Fair Isaac Corp (FICO) Posts Solid Earnings Growth in Q1 Fiscal 2024

Revenue: Increased to $382.1 million, up from $344.9 million in the prior year period.

Net Income: Rose to $121.1 million, or $4.80 per share, compared to $97.6 million, or $3.84 per share, in the prior year.

Non-GAAP Net Income: Grew to $121.2 million, with Non-GAAP EPS at $4.81.

Free Cash Flow: Improved to $120.8 million, up from $91.6 million in the prior year period.

Software Revenue: Increased by 14%, driven by recurring revenue growth.

Scores Revenue: Grew by 8%, with B2B revenue up by 12%.

Fiscal 2024 Guidance: Reiterated, with expectations of double-digit percentage revenue and EPS growth.

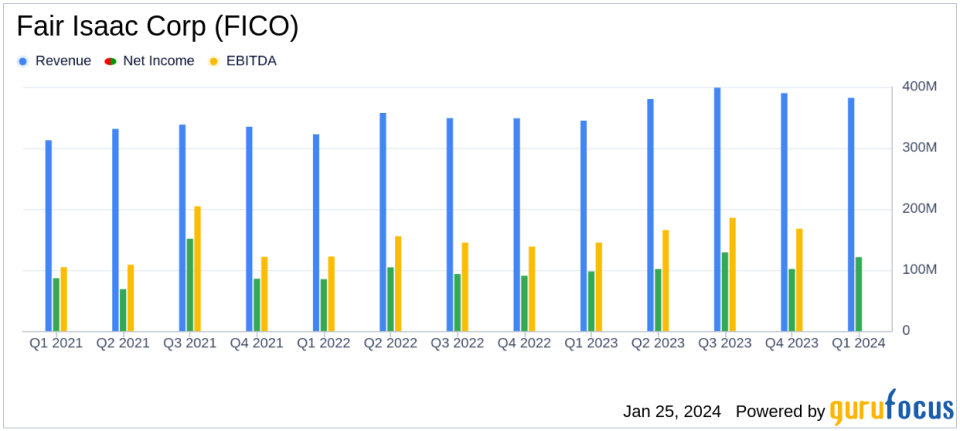

On January 25, 2024, Fair Isaac Corp (NYSE:FICO) released its 8-K filing, announcing its financial results for the first quarter of fiscal year 2024. The company, a leader in predictive analytics and decision management software, reported a significant increase in revenue and earnings per share (EPS), signaling a robust start to the fiscal year.

Founded in 1956, Fair Isaac Corp is renowned for its FICO credit scores, a critical measure of consumer credit risk. The company's offerings extend beyond credit scoring to include a suite of analytics and decision-making software used by businesses across various industries to enhance operational decisions.

Financial Highlights and Segment Performance

Fair Isaac Corp's revenue for the quarter stood at $382.1 million, a notable increase from $344.9 million in the same period last year. This growth was driven by an 8% increase in Scores revenue, which reached $192.1 million, and a 14% rise in Software revenue, totaling $190.0 million. The company's B2B scoring solutions saw a 12% revenue increase, primarily due to higher unit prices, while B2C revenue experienced a slight decline due to lower volumes on myFICO.com.

The company's net income also saw a healthy increase, reaching $121.1 million, or $4.80 per share, compared to $97.6 million, or $3.84 per share, in the prior year. Non-GAAP net income was slightly higher at $121.2 million, with Non-GAAP EPS at $4.81. Free cash flow improved significantly to $120.8 million, up from $91.6 million in the prior year period, reflecting the company's strong operational efficiency.

Operational and Strategic Developments

CEO Will Lansing commented on the quarter's performance, stating, "We had a good start to our fiscal year, with another quarter of strong growth." The company's outlook remains positive, with a reiteration of its fiscal year 2024 guidance, which anticipates double-digit percentage revenue and EPS growth.

The company's Software segment demonstrated robust performance, with an 18% year-over-year increase in Software Annual Recurring Revenue. The Software Dollar-Based Net Retention Rate was 114% in the first quarter, indicating strong customer retention and potential for future revenue growth.

We reiterate our fiscal year 2024 guidance, which includes double-digit percentage revenue and EPS growth," said Will Lansing, chief executive officer.

Financial Position and Outlook

Fair Isaac Corp's balance sheet remains solid, with cash and cash equivalents of $160.4 million as of December 31, 2023. The company's long-term debt stands at $1.8 billion, reflecting its investment in growth and strategic initiatives.

Looking ahead, Fair Isaac Corp is confident in its ability to maintain momentum and achieve its fiscal 2024 targets. The company's guidance forecasts revenues of $1.675 billion, GAAP net income of $490 million, and GAAP EPS of $19.45. On a Non-GAAP basis, net income is expected to be $566 million, with Non-GAAP EPS projected at $22.45.

Investors and analysts can access more details on the company's performance and strategic updates during the webcast hosted on January 25, 2024. The replay will be available on FICO's website for those unable to attend the live event.

For value investors and potential GuruFocus.com members, Fair Isaac Corp's latest earnings report underscores the company's continued growth trajectory and operational strength. With a reaffirmed outlook and solid financials, FICO remains a noteworthy company to watch in the analytics and decision management software industry.

For more detailed financial information and updates on Fair Isaac Corp, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Fair Isaac Corp for further details.

This article first appeared on GuruFocus.