Factors to Note Ahead of NCR Corporation's (NCR) Q2 Earnings

NCR Corporation NCR is set to report second-quarter 2023 results on Aug 2.

For the second quarter of 2023, NCR projects revenues between $1.9 billion and $2 billion. The Zacks Consensus Estimate for second-quarter revenues is pegged at $1.95 billion, suggesting a 2.3% increase from the year-ago period.

The company forecasts a non-GAAP EPS in the band of 70-76 cents for the to-be-reported quarter. The consensus mark for earnings stands at 63 cents per share, 11.3% lower than the year-ago quarter.

In the last reported quarter, NCR delivered outstanding results, with strong revenue growth and increased profitability despite the challenging macroeconomic environment. The enterprise technology provider’s first-quarter non-GAAP earnings jumped 6% year over year to 56 cents per share and beat the Zacks Consensus Estimate of 43 cents. Revenues increased 1% year over year to $1.89 billion and beat the consensus mark of $1.84 billion.

Let’s see how things have shaped up before this announcement.

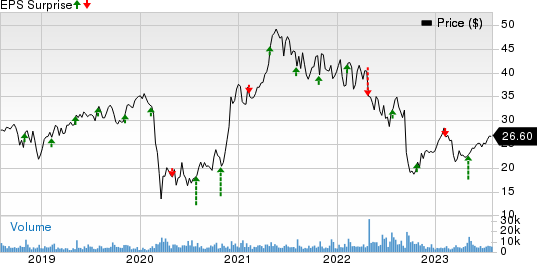

NCR Corporation Price and EPS Surprise

NCR Corporation price-eps-surprise | NCR Corporation Quote

Key Factors to Consider

NCR’s second-quarter performance is likely to have benefited from the strong demand for its software and service solutions across the banking, retail and hospitality industries. The rapid adoption of digital banking solutions is driving its Banking segment revenues.

The company received positive feedback from customers on the new features and the functionality of its digital banking solutions. Our estimate for the Digital Banking division’s revenues is currently pegged at $134.6 million, suggesting year-over-year growth of 2.8%.

In light of the pandemic and efforts to lower costs, hospitality-related businesses and food, restaurant, convenience, drug and fuel retail chain operators globally have been seeking technology to automate their processes. This has been driving the demand for NCR’s store and work operation automation-related software and service solutions.

In the last reported quarter, revenues from the Retail segment grew 1.1% year over year, while the Hospitality division’s sales soared 5.7%. The trend is likely to have continued in the second quarter. However, a negative impact of unfavorable foreign currency exchange rates is likely to have more than offset the benefits of the aforementioned factors for the Retail and Hospitality segments’ performance in the to-be-reported quarter.

Our estimate for the Retail division’s revenues is currently pegged at $561.1 million, indicating a year-over-year decline of 0.2%. Our estimate for the Hospitality business unit suggests revenues to decline approximately 2.4% year over year and reach $232.4 million.

NCR’s acquisition of Cardtronics last year is anticipated to have driven the acceleration of the NCR-as-a-service strategy. Cardtronics’ robust debit network expanded NCR’s payments platform and helped it connect with retail and bank customers, thereby facilitating customer acquisition. However, a strong U.S. dollar is likely to have more than offset the benefits. Our estimate for the Self-Service Banking segment is pegged at $649.6 million, indicating a year-over-year decline of 4.3%.

Additionally, NCR’s overall second-quarter performance is likely to have been negatively impacted by softening IT spending as organizations are pushing back their investments in big and expensive technology products due to global economic slowdown concerns.

Furthermore, the strong U.S. dollar, increased interest expenses and a higher tax rate are likely to have more than offset the benefits of last year’s pricing and cost actions. This is anticipated to have dragged the bottom line lower than the year-ago quarter.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for NCR this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that’s not the case here.

Though NCR currently sports a Zacks Rank of #1, it has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Per our model, NVIDIA NVDA, Apple AAPL and Alibaba BABA have the right combination of elements to post an earnings beat in their upcoming releases.

NVIDIA is slated to report second-quarter fiscal 2024 results on Aug 23. The company sports a Zacks Rank #1 and has an Earnings ESP of +5.56% at present. NVDA’s earnings beat the Zacks Consensus Estimate twice in the trailing four quarters while missing the same on two occasions, the average surprise being 0.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for second-quarter earnings is pegged at $2.06 per share, suggesting a whopping increase of 303.9% from the year-ago quarter’s earnings of 51 cents. NVIDIA’s quarterly revenues are estimated to increase 64.4% year over year to $11.02 billion.

Apple carries a Zacks Rank #3 and has an Earnings ESP of +0.66%. The company is scheduled to report third-quarter fiscal 2023 results on Aug 3. Its earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, with the average surprise being 2.7%.

The Zacks Consensus Estimate for Apple’s third-quarter earnings stands at $1.19 per share, a penny lower than the year-ago quarter. It is estimated to report revenues of $81.26 billion, which suggests a decrease of approximately 2.1% from the year-ago quarter.

Alibaba carries a Zacks Rank #3 and has an Earnings ESP of +6.19%. The company is scheduled to report first-quarter fiscal 2024 results on Aug 10. Its earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 16.9%.

The Zacks Consensus Estimate for BABA’s first-quarter earnings is pegged at $1.90 per share, indicating a year-over-year increase of 8.6%. The consensus mark for revenues stands at $31.01 billion, suggesting a year-over-year rise of 1%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

NCR Corporation (NCR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report