FactSet Research Systems Inc (FDS): A Deep Dive into Financial Metrics and Competitive Strengths

FactSet Research Systems Inc (NYSE:FDS) has recently been in the spotlight, drawing interest from investors and financial analysts due to its robust financial stance. With shares currently priced at $433.81, FactSet Research Systems Inc has witnessed a daily loss of 0.72%, marked against a three-month change of 9.69%. A thorough analysis, underlined by the GF Score, suggests that FactSet Research Systems Inc is well-positioned for substantial growth in the near future.

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

FactSet Research Systems Inc has been assigned the following ranks:

Financial strength rank: 6/10

Profitability rank: 10/10

Growth rank: 10/10

GF Value rank: 5/10

Momentum rank: 8/10

Each one of these components is ranked and the ranks also have positive correlation with the long term performances of stocks. The GF score is calculated using the five key aspects of analysis. Through backtesting, we know that each of these key aspects has a different impact on the stock price performance. Thus, they are weighted differently when calculating the total score. With a high profitability rank and growth rank, and a slightly lower GF Value rank, GuruFocus assigned FactSet Research Systems Inc the GF Score of 95 out of 100, which signals the highest outperformance potential.

FactSet Research Systems Inc: A Snapshot

FactSet Research Systems Inc, with a market cap of $16.55 billion and sales of $2.09 billion, provides financial data and portfolio analytics to the global investment community. The company aggregates data from third-party data suppliers, news sources, exchanges, brokerages, and contributors into its workstations. In addition, it provides essential portfolio analytics that companies use to monitor portfolios and address reporting requirements. Buy-side clients account for 83% of FactSet's annual subscription value. In 2015, the company acquired Portware, a provider of trade execution software. In 2017, it acquired BISAM, a risk management and performance measurement provider. In 2022, it completed its purchase of CUSIP Global Services.

Financial Strength Breakdown

According to the Financial Strength rating, FactSet Research Systems Inc's robust balance sheet exhibits resilience against financial volatility, reflecting prudent management of capital structure.

The Interest Coverage ratio for FactSet Research Systems Inc stands impressively at 10.72, underscoring its strong capability to cover its interest obligations. This robust financial position resonates with the wisdom of legendary investor Benjamin Graham, who favored companies with an interest coverage ratio of at least 5.

With an Altman Z-Score of 5.45, FactSet Research Systems Inc exhibits a strong defense against financial distress, highlighting its robust financial stability.

With a favorable Debt-to-Revenue ratio of 0.88, FactSet Research Systems Inc's strategic handling of debt solidifies its financial health.

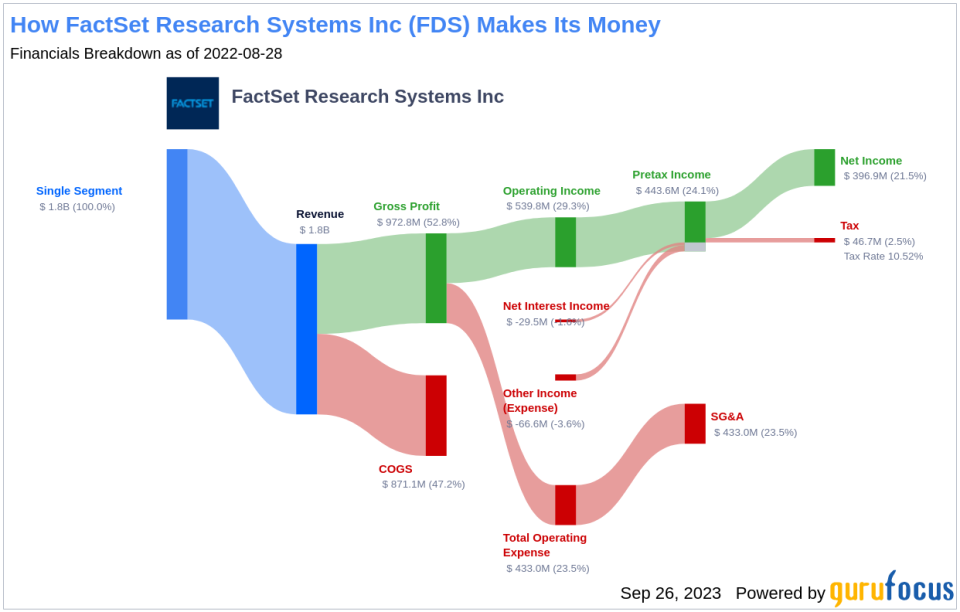

Profitability Rank Breakdown

The Profitability Rank shows FactSet Research Systems Inc's impressive standing among its peers in generating profit.

FactSet Research Systems Inc Operating Margin has increased (16.00%) over the past five years, as shown by the following data: 2019: 30.52; 2020: 30.53; 2021: 29.79; 2022: 29.27; 2023: 31.46; .

Furthermore, FactSet's Gross Margin has seen a consistent rise over the past five years, as evidenced by the data: 2019: 53.78; 2020: 53.45; 2021: 50.59; 2022: 52.76; 2023: 53.33; . This trend underscores the company's growing proficiency in transforming revenue into profit.

FactSet Research Systems Inc's strong Predictability Rank of 5.0 stars out of five underscores its consistent operational performance, providing investors with increased confidence.

Growth Rank Breakdown

Ranked highly in Growth, FactSet Research Systems Inc demonstrates a strong commitment to expanding its business.

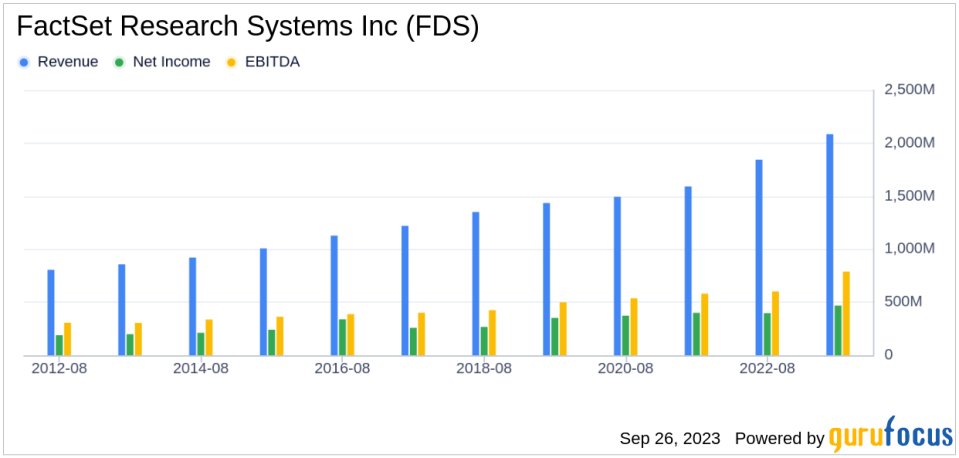

The company's 3-Year Revenue Growth Rate is 11.5%, which outperforms better than 58.74% of 681 companies in the Capital Markets industry

Moreover, FactSet Research Systems Inc has seen a robust increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA) over the past few years. Specifically, the three-year growth rate stands at 13.4, and the rate over the past five years is 11.5. This trend accentuates the company's continued capability to drive growth.

Conclusion

With its strong financial strength, profitability, and growth metrics, the GF Score highlights FactSet Research Systems Inc's unparalleled position for potential outperformance. This analysis suggests that FactSet Research Systems Inc is a promising investment opportunity for value investors seeking robust financial performance and growth potential.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.