Factors to Note Before The TJX Companies' (TJX) Q3 Earnings

The TJX Companies, Inc. TJX is likely to witness year-over-year growth in the top and the bottom line when it reports third-quarter fiscal 2022 earnings on Nov 17, before market open. The Zacks Consensus Estimate for revenues is pegged at $12.3 billion, suggesting a rise of 21.7% from the prior-year quarter’s reported figure.

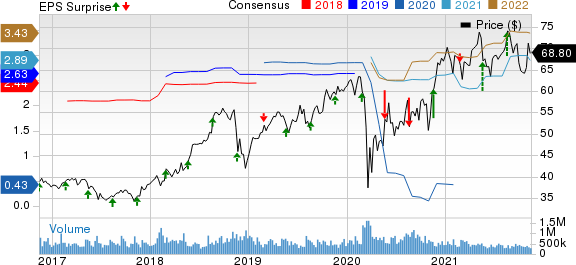

The Zacks Consensus Estimate for earnings has dropped by a penny over the past 30 days to 81 cents per share, which indicates a 14.1% rise from the figure reported in the prior-year period. The off-price apparel and home fashions retailer has a trailing four-quarter earnings surprise of 33.3%, on average. The TJX Companies delivered an earnings surprise of 36.2% in the last reported quarter.

The TJX Companies, Inc. Price, Consensus and EPS Surprise

The TJX Companies, Inc. price-consensus-eps-surprise-chart | The TJX Companies, Inc. Quote

Key Factors to Note

The TJX Companies has been benefiting from its strong store and e-commerce growth efforts. Its regular store openings have been helping it expand across the United States, Europe, Canada and Australia. Further, with an increasing number of consumers resorting to online shopping, The TJX Companies has undertaken several initiatives to boost online sales and strengthen its e-commerce business. On its fiscal second-quarter earnings call, management highlighted that it is seeing impressive sales for the U.S. and U.K. online businesses. The TJX Companies’ off-price model, strategic store locations, impressive brands and fashion products bode well, both in stores and online.

The TJX Companies’ HomeGoods segment has been seeing robust demand for a while now. On its last earnings call, management stated that the company is on track to roll out homegoods.com during the fiscal third quarter, which will offer impressive home fashion products at great value on its digital platform. Also, the company’s marketing efforts and loyalty programs have been aiding.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for The TJX Companies this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The TJX Companies currently has a Zacks Rank #3 and an Earnings ESP of +2.61%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Retailers Likely to Post a Beat Next Week

Macy's M has an Earnings ESP of +9.77% and sports a Zacks Rank #1. The company is likely to register bottom-line growth when it reports third-quarter fiscal 2021 numbers. The Zacks Consensus Estimate for quarterly earnings has moved up 19.2% in the last seven days to 31 cents per share, suggesting an improvement from a loss of 19 cents per share reported in the year-ago quarter.

Macy's top line is also expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $5.29 billion, which suggests growth of 32.6% from the figure reported in the prior-year quarter. M has a trailing four-quarter earnings surprise of 269.8%, on average.

Home Depot HD has an Earnings ESP of +1.42% and carries a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports third-quarter fiscal 2021 numbers. The Zacks Consensus Estimate for its quarterly earnings has moved up 2.1% in the past seven days to $3.40 per share, suggesting 6.9% growth from the year-ago quarter’s reported number.

Home Depot’s top line is also expected to rise year over year. The Zacks Consensus Estimate for its quarterly revenues is pegged at $34.77 billion, suggesting a rise of 3.7% from the figure reported in the prior-year quarter. HD has a trailing four-quarter earnings surprise of 9.2%, on average.

Lowe's Companies LOW has an Earnings ESP of +5.71% and carries a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports third-quarter fiscal 2021 numbers. The Zacks Consensus Estimate for quarterly earnings has moved up 2.2% in the last seven days to $2.32 per share, suggesting a 17.2% increase from the year-ago quarter’s reported number.

However, Lowe’s top line is expected to decline year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $21.83 billion, suggesting a decline of 2.1% from the figure reported in the prior-year quarter. LOW has a trailing four-quarter earnings surprise of 10.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research