Factors That Underscore Red Robin's (RRGB) Solid Prospects

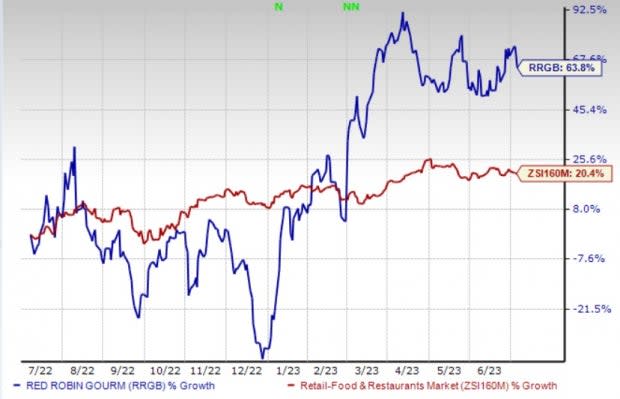

Red Robin Gourmet Burgers, Inc. RRGB is benefiting from its robust loyalty program, off-premise sales, menu innovation and increased focus on Donatos. Consequently, the company’s shares have gained 63.8% in the past year compared with the industry’s growth of 20.4%.

Our model predicts the Zacks Rank #1 (Strong Buy) company’s earnings and sales in 2023 to witness rises of 3% and 53% year over year, respectively.

Let’s delve deeper into the factors likely to spur RRGB’S growth.

Robust Loyalty Program

Red Robin’s robust loyalty program is driving growth. It engages guests through this program with offers designed to increase the frequency of visits. It also informs its enrolled guests about new menu items to generate awareness and for trials.

To bring back its lapsed guests and increase visit frequency (in comparison to 2019 levels), the company has shifted its focus from broad discounting initiatives to targeted royalty offers. As of first-quarter fiscal 2023, RRGB’s royalty members totaled 11.5 million compared with 11.3 million reported in the previous quarter.

Image Source: Zacks Investment Research

Strong Off-premise Sales & Menu Innovation

RRGB’s off-premise sales have increased sharply compared with the pre-COVID-19 levels. Although more guests have started visiting restaurants, its off-premise sales remain strong.

Management intends to maintain the momentum by focusing on modifications with respect to its processes, staffing, floor plans and technology. It is initiating an expanded floor plan space to support its off-premises and catering orders without impacting the dine-in business. Notably, the initiatives pave the path for effective and accurate executions.

Red Robin continues to focus on menu innovation to drive growth. During fiscal first quarter, it reported developments with respect to new entrees and non-fried appetizers. RRGB remains optimistic in this regard and anticipates to roll out the upgrades in October 2023.

Increased focus on Donatos

Red Robin still considers Donatos as key growth drivers. In fiscal 2022, comparable restaurant revenues serving Donatos pizza outperformed non-Donatos locations by 470 basis points year over year. RRGB completed the installation of 25 Donatos in first-quarter fiscal 2023.

As of Apr 16, 2023, it completed the installation of Donatos in 272 company-owned restaurants. Red Robin is optimistic about the success of this partnership. Management anticipates annual sales of pizza to be more than $60 million and profitability to be above $25 million by 2024.

Other Key Picks

Here we present some other top-ranked stocks in the Retail-Wholesale sector.

Chuy's Holdings, Inc. CHUY currently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 23.4%, on average. Shares of CHUY have skyrocketed 93.2% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Chuy’s Holdings’ 2023 sales and EPS suggests growth of 9.9% and 27%, respectively, from the year-ago period’s levels.

BJ's Restaurants, Inc. BJRI flaunts a Zacks Rank #1 at present. BJRI has a long-term earnings growth rate of 15%. The stock has improved 46.7% in the past year.

The Zacks Consensus Estimate for BJ's Restaurants’ 2023 sales and EPS indicates improvements of 5.5% and 311.8%, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO carries a Zacks Rank #2 (Buy). ARCO has a long-term earnings growth rate of 9.5%. The stock has gained 59% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS implies rises of 13.4% and 4.4%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report