Factors to Note Ahead of FEMSA's (FMX) Upcoming Q2 Earnings

Fomento Economico Mexicano, S.A.B. de C.V. FMX, or FEMSA, is slated to report second-quarter 2023 earnings on Jul 27. The company is likely to have witnessed top and bottom-line growth in the quarter under review.

The Zacks Consensus Estimate for FMX’s second-quarter earnings of $1.21 per share suggests 10% growth from the year-ago quarter’s reported figure. The consensus estimate for earnings has been unchanged in the past 30 days. The consensus mark for quarterly revenues is pegged at $11.1 billion, indicating growth of 32.9% from the year-ago quarter's reported figure.

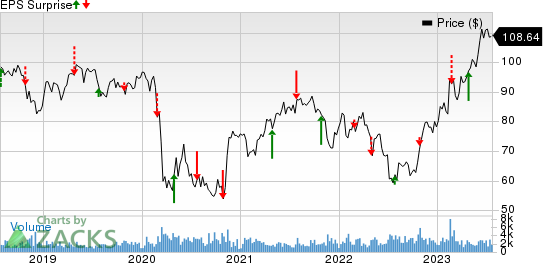

In the last reported quarter, the company delivered an earnings surprise of 52.6%. It has a trailing four-quarter negative earnings surprise of 1.3%, on average.

Fomento Economico Mexicano S.A.B. de C.V. Price and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. price-eps-surprise | Fomento Economico Mexicano S.A.B. de C.V. Quote

Factors at Play

FEMSA has been reaping the benefits of its diversified business, continued strength in OXXO Mexico and OXXO Gas, expansion into newer businesses, and digital initiatives. These positives have been well reflected in its earnings performance.

The company has been on track with its strategy of creating a distribution platform in the United States through the expansion of its footprint in the specialized distribution industry. Its venture in the specialized distribution industry relates to its plan of investing in adjacent businesses, which can leverage capabilities across different markets, providing an opportunity for attractive growth and risk-adjusted returns. These efforts are expected to have contributed to the company’s top-line performance in the to-be-reported quarter.

The company’s second-quarter results are expected to reflect growth through investments in digital and technology-driven initiatives. Its focus on offering customers more options to make contactless purchases by intensifying digital and technology-driven initiatives across operations has been aiding the digital performance.

The company’s Coca-Cola FEMSA has been leading the way with its omnichannel business, whereas FEMSA Comercio has been progressing with the adoption of digital initiatives. Investments in digital offerings, loyalty programs and fintech platforms bode well. Its OXXO digital wallet, OXXO Premia and loyalty program have also been performing well. Such endeavors are likely to have aided revenues in the to-be-reported quarter.

We expect revenues for the Proximity division to increase 16.6% year over year in the second quarter, backed by gains in the OXXO retail business. Revenues for the Fuel, Health and Coca-Cola FEMSA businesses are expected to increase 17.1%, 13.1% and 16.3%, respectively, in the to-be-reported quarter.

However, the company has been witnessing margin pressures, which are expected to have continued in the second quarter. FEMSA’s performance is expected to have been partly hurt by the impacts of supply-chain disruptions and higher raw material costs. Inflation in steel and aluminum prices is expected to have been concerning.

We estimate the operating margin to decline 80 basis points year over year to 8.4% in the second quarter.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for FEMSA this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FEMSA has an Earnings ESP of 0.00% and a Zacks Rank #3.

Stocks Poised to Beat Earnings Estimates

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to deliver an earnings beat.

Molson Coors TAP has an Earnings ESP of +12.96% and currently sports a Zacks Rank of 1. It is likely to register top and bottom-line growth while reporting second-quarter 2023 results. The consensus mark for TAP’s quarterly revenues is pegged at $3.21 million, which suggests 10% growth from the prior-year quarter’s reported figure.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus mark for Molson Coors’ quarterly earnings is pegged at $1.49 per share, suggesting growth of 25.2% from the year-ago quarter’s reported figure. The estimate has moved up 4.9% in the past seven days. TAP has delivered an earnings surprise of 32.1%, on average, in the trailing four quarters.

Church & Dwight Co. CHD currently has an Earnings ESP of +1.39% and a Zacks Rank of 2. It is likely to register increases in the top and bottom lines when reporting second-quarter 2023 results. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.4 billion, implying a rise of 7.3% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for Church & Dwight’s quarterly earnings is pegged at 79 cents per share, suggesting an increase of 4% from the year-ago quarter’s reported number. The estimate has been unchanged in the past 30 days. CHD has delivered an earnings surprise of 9.8%, on average, in the trailing four quarters.

Coca-Cola KO currently has an Earnings ESP of +2.00% and a Zacks Rank of 3. It is likely to register increases in the top and bottom lines when reporting second-quarter 2023 results. The Zacks Consensus Estimate for KO’s quarterly earnings has moved up by a penny in the past 30 days to 72 cents per share, indicating growth of 2.9% from the year-ago quarter's figure.

The Zacks Consensus Estimate for Coca-Cola’s quarterly revenues is pegged at $11.7 billion, suggesting growth of 3.6% from the prior-year quarter’s reported figure. KO has delivered an earnings surprise of 4.2%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report