FactSet (FDS) Stock Gains 9% in Three Months: Here's How

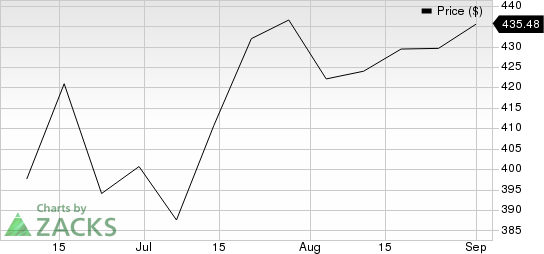

FactSet Research Systems Inc. FDS has had an impressive run over the past three months. The stock has gained 9.3%, outperforming the 6.9% rally of the industry it belongs to and the 5.3% growth of the Zacks S&P 500 composite.

Drivers of the Rally

FactSet has been engaged for more than 40 years in delivering extensive data, sophisticated analytics and flexible technology to global financial professionals, and is currently benefiting from a growing customer base and strong global presence.

FactSet Research Systems Inc. Price

FactSet Research Systems Inc. price | FactSet Research Systems Inc. Quote

The company added 40 clients in the third quarter of 2023, driven by an increase in corporate and wealth clients, taking the total client count to 7,770. The annual client retention rate was 92%. FactSet’s Organic Annual Subscription Value plus professional services were up 8% year over year.

FactSet maintains a performance-based organizational culture with a focus on talent and technology. The company remains focused on expanding its digital platform, delivering cloud-based data and analytics to clients. It emphasizes the extensive use of technology to fast-track product creation and content collection.

The recent acquisition of idaciti supports FactSet’s ongoing initiative to digitally revamp its content collection infrastructure, while also expediting the availability of essential data sets that underpin advanced future workflows. The 2022 acquisition of CUSIP Global Services has strengthened the company’s position in the global capital markets.

Favorable Estimate Revisions

The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. One estimate for 2023 has moved north over the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for 2023 earnings has increased 0.3%.

Zacks Rank and Other Stocks to Consider

FactSet currently carries a Zacks Rank #2 (Buy).

The following stocks from the Business Services sector are also worth consideration:

DocuSign DOCU beat the Zacks Consensus Estimate in all the four trailing quarters and has an earnings surprise of 25.6%. The consensus estimate for 2023 earnings is pegged at $2.52 per share, indicating 24.1% year-over-year growth. The consensus mark for 2023 revenues indicates an 8.1% increase from the year-ago figure. DOCU currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRA International CRAI beat the Zacks Consensus Estimate in two of the four trailing quarters and missed on two instances, the average earnings surprise being 5.1%. The current Zacks Consensus Estimate for 2023 revenues indicates a 6.6% increase from the year-ago figure. The consensus mark for earnings is pegged at $5.49 per share, indicating a 7.6% year-over-year decline. CRAI carries a Zacks Rank #2, at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report