FactSet Research Systems Inc CEO Frederick Snow Sells 3,000 Shares

Frederick Snow, the CEO of FactSet Research Systems Inc (NYSE:FDS), has recently sold 3,000 shares of the company's stock, according to a filing with the Securities and Exchange Commission. The transaction took place on December 4, 2023, and has caught the attention of investors and analysts alike, as insider sales can provide valuable insights into a company's prospects.

Who is Frederick Snow?

Frederick Snow has been serving as the CEO of FactSet Research Systems Inc, a leading provider of integrated financial information and analytical applications to the global investment community. Under Snow's leadership, FactSet has continued to expand its offerings and maintain its reputation for high-quality solutions that support the investment process. His tenure has been marked by strategic growth initiatives and a focus on enhancing the company's technology and content offerings.

FactSet Research Systems Inc's Business Description

FactSet Research Systems Inc is a global provider of financial data and software solutions for investment professionals. The company offers a wide range of products and services designed to support the entire investment process, from initial research to portfolio analysis and risk management. FactSet's solutions are used by asset managers, hedge funds, private equity firms, investment bankers, and other financial professionals to access accurate and timely information that is crucial for making informed investment decisions.

Analysis of Insider Buy/Sell and Relationship with Stock Price

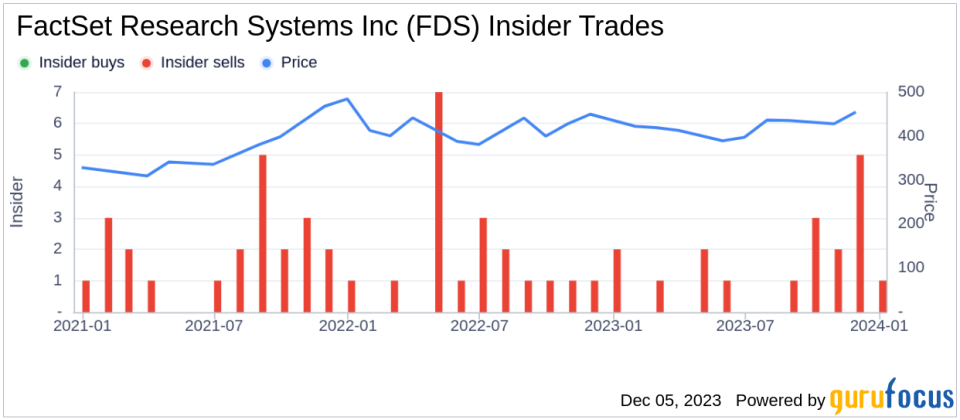

Insider transactions are closely monitored by investors as they can provide clues about a company's future performance. Over the past year, Frederick Snow has sold a total of 18,000 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider may perceive the stock's current price as being on the higher side relative to its future prospects.

However, it is important to consider that insiders may sell shares for various reasons that do not necessarily reflect their outlook on the company's future performance, such as diversifying their personal portfolio, tax planning, or other personal financial needs.

The insider transaction history for FactSet Research Systems Inc shows a trend of more insider selling than buying over the past year, with 17 insider sells and no insider buys. This trend could be interpreted in several ways, but without additional context, it is not definitive evidence of the company's trajectory.

On the day of the insider's recent sale, shares of FactSet Research Systems Inc were trading at $452.79, giving the company a market cap of $16.961 billion. The price-earnings ratio of 37.08 is higher than the industry median of 17.92 and also above the company's historical median price-earnings ratio, indicating that the stock may be priced at a premium compared to its peers and its own historical valuation.

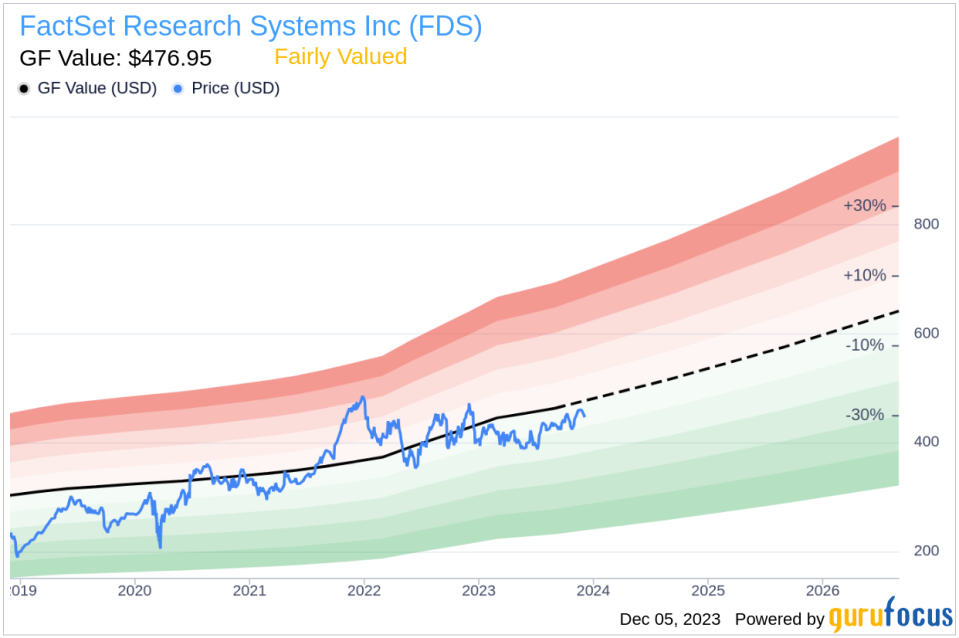

Despite the higher price-earnings ratio, the stock is considered Fairly Valued with a price-to-GF-Value ratio of 0.95, based on a GF Value of $476.95. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The GF Value suggests that FactSet's stock price is in line with the company's intrinsic value, which may provide some reassurance to investors concerned about the insider selling activity.

The insider trend image above illustrates the recent selling activity and can help investors visualize the pattern of insider transactions over time.

The GF Value image provides a graphical representation of the stock's current valuation in relation to its intrinsic value, as estimated by GuruFocus.

Conclusion

While the insider's recent sale of 3,000 shares may raise questions among investors, it is essential to consider the broader context of the company's valuation and performance. FactSet Research Systems Inc's strong market position and the Fairly Valued stock price based on the GF Value may suggest that the insider's selling activity does not necessarily indicate a negative outlook for the company. Investors should continue to monitor insider transactions and other fundamental indicators to inform their investment decisions.

As always, insider transactions are just one piece of the puzzle when evaluating a stock's potential. A comprehensive analysis that includes financial performance, industry trends, and broader market conditions is crucial for making informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.