Factors to Note Ahead of Generac's (GNRC) Q4 Earnings Release

Generac Holdings Inc GNRC will report fourth-quarter 2023 results on Feb 14.

The Zacks Consensus Estimate for quarterly revenues is pegged at $1.10 billion, indicating a year-over-year increase of 4.6%. The consensus estimate for earnings is pegged at $2.09 per share, suggesting a 17.4% rise year over year.

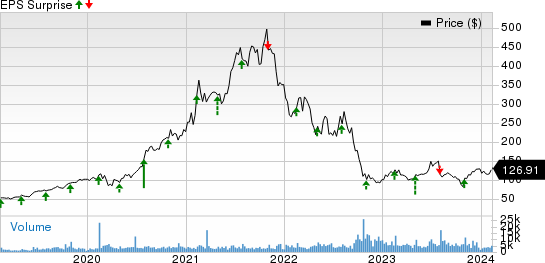

GNRC beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average earnings surprise of 7.1%. In the past year, shares of the company have gained 3.8% against the sub-industry’s decline of 44.2%.

Generac Holdings Inc. Price and EPS Surprise

Generac Holdings Inc. price-eps-surprise | Generac Holdings Inc. Quote

Key Factors

Generac’s performance is likely to have benefited from continued strength in the Commercial & Industrial (C&I) product shipments and solid growth in home standby generator shipments. The Zacks Consensus Estimate for C&I products' revenues is pegged at $372 million, implying 12% year-over-year growth.

The company’s Residential Energy Technology Products and Solutions segment is likely to have benefited from solid sales of Ecobee. The company announced that Ecobee smart thermostats can now be integrated with Generac 4G LTE Cellular Propane Tank Monitors to monitor fuel levels in the propane tank from the smart thermostat screen.

Apart from this, the ongoing grid stability concerns and volatile energy markets will drive shipments of natural gas generators used in applications beyond traditional emergency standby projects.

In the quarter under review, the company announced that it had made a minority investment in a leading smart electric vehicle charging and energy management company — Wallbox. The partnership will improve Generac’s distribution capacity in the United States by providing its customers with Wallbox's range of EV charging solutions, which includes L2 AC chargers and its bidirectional charger, Quasar 2.

However, Generac’s performance is likely to have been affected by demand softness in Residential products owing to gradual field inventory levels of home standby generators. Also, portable generator sales are likely to decrease year over year due to elevated year-ago sales, which include the impact of Hurricane Ian. The Zacks Consensus Estimate for Residential products' revenues is pegged at $606 million, suggesting a 4.3% plunge year over year.

What Our Model Says

Our proven model does not predict an earnings beat for Generac this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here, as you can see below.

Generac has an Earnings ESP of -5.94% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Shopify Inc SHOP has an Earnings ESP of +1.02% and currently sports a Zacks Rank #1. SHOP is scheduled to report quarterly earnings on Feb 13. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SHOP’s to-be-reported quarter’s earnings and revenues is pegged at 31 cents per share and $2.07 billion, respectively. Shares of SHOP have gained 86.2% in the past year.

Iridium Communications IRDM has an Earnings ESP of +43.80% and currently carries a Zacks Rank #3. IRDM is scheduled to report quarterly earnings on Feb 15.

The Zacks Consensus Estimate for IRDM’s to-be-reported quarter’s earnings and revenues is pegged at 3 cents per share and $195.2 million, respectively. Shares of IRDM have plunged 39.3% in the past year.

United States Cellular USM has an Earnings ESP of +350.00% and currently carries a Zacks Rank #3. USM is scheduled to report quarterly earnings on Feb 16.

The Zacks Consensus Estimate for USM’s to-be-reported quarter’s revenues is pegged at $970.2 million. Shares of USM have rallied 89.7% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

Generac Holdings Inc. (GNRC) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report