FactSet Research Systems Inc (FDS) Reports Solid Growth in Q2 2024 Earnings

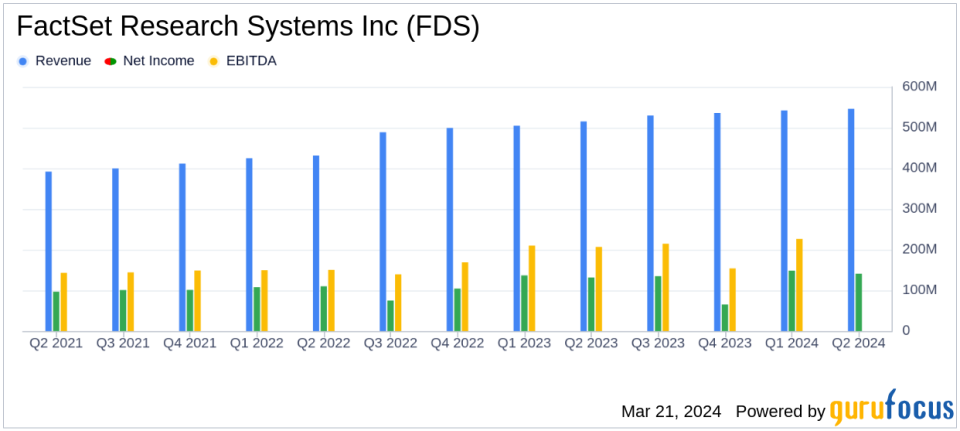

Revenue: Q2 GAAP revenues increased by 6.0% year over year to $545.9 million.

Earnings Per Share (EPS): GAAP diluted EPS rose by 8.0% to $3.65, and adjusted diluted EPS grew by 11.1% to $4.22.

Operating Margin: GAAP operating margin improved by approximately 50 basis points to 33.3%, and adjusted operating margin increased by approximately 130 basis points to 38.3%.

Annual Subscription Value (ASV): Organic ASV plus professional services reached $2,209.5 million, a 5.4% increase from the previous year.

Client and User Count: Client count grew to 8,020, while user count saw a decrease of 605 to 206,478.

Dividend: A quarterly dividend of $0.98 per share will be paid on March 21, 2024.

Share Repurchase: FactSet repurchased 113,050 shares for $52.3 million at an average price of $462.23.

On March 21, 2024, FactSet Research Systems Inc (NYSE:FDS), a leading provider of financial data and analytics, announced its earnings for the second quarter of fiscal year 2024. The company reported a 6.0% increase in GAAP revenues, which amounted to $545.9 million, compared to the same period last year. This growth is attributed to the strong performance across asset owners, corporates, hedge funds, and private equity and venture capital clients. FactSet's 8-K filing details these results and more.

FactSet aggregates data from various sources and provides essential portfolio analytics, primarily serving buy-side clients, which account for 82% of the company's annual subscription value. The company has made strategic acquisitions over the years, including Portware in 2015 and BISAM in 2017, and completed its purchase of CUSIP Global Services in 2022.

Financial Performance and Challenges

The company's GAAP operating margin increased to 33.3%, reflecting higher revenues and lower personnel expenses due to a lower bonus accrual, alongside a higher capitalization benefit. However, these were partially offset by an approximately $11 million restructuring charge related to personnel reductions. The adjusted operating margin also saw an improvement, reaching 38.3% due to similar factors, though this was slightly offset by increased bad debt expenses.

FactSet's GAAP diluted EPS increased to $3.65, an 8.0% rise from the prior year, while the adjusted diluted EPS grew by 11.1% to $4.22. Adjusted EBITDA also saw a significant increase of 9.2%, reaching $218.1 million. These financial achievements underscore FactSet's ability to grow its revenue and manage expenses effectively, which is crucial in the capital markets industry where competition and market volatility can impact performance.

Key Financial Metrics

FactSet's balance sheet remains robust with cash and cash equivalents of $381.7 million as of February 29, 2024. The company's net income for the quarter stood at $140.9 million, a 7.1% increase from the previous year. The effective tax rate for the quarter was slightly higher at 16.4%, compared to 16.1% for the same period last year, due to higher taxable income.

CEO Phil Snow commented on the company's performance, stating,

FactSet is an anchor partner for our clients in all market conditions. We remain optimistic about our growth potential as we continue to invest in our platform and leverage the power of generative AI to help our clients uncover new ideas and lower their total cost of ownership."

CFO Linda Huber also highlighted the importance of expense management,

Careful expense management continues to provide us with an opportunity to invest in our top strategic opportunities, such as generative AI,

indicating the company's focus on balancing growth investments with financial prudence.

Outlook and Strategic Developments

FactSet is reaffirming its outlook for fiscal 2024, expecting to finish at the lower end of the guidance range for Organic ASV plus professional services growth and GAAP revenues. The company anticipates organic ASV plus professional services to grow in the range of $110 million to $150 million during fiscal 2024, representing a 6% growth at the midpoint. GAAP revenues are expected to be between $2,200 million and $2,210 million.

The company also announced the release of Transcript Assistant, a GenAI-powered chatbot, and the appointment of Laurie Hylton to its Board of Directors. These developments reflect FactSet's commitment to innovation and strategic leadership.

For value investors and potential GuruFocus.com members, FactSet's latest earnings report demonstrates a company with a strong financial foundation, a commitment to innovation, and a strategic approach to growth. The company's performance in a competitive industry and its ability to deliver value to its clients make it a noteworthy consideration for investment portfolios.

Explore the complete 8-K earnings release (here) from FactSet Research Systems Inc for further details.

This article first appeared on GuruFocus.