Factors to Note Ahead of Lumen's (LUMN) Q4 Earnings Release

Lumen Technologies, Inc LUMN is scheduled to report fourth-quarter 2023 results on Feb 6, after the closing bell.

The Zacks Consensus Estimate for total revenues is pegged at $3.44 billion, suggesting a fall of 9.6% from a year ago. The consensus estimate is currently pegged at a loss of 3 cents per share. In the year-ago quarter, LUMN reported earnings of 43 cents.

The company missed the Zacks Consensus Estimate in two of the last four quarters and beat in the remaining quarters. It has a trailing four-quarter earnings surprise of 0.69%, on average.

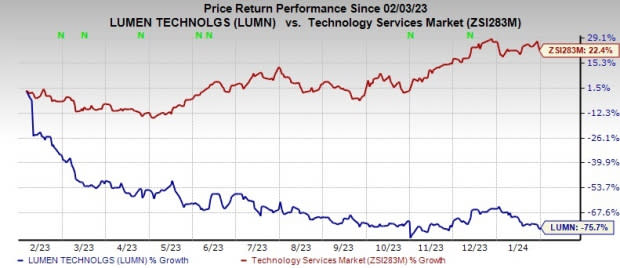

In the past year, shares of LUMN have lost 75.7% against the sub-industry’s growth of 22.4%.

Image Source: Zacks Investment Research

Factors to Note

Momentum in security, cloud, unified communications and IT products is likely to have offered some cushioning to the top-line performance. Management is also focusing on cost discipline and shutting down non-value-added processes, which are likely to provide some support to the bottom line.

Lumen Technologies, Inc. Price and EPS Surprise

Lumen Technologies, Inc. price-eps-surprise | Lumen Technologies, Inc. Quote

Continued investments in Quantum Fiber and enterprise business may have been positives. The company added 19,000 Quantum fiber subscribers, taking the count to 896,000 in the reported quarter.

In the third quarter, total enablements were approximately 141,000. As of Sep 30, 2023, the total enabled locations in the retained states were 3.5 million. The company is targeting to exceed 500,000 enabled locations in 2023.

Also, LUMN has been undergoing a time-consuming digital transformation process. Weakness in the Business, Enterprise Channels and Mass Markets business segments along with massive debt is another headwind.

Our projection for the Business and Mass Markets segments’ revenues is pegged at $2,671.7 million and $749.2 million, respectively.

Apart from a time-consuming business transformation endeavor, uncertainty prevailing over global macroeconomic conditions, forex volatility and inflationary pressure are also likely to have a negative impact on Lumen’s fourth-quarter revenues.

Recent Developments

On Jan 25, 2024, Lumen entered into an amended and restated transaction support agreement ("TSA") with a group of creditors who now represent, in the aggregate, over $12.5 billion of the outstanding debt of the company and its subsidiaries. It represents over 70% in the aggregate of Lumen and Level 3 debt maturing through 2027.

The amended TSA is now supported by a relatively larger group of creditors than the agreement previously announced on Oct 31, 2023. The TSA will extend debt maturities to 2029 and beyond. It will provide $1.325 billion of financing to the company through new long-term debt and provide access to a new revolving credit facility in an amount expected to be $1 billion. Lumen expects to conclude the transactions considered in the TSA in the first quarter of 2024, subject to the satisfaction of remaining closing conditions.

On Jan 8, 2024, Lumen announced that it has obtained Wi-Fi 7 certification for two wireless devices. The company debuted these devices a few days back which are ideal for bandwidth-heavy activities like gaming, virtual reality, 8K video streaming and large data transfers. Lumen noted that it is the first company in the industry to achieve Wi-Fi CERTIFIED 7 devices with its custom-developed solutions. Wi-Fi Alliance certified two Lumen Wi-Fi 7 devices are W1700K (can be used as a desk or wall mount) and W1701K (wall plug-in device).

On Dec 29, 2023, LUMN announced the launch of a custom-designed Wi-Fi 7 device to transform wireless connectivity. This technology will improve connectivity and enhance the Wi-Fi experience for Quantum Fiber multi-gig customers.

The new device will improve network coverage as it covers up to 90% of a home, which reduces the need for additional nodes. It also supports multiple users and high-bandwidth demands without requiring extensive ethernet cable connections. It is ideal for bandwidth-heavy activities like 8K video streaming, gaming, virtual reality and large data transfers.

On Nov 7, 2023, management announced that it clinched a $110 million contract from the U.S. Defense Information Systems Agency to deliver mission-critical network services to the U.S. Department of Defense.

Earnings Whispers

Our proven model does not predict an earnings beat for Lumen this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

LUMN has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Watts Water Technologies WTS has an Earnings ESP of +0.87% and currently carries a Zacks Rank of 2. WTS is set to announce quarterly figures on Feb 12.

The Zacks Consensus Estimate for WTS’ to-be-reported quarter’s earnings and revenues is pegged at $1.78 per share and $532.4 million, respectively. Shares of WTS have gained 17.6% in the past year.

InterDigital, Inc IDCC has an Earnings ESP of +1.93% and presently carries a Zacks Rank #2. IDCC is slated to release quarterly numbers on Feb 15.

The Zacks Consensus Estimate for IDCC’s to-be-reported quarter’s earnings and revenues is pegged at $1.21 per share and $104.3 million, respectively. Shares of IDCC have increased 46.9% in the past year.

Shopify Inc SHOP has an Earnings ESP of +1.02% and currently sports a Zacks Rank #1. SHOP is scheduled to report quarterly earnings on Feb 13. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SHOP’s to-be-reported quarter’s earnings and revenues is pegged at 31 cents per share and $2.07 billion, respectively. Shares of SHOP have plunged 44.6% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report