Factors Likely to Influence Deckers' (DECK) Q3 Earnings

Deckers Outdoor Corporation DECK is likely to register an increase in the top line when it reports third-quarter fiscal 2024 earnings results on Feb 1 after market close. The Zacks Consensus Estimate for revenues is pegged at $1,435 million, indicating an improvement of 6.6% from the prior-year reported figure.

The company, renowned for its design, marketing and distribution of footwear, apparel and accessories, is expected to observe a year-over-year increase in its bottom line. The Zacks Consensus Estimate for third-quarter earnings per share has climbed 2.8% to $11.36 in the past seven days, suggesting an improvement of 8.4% from the year-ago period.

Deckers has maintained a trailing four-quarter earnings surprise of 26.3%, on average. In the last reported quarter, this Goleta, CA-based company’s bottom line outperformed the Zacks Consensus Estimate by a margin of 54.7%.

Key Factors to Note

Deckers’ third-quarter performance is likely to have benefited from the acceleration of omnichannel capabilities, a customer-centric approach and marketing strategies. The company’s focus on expanding brand assortments, introducing an innovative line of products and enhancing the direct-to-consumer business may have acted as tailwinds. Additionally, the strategic price increases of products might have supported the top line in the quarter under review.

Keeping pace with changing trends, Deckers has constantly been developing its e-commerce portal to capture incremental sales. The company has been making substantial investments to strengthen its online presence and enhance the shopping experience.

We expect strength in the HOKA ONE ONE brand, with sales anticipated to increase 16.2%. However, the Teva brand is likely to face challenges, leading to an estimated 8.7% decline in sales. Additionally, the Sanuk brand is expected to experience a more significant decline of 16.1%. For the UGG brand, we expect a marginal decline of 0.8% in sales.

However, the company faces challenges in the SG&A domain. We anticipate SG&A expenses to increase 15.8% year over year in the quarter. As a percentage of net sales, we expect the metric to increase 310 basis points to 29.1%.

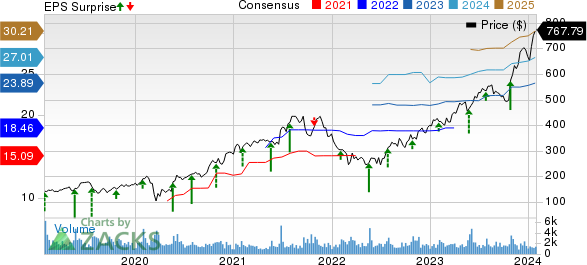

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Deckers this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here.

Deckers has an Earnings ESP of +1.39% and a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat this season:

Abercrombie & Fitch ANF currently has an Earnings ESP of +3.14% and sports a Zacks Rank #1. The Zacks Consensus Estimate for fourth-quarter fiscal 2023 earnings per share is pegged at $2.71, sharply up from 81 cents registered in the year-ago period. You can see the complete list of today’s Zacks #1 Rank stocks here.

Abercrombie & Fitch’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.43 billion, which indicates an increase of 18.9% from the figure reported in the prior-year quarter. ANF has a trailing four-quarter earnings surprise of 713%, on average.

Five Below FIVE currently has an Earnings ESP of +0.41% and a Zacks Rank #3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $3.76 suggests a rise of 22.5% from the year-ago quarter.

Five Below’s top line is anticipated to advance year over year. The consensus mark for revenues is pegged at $1.35 billion, indicating an increase of 19.9% from the figure reported in the year-ago quarter. FIVE has a trailing four-quarter earnings surprise of 5.7%, on average.

Ulta Beauty ULTA currently has an Earnings ESP of +0.97% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $7.48 suggests an increase of 12% from the year-ago reported number.

Ulta Beauty’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.51 billion, which suggests an increase of 8.9% from the prior-year quarter. ULTA has a trailing four-quarter earnings surprise of 5.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report