partnerships; and continued showroom expansion are likely to have bolstered sales in the to-be-reported quarter. In April, the company started shipping new mattresses to partners to retailers ahead of their debut scheduled for mid-May. Gains from the debut of these products are expected to get reflected in its second-quarter results.

Further, the company has reimagined its Purple brand to be bolder and more appealing to the premium consumer. Its new messaging to promote its differentiated GelFlex Grid technology for a better sleep experience is likely to have resonated well with customers. This is expected to have boosted the performance in the to-be-reported quarter.

On the last reported quarter’s earnings call, management anticipated second-quarter revenues to be stronger than the first quarter but below the prior-year levels.

The company’s margins in the second quarter are expected to have benefited from the rightsizing of the cost structure, and improving supply-chain and manufacturing efficiencies. Lower materials, labor and freight costs, along with the manufacturing efficiency and cost-reduction initiatives, are expected to have boosted the gross margin in the to-be-reported quarter.

The company is also likely to have witnessed reduced operating expenses, driven by lower marketing and sales expenses resulting from the planned reduction of advertising spending to improve marketing efficiency. Improved sales and margins are likely to have boosted the bottom line in the to-be-reported quarter.

However, the company’s second-quarter results may continue to reflect the impacts of the ongoing shift in demand for home-related products, inflationary pressure on discretionary consumer spending and the intentional reduction in advertising spend. Additionally, the company is likely to have incurred launch-related expenses in the second quarter.

On the last reported quarter’s earnings call, management predicted a shift of $3 million of launch-related expenses to the second quarter from the first quarter. The company expected its adjusted EBITDA in the second quarter to reflect the impacts of launch-related expenses.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Purple Innovation this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Monster Beverage has a Zacks Rank #3 and an Earnings ESP of 0.00%.

Stocks Poised to Beat Earnings Estimates

Inter Parfums IPAR has an Earnings ESP of +6.22% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for its second-quarter revenues is pegged at $309.1 million, which suggests growth of 26.3% from the figure reported in the prior-year quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ quarterly earnings has moved up by a penny in the past seven days to 89 cents per share, suggesting growth of 3.5% from the year-ago quarter’s reported number. IPAR’s earnings beat the consensus estimate in the trailing four quarters, delivering an earnings surprise of 37.2%, on average.

Coty COTY has an Earnings ESP of +20.00% and a Zacks Rank #2 at present. The Zacks Consensus Estimate for its fourth-quarter fiscal 2023 revenues is pegged at $1.32 billion, which suggests growth of 13.4% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for COTY’s quarterly earnings has moved up by a penny in the past 30 days at 2 cents per share. The consensus estimate suggests an improvement from a loss of 1 cent reported in the year-ago quarter. COTY’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, delivering an earnings surprise of 145%, on average.

Grocery Outlet GO has an Earnings ESP of +4.74% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for its second-quarter 2023 revenues is pegged at $974.4 million, which suggests growth of 8.6% from the figure reported in the prior-year quarter.

The consensus estimate for Grocery Outlet's quarterly earnings has been unchanged in the past 30 days at 26 cents per share, suggesting a decline of 10.3% from the year-ago quarter’s reported number. GO’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, delivering an earnings surprise of 13.7%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

PURPLE INNOVATION, INC. (PRPL) : Free Stock Analysis Report