Factors Likely to Influence Hershey's (HSY) Q3 Earnings

The Hershey Company HSY is likely to register top- and bottom-line growth when it reports third-quarter 2023 earnings on Oct 26.

The Zacks Consensus Estimate for revenues is pegged at almost $3 billion, suggesting a rise of 9% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for the bottom line has dropped by a penny to $2.47 per share over the past seven days. The projection indicates an increase of 13.8% from the figure reported in the year-ago period quarter.

The confectionery products and pantry items company has a trailing four-quarter earnings surprise of 8.9%, on average. Hershey delivered an earnings surprise of 6.4% in the last reported quarter.

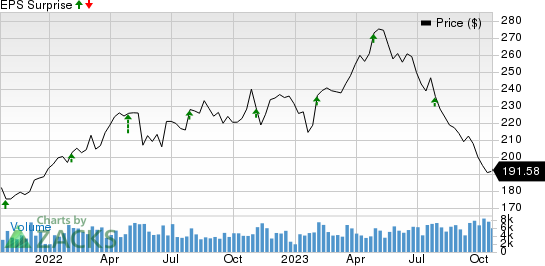

Hershey Company (The) Price and EPS Surprise

Hershey Company (The) price-eps-surprise | Hershey Company (The) Quote

Factors To Note

Hershey has been benefiting from rising consumer demand for its products globally. In this regard, management regularly brings innovation to its core brands to meet consumer needs. The company also supports brands through solid media marketing. Also, HSY has been enhancing its portfolio through prudent buyouts, helping it boost revenues. We believe that the continuation of these aspects bodes well for the quarter to be reported.

Hershey has been undertaking strategic pricing initiatives, which is yielding. In second-quarter 2023, organic price contributed 7.7% to organic net sales growth. We expect organic sales growth of 8.1% year over year in the third quarter of 2023.

Yet, an increase in selling, marketing and administrative (SG&A) expenses are likely to have affected Hershey’s performance in the third quarter. We expect the metric to rise 15% in the quarter.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Hershey this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hershey carries a Zacks Rank #3 with an Earnings ESP of +1.29%.

Stocks With the Favorable Combination

Here are three companies worth considering, as our model shows that these have the correct combination to beat on earnings this time:

Church & Dwight Co. CHD has an Earnings ESP of +5.00% and a Zacks Rank #1. The company is slated to witness top-line growth when it reports third-quarter 2023 results. The Zacks Consensus Estimate for CHD’s quarterly revenues is pegged at $1.43 billion, suggesting growth of 8.5% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Although the Zacks Consensus Estimate for Church & Dwight’s quarterly earnings has moved up by a penny over the last seven days to 68 cents per share, indicating a decline of 10.5% from the year-ago quarter’s reported number. CHD has delivered an earnings surprise of 12.1%, on average, in the trailing four quarters.

The Boston Beer Company SAM has an Earnings ESP of +0.71% and has a Zacks Rank #3. The company is likely to register bottom-line growth when it reports third-quarter 2023 numbers. The Zacks Consensus Estimate for The Boston Beer Company’s quarterly earnings per share of $4.25 suggests an increase of 11.3% from the year-ago quarter’s levels.

SAM has a trailing four-quarter negative earnings surprise of 74.9%, on average. The Zacks Consensus Estimate for The Boston Beer Company’s quarterly revenues is pegged at $592.9 million, indicating a drop of 0.6% from the figure reported in the prior-year quarter.

Colgate-Palmolive Company CL has an Earnings ESP of +0.37% and a Zacks Rank of 3. The company is likely to register increases in the top and the bottom line when it reports third-quarter 2023 results. The Zacks Consensus Estimate for Colgate-Palmolive’s quarterly revenues is pegged at $4.8 billion, suggesting growth of 8.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the past 30 days at 80 cents per share, which indicates 8.1% growth from the year-ago quarter's reported number. CL delivered an earnings surprise of 1.7%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report