FactSet (FDS) Rises 11% Year to Date: Here's What to Know

FactSet Research Systems Inc. FDS has had an impressive run in the year-to-date period. The stock has gained 11.8%, outperforming the 10.3% rise of the industry it belongs to.

Factors Helping the Surge

FactSet has a consistent track record of rewarding its shareholders through share repurchases and dividends. During fiscal 2022, the company repurchased shares worth $18.64 million and paid a dividend of $125.9 million. During fiscal 2021 and 2020, it repurchased shares worth $264.7 million and $199.6 million and paid dividends of $117.9 million and $110.4 million, respectively. Such moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business.

The recent acquisition of idaciti supports FactSet’s ongoing initiative to digitally revamp its content collection infrastructure while also expediting the availability of essential data sets that underpin advanced future workflows. The 2022 acquisition of CUSIP Global Services has strengthened the company’s position in the global capital markets.

FactSet continues to ride on a growing customer base and strong global presence. The company added 151 clients in the fourth quarter of fiscal 2023, driven by an increase in corporate and wealth clients, taking the total client count to 7,921. The annual client retention rate was 91%. FactSet’s Organic Annual Subscription Value plus professional services were up 7.2% year over year.

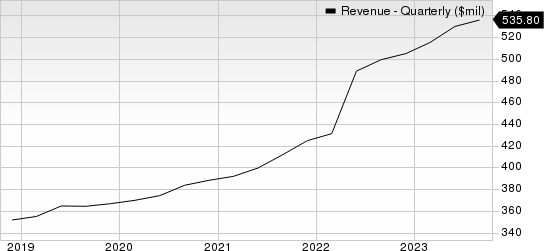

FactSet Research Systems Inc. Revenue (Quarterly)

FactSet Research Systems Inc. revenue-quarterly | FactSet Research Systems Inc. Quote

Zacks Rank and Stocks to Consider

FactSet currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the broader Business Service sector that investors may consider:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9%. The consensus mark for 2023 revenues is pegged at $2.7 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.72 per share, indicating a 14.2% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report